|

|

| Rating: 4.7 | Downloads: 500,000+ |

| Category: Business | Offer by: Rain Technologies Inc |

Rain Instant Pay is a streamlined payment processing application designed for businesses requiring fast, secure transactions. It enables merchants to accept various payment methods directly from their mobile device or integrated dashboard, catering to small businesses and online stores needing efficient payment solutions.

The core appeal of Rain Instant Pay lies in its speed and simplicity; facilitating quick sales processing and providing essential financial insights without unnecessary complexity. It’s ideal for entrepreneurs and small business owners looking to manage their online payments efficiently and securely on the go.

App Features

- Quick Transaction Processing: Rain Instant Pay excels at handling payment authorizations swiftly, often completing the process for online or card transactions in seconds, allowing users to immediately confirm sales and move on to the next customer, significantly boosting sales throughput.

- Military-Grade Encryption & Security: Utilizing robust 256-bit SSL encryption and tokenization, the app ensures sensitive cardholder data is securely transmitted and stored, providing vital protection against data breaches and PCI compliance requirements. This enhances user trust and reduces risk.

- Multicurrency Handling: Seamlessly process payments in numerous currencies, automatically detecting customer card currencies or allowing manual selection during transaction entry. This feature is invaluable for international businesses expanding their customer base beyond local markets.

- Seamless Dashboard Integration (Web/App): Easily manage orders, view transaction history, and monitor financial summaries within an intuitive dashboard, accessible both on the mobile app and via a web interface, ensuring centralized control for efficient business oversight. Users can switch contexts effortlessly.

- User Management & Permissions: Administrators can set distinct login credentials and assign granular permission levels to different team members, ensuring that cashiers, managers, or accountants only access features relevant to their roles and responsibilities. For example, a cashier cannot view financial reports or adjust settings.

- Comprehensive Sales Reporting: Gain valuable business intelligence with detailed analytics on sales volume, popular products or services, transaction success rates, and payment methods used. These insights help identify trends and inform strategic decisions, moving beyond simple payment processing to actionable business data.

Pros & Cons

Pros:

- Exceptional Transaction Speed

- User-Friendly Mobile Interface

- High Level of Transaction Security

- Flexible Integration Options

Cons:

- Transaction Fees May Be Higher Depending On Volume/Type

- Customization Options Are Limited For Branding

- Potential For Additional Setup Costs For Advanced Features

- Customer Support Response Times Can Vary Slightly Outside Core Hours

Similar Apps

| App Name | Highlights |

|---|---|

| Stripe |

A widely used platform offering powerful API access and various payment products, known for developer flexibility and extensive global coverage. |

| Square |

Popular for its comprehensive suite including card readers, invoicing, and point-of-sale systems, emphasizing simplicity with integrated tools for small businesses. |

| Checkout.com |

Known for competitive rates and advanced features, offering robust API capabilities and strong security protocols for online merchants. |

| Adyen |

Specializes in handling complex global payments, providing unified platform access and support for hundreds of payment methods across numerous countries. |

Frequently Asked Questions

Q: Can Rain Instant Pay handle recurring billing or subscriptions effectively?

A: Yes, Rain Instant Pay supports recurring payment profiles, making it easy to manage subscription services where customers are charged automatically on a scheduled basis, like monthly memberships or subscription boxes.

Q: Is the Rain Instant Pay mobile application secure for processing sensitive financial information?

A: Absolutely. Security is paramount with Rain Instant Pay; the app employs bank-grade encryption (256-bit SSL) for all data transmissions and complies with PCI DSS standards, ensuring customer payment details remain protected at all times.

Q: Does Rain Instant Pay offer multi-language support for my business customers and dashboard interface?

A: Yes, Rain Instant Pay typically offers dashboard interfaces and potentially customer-facing elements in multiple languages, although specific language support can depend on the target market and subscription tier; it’s best to verify with your account manager or settings.

Q: Are there any upfront hardware costs, or can I start using Rain Instant Pay purely via mobile or web?

A: Rain Instant Pay can often be started with minimal hardware, sometimes relying solely on integrated online payments or secure mobile SDKs (Software Development Kits) for certain payment types. However, physical card readers or POS terminals may be needed for in-person transactions, depending on your subscription plan.

Q: What happens if a transaction fails or is disputed using Rain Instant Pay?

A: Rain Instant Pay clearly marks failed transactions within your dashboard. Disputed transactions are flagged separately, and the platform usually provides access to chargeback management tools and documentation requirements to help you respond to the customer’s financial institution effectively.

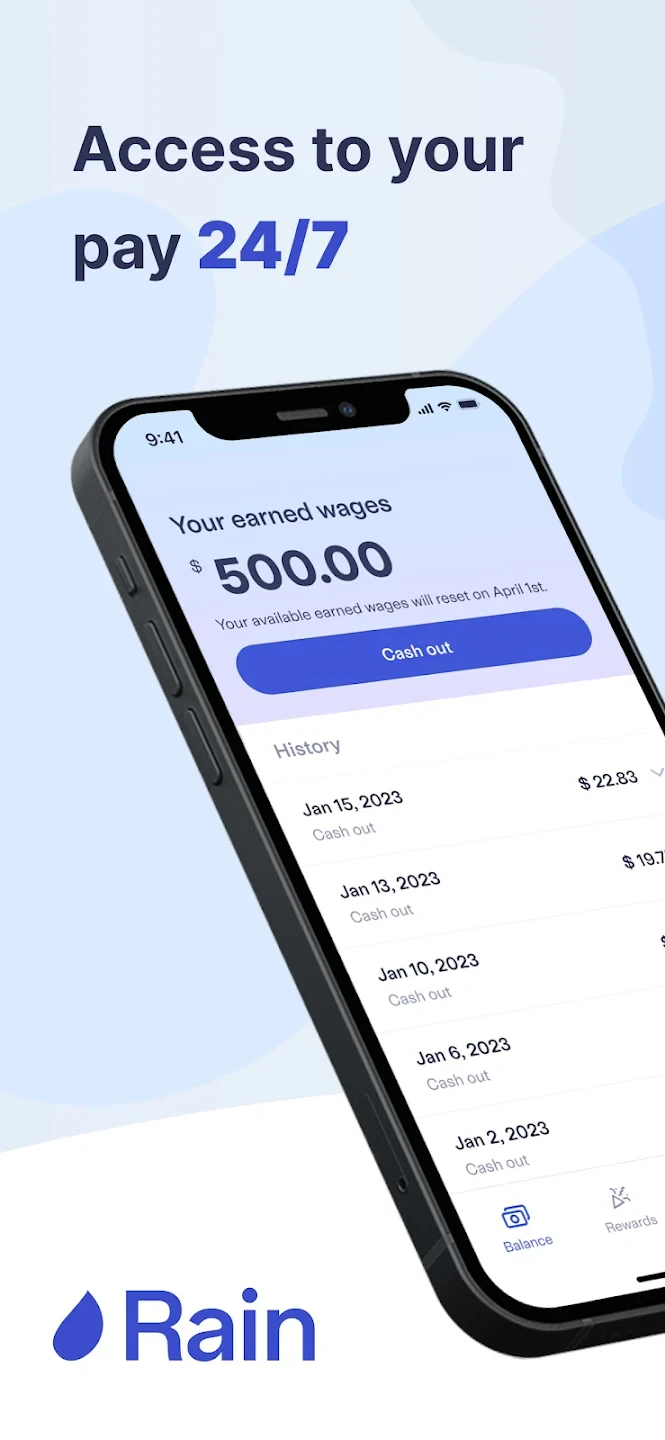

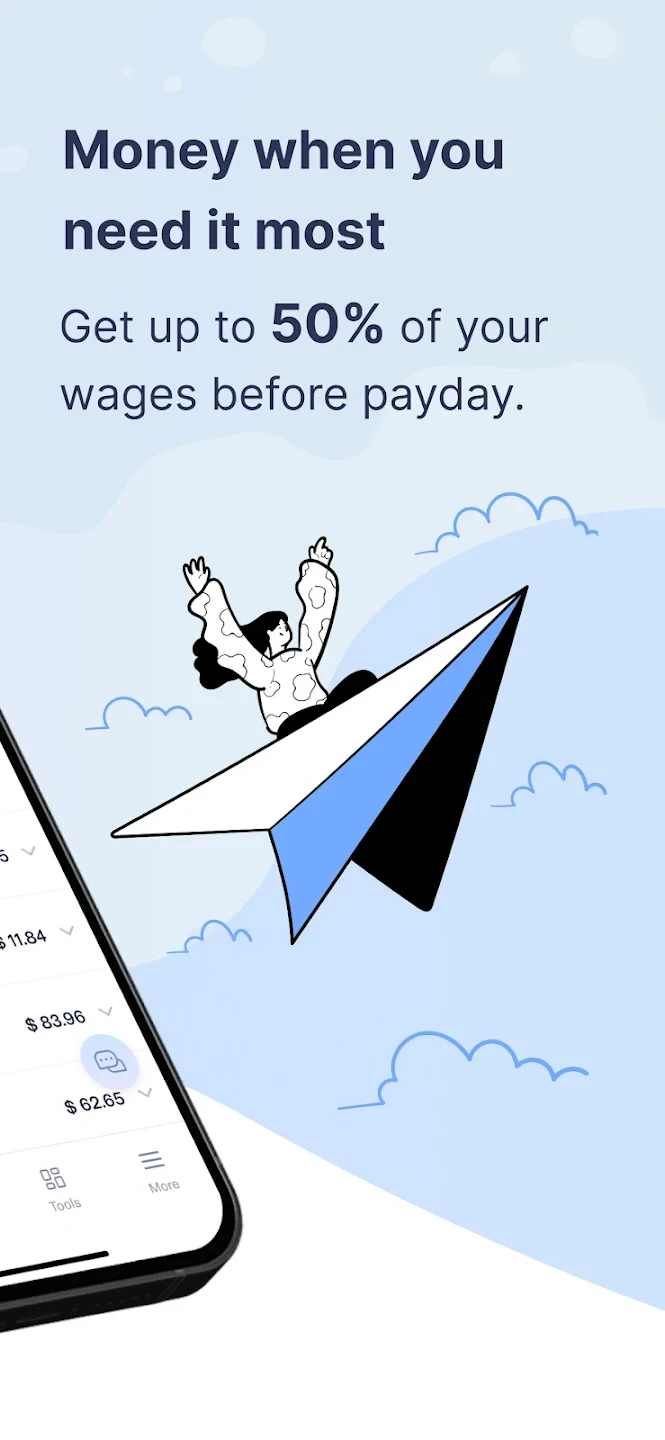

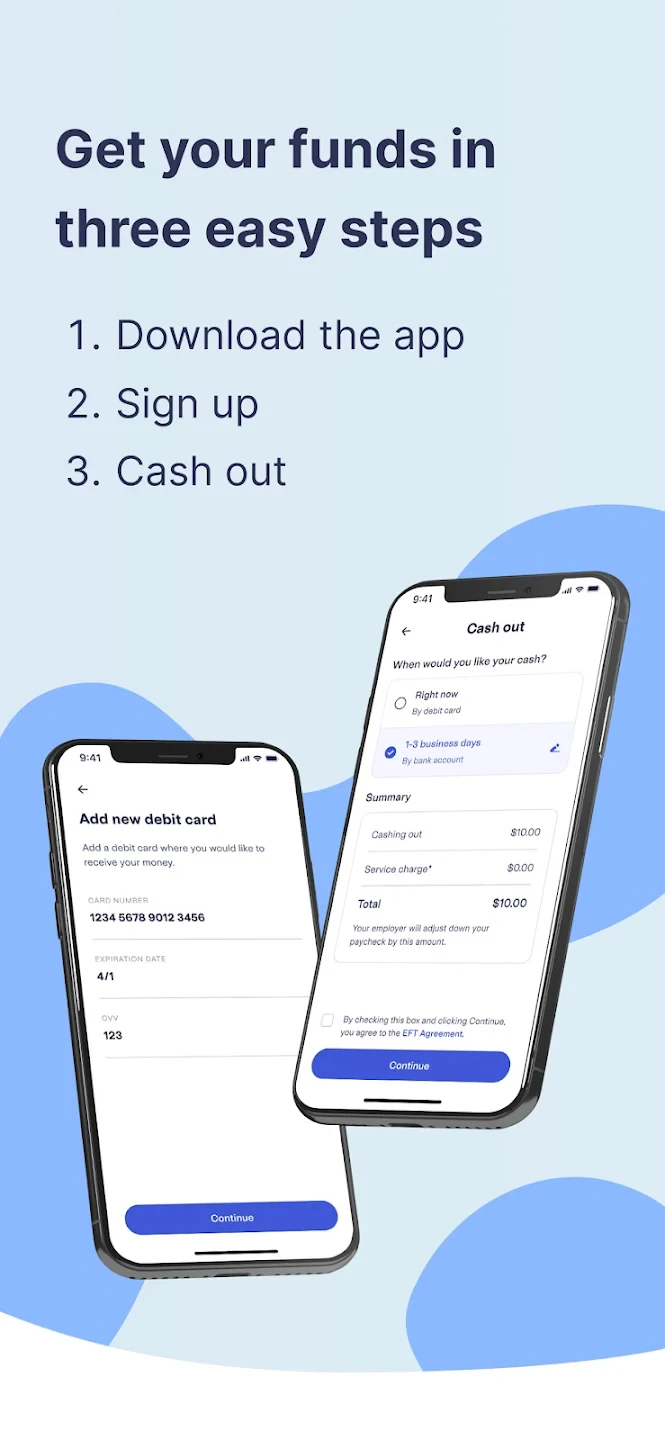

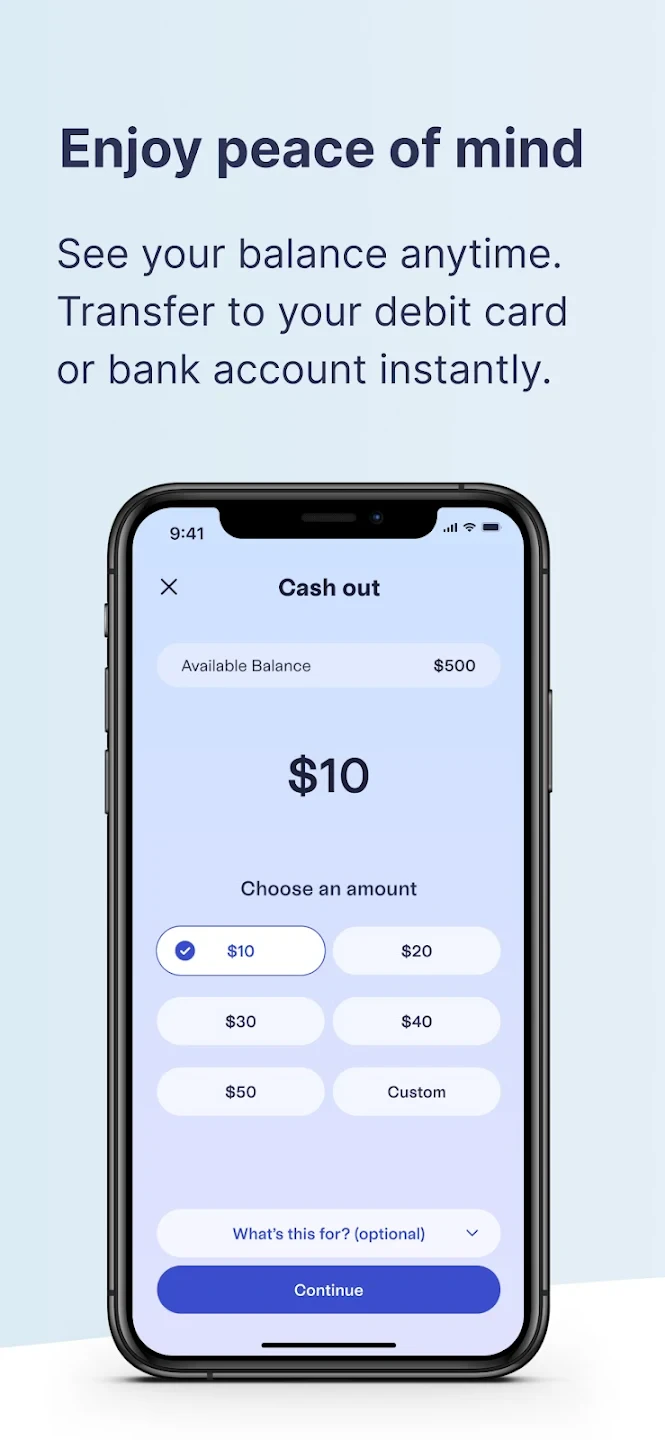

Screenshots

|

|

|

|