|

|

| Rating: 4.8 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Ria Money Transfer (Ria Financial) |

Ria Money Transfer: Send Money is a mobile application designed for securely and conveniently sending funds across international borders. It caters primarily to individuals needing to remit money to friends, family, or business partners located overseas, offering a streamlined alternative to traditional banks and physical transfer services.

The key appeal of Ria Money Transfer: Send Money lies in its focus on speed, competitive exchange rates, and user-friendly features, making international money transfers faster and potentially more economical for frequent users. It simplifies the often complex process, providing clarity and control over the sending experience.

App Features

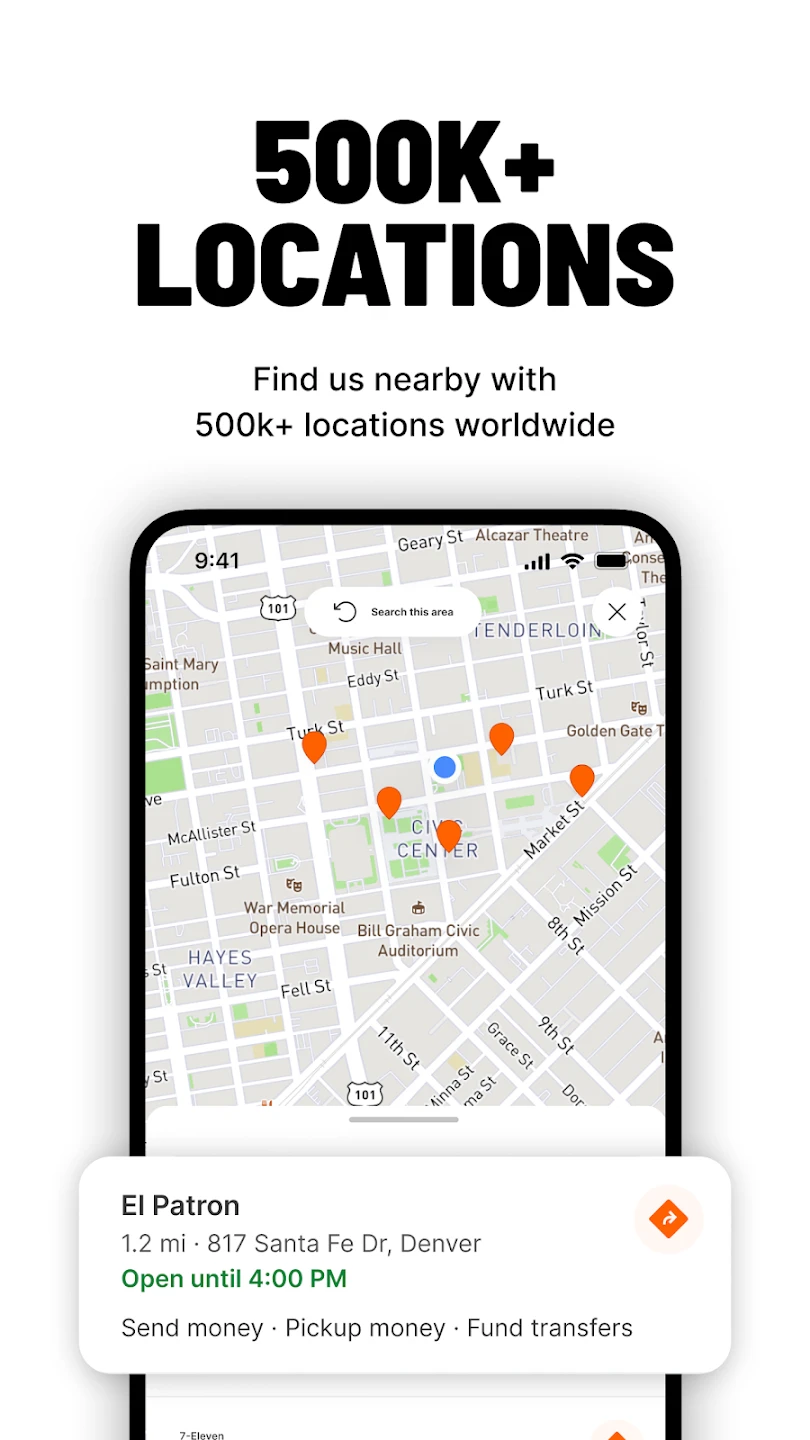

- Global Receiving Locations: The app allows you to send money to a wide range of countries and specific bank accounts or local money transfer providers, ensuring you can reach recipients almost anywhere in the world. This extensive reach makes international transfers accessible for various personal and business needs, whether you’re supporting loved ones abroad or settling professional invoices quickly.

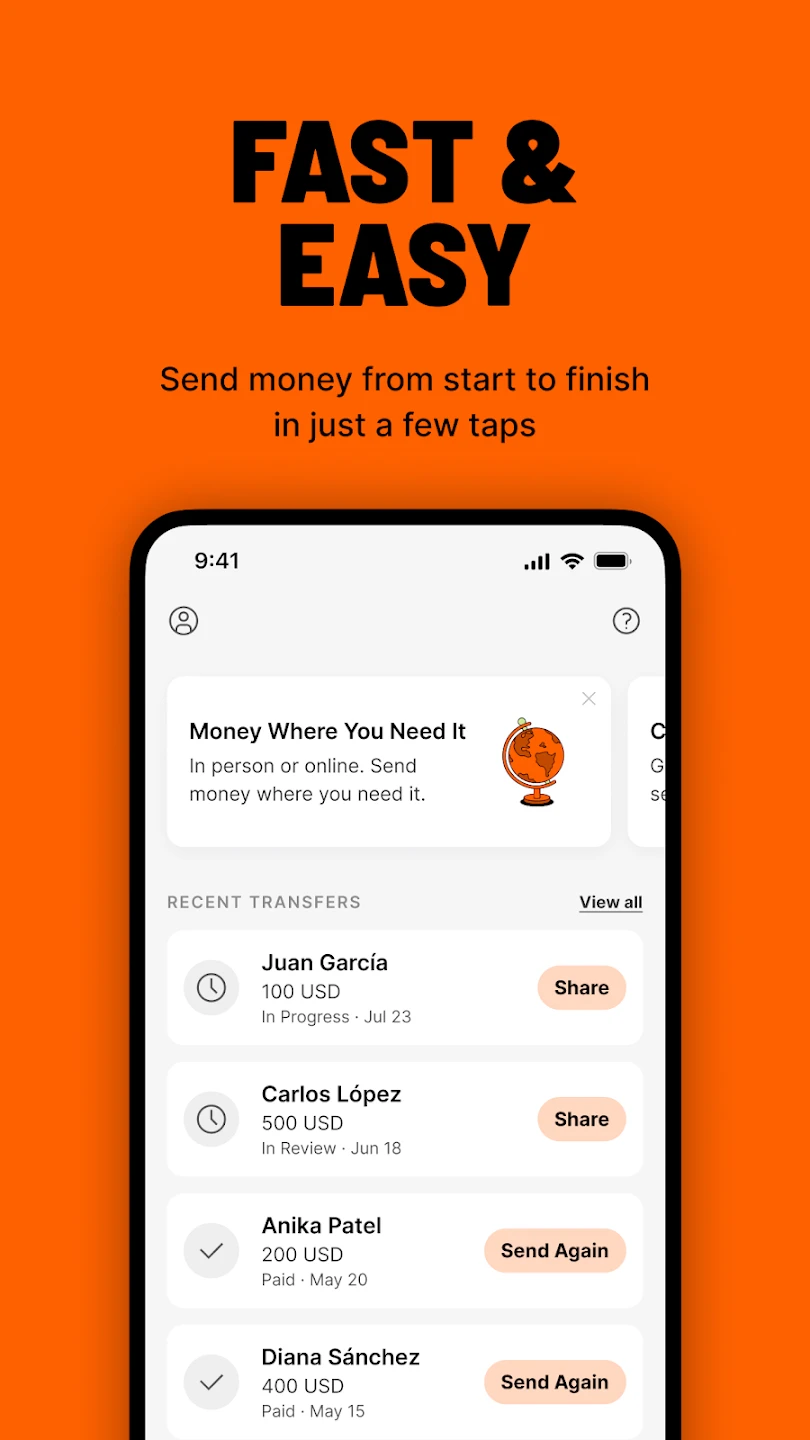

- Multiple Transfer Options & Tracking: You can choose between standard or expedited (next-day) delivery options depending on urgency and cost. Furthermore, you gain full visibility into your transaction’s status through real-time updates and detailed tracking, allowing you to easily verify if the recipient has received the funds or if there are any issues requiring attention.

- Multi-Currency Wallet: Manage your currency effectively with an integrated wallet that often supports multiple currencies. This facilitates smoother transactions by holding funds in the currency needed for sending, minimizing conversion steps and potentially improving exchange rates compared to doing conversions separately.

- Secure & Multi-Factor Authentication: Your funds’ security is paramount; the app employs robust encryption and multi-factor authentication methods to protect your account and transactions. This ensures peace of mind when sending money online, safeguarding sensitive information from potential threats during the transfer process.

- Budgeting & Transaction History: Access detailed transaction histories and potentially built-in tools to monitor your spending related to sending money. This feature helps you budget effectively and understand the costs associated with international transfers for personal or regular business use, promoting financial responsibility.

- Recipient Management: Save frequently sent-to beneficiaries’ details (with appropriate security measures) to streamline future transfers, potentially making them one-click actions. This saves significant time for regular transfers, such as recurring payments to family or frequent business partners, by reducing the need to re-enter recipient information.

Pros & Cons

Pros:

- Generally Competitive Exchange Rates & Low Fees

- Transfers Processed Relatively Quickly (Especially Express Options)

- User-Friendly Mobile Applications for Both iOS and Android

- High Transparency in Transfer Fees and Exchange Rates Displayed

- Multiple Sending Methods Available (Bank Account, Digital Wallet, Physical Cash)

- Extensive Worldwide Receiving Options Cover Many Destinations

Cons:

- Some Fees Can Still Add Up for Very Large Transfer Amounts

- International Banking Regulations Can Occasionally Delay Funds

- Customer Support Response Times Might Vary

- Not All Countries May Offer the Fastest Transfer Speeds

Similar Apps

| App Name | Highlights |

|---|---|

| TransferWise (now Wise) |

This app focuses on efficient international transfers using mid-market exchange rates often seen in banks. Known for railway diagrams showing fee transparency and supporting numerous currencies and bank accounts. |

| PayPal |

While versatile for payments and money transfers, PayPal offers competitive rates and quick transfers. Includes built-in currency conversion and seamless global accessibility for many users. |

| WorldRemit |

Known for its focus on sending money directly to mobile wallets, bank accounts, or even purchasing airtime in over 50 countries. Offers unique local payment methods and competitive exchange rates for targeted regions. |

| XE Money Transfer |

A direct service from XE, an online currency provider. Provides tools like a transfer calculator to estimate costs and offers access to foreign currency for physical cash pickups. |

Frequently Asked Questions

Q: What is the minimum amount I can send via the Ria Money Transfer: Send Money app?

A: The minimum send amount typically ranges from $20 to $30 USD, depending on the destination country and currency. This ensures a small transfer is possible even for occasional use, while larger amounts are also accommodated.

Q: How quickly can I expect the money to reach my recipient?

A: Standard Ria Money Transfer: Send Money usually takes 1-3 business days, though you might opt for the Express or Next-Day service for an additional fee, guaranteeing funds within 24 hours. Delivery times depend on the receiving country, currency type, and the chosen delivery speed.

Q: Are there any hidden fees I should be aware of when sending money through Ria?

A: Ria aims for transparency. Fees are clearly displayed before you send the money, typically including a sending fee and the applicable exchange rate spread. Always review the total cost breakdown provided in the app before confirming a transfer to avoid surprises.

Q: Do I need an internet connection to send money using this app? Can I use cellular data?

A: Yes, a stable internet connection via Wi-Fi or mobile data is required to use the Ria Money Transfer: Send Money app fully. You cannot send money offline; however, once initiated, the transfer process often involves secure steps that might complete even if you lose your connection shortly after starting (though this depends on the bank or provider receiving the funds).

Q: Is my personal information and sending activity secure with Ria Money Transfer: Send Money?

A: Yes, Ria employs strong security measures including bank-level encryption, multi-factor authentication (like SMS codes or biometrics), and complies with relevant regulations (e.g., AML/KYC). Your data and transaction history are protected, but always practice good security habits like using a strong password for your app account.

Screenshots

|

|

|

|