|

|

| Rating: 4.2 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Robinhood |

The Robinhood – FinTech SuperApp is a mobile application designed to provide users easy access to financial markets through commission-free trading in stocks, ETFs, options, and cryptocurrencies. It offers a streamlined interface for buying and selling various financial instruments and managing one’s investment portfolio, primarily targeting individuals seeking simple and low-cost investment options.

This Robinhood – FinTech SuperApp empowers users to invest and trade with minimal fees, making market access more affordable. Its intuitive design and broad range of tradable assets allow users—from beginners learning the ropes to experienced investors managing larger portfolios—to engage actively with the financial markets directly from their smartphone.

App Features

- Commission-Free Trading: Buy and sell stocks, ETFs, options, and cryptocurrencies without paying per-trade commissions or other transaction fees. This significantly lowers the barrier to entry and helps retain more capital invested.

- Portfolio Tracking: View the performance of your holdings, track market news, and analyze your investment portfolio in one place. Features like watchlists and portfolio summaries provide clear insights into your financial progress and market movements.

- Stock and ETF Investing: Invest in thousands of US-listed stocks and exchange-traded funds, offering exposure to diverse sectors and companies. This wide selection allows users to build diversified portfolios according to their risk tolerance and investment goals.

- Cryptocurrency Trading: Trade Bitcoin and other leading cryptocurrencies alongside traditional financial instruments. Available directly within the app, often with user-friendly tools for managing these volatile assets.

- Market News & Education: Access real-time market news, stock tickers, and educational content within the app to make informed decisions. This integration helps users stay updated on financial events and understand investment concepts.

- User Accounts & Settings: Manage your account details, security settings, and linked bank accounts directly from the interface. Easy access allows for smooth onboarding and quick adjustments to your financial profile as needed.

Pros & Cons

Pros:

- Zero Commission Trading

- User-Friendly Interface

- Wide Range of Tradable Assets

- Low Minimum Investment Requirement

Cons:

- Limited Advanced Features

- No Direct Investment Advice

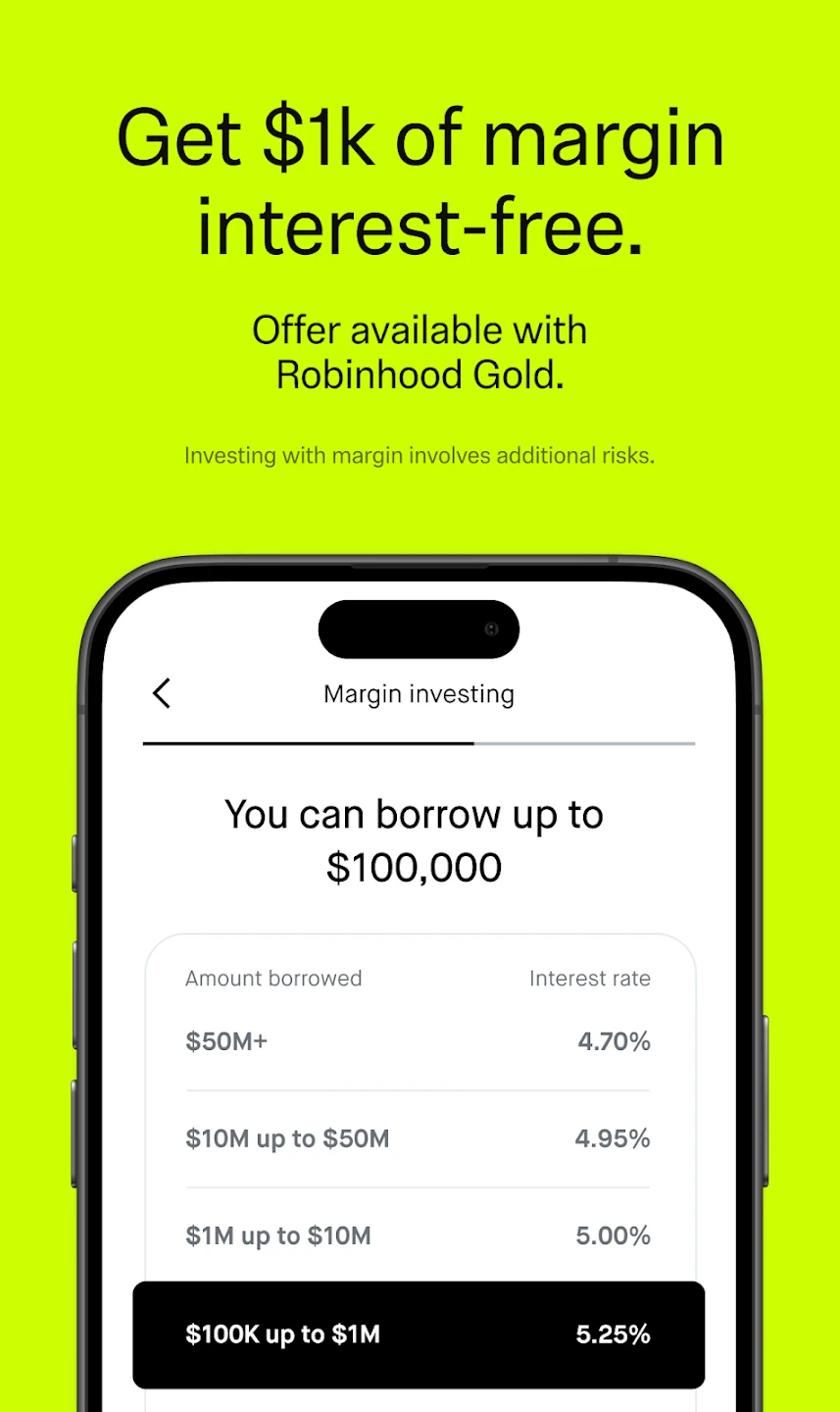

- Margin Trading Not Available

- No Retirement Accounts Included

Similar Apps

| App Name | Highlights |

|---|---|

| Acorns Invest |

Focuses on automated investing and dollar-cost averaging, often for beginners. Includes features like round-up investing and a small stock portfolio tracker. |

| Mirae Asset Global |

Known for providing market analysis, portfolio analytics, and educational tools for active traders and investors looking for more detailed insights. |

| Revolut Markets |

An all-in-one superapp offering currency exchange, banking, and commission-free trading across a global range of assets including stocks, ETFs, and crypto. |

Frequently Asked Questions

Q: What types of investments can I make using the Robinhood – FinTech SuperApp?

A: Robinhood – FinTech SuperApp allows commission-free trading in US stocks, exchange-traded funds (ETFs), cryptocurrency (such as Bitcoin), and options trading (subject to account verification and funding).

Q: Are there any account fees or minimum balance required for Robinhood – FinTech SuperApp?

A: Robinhood generally has no account fees, and there is no minimum balance requirement for opening or maintaining an account. Users just need to link a funding source to start trading.

Q: How secure is my information and funds within the Robinhood – FinTech SuperApp?

A: Security is prioritized; the app uses encryption for data, two-factor authentication for added protection, and holds assets securely. However, as with any financial investment, there’s inherent market risk involved.

Q: Can I transfer funds directly from my Robinhood – FinTech SuperApp account to my bank account?

A: Yes, you can transfer your cash holdings from your Robinhood app to linked external bank accounts, either immediately or after settling (typically T+2 business days).

Q: Does Robinhood – FinTech SuperApp offer customer support, and is it available 24/7?

A: Support is available through various channels, including chat and email, but availability may not be 24/7, particularly outside of standard business hours.

Screenshots

|

|

|

|