|

|

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Rocket Money – Bills & Budgets |

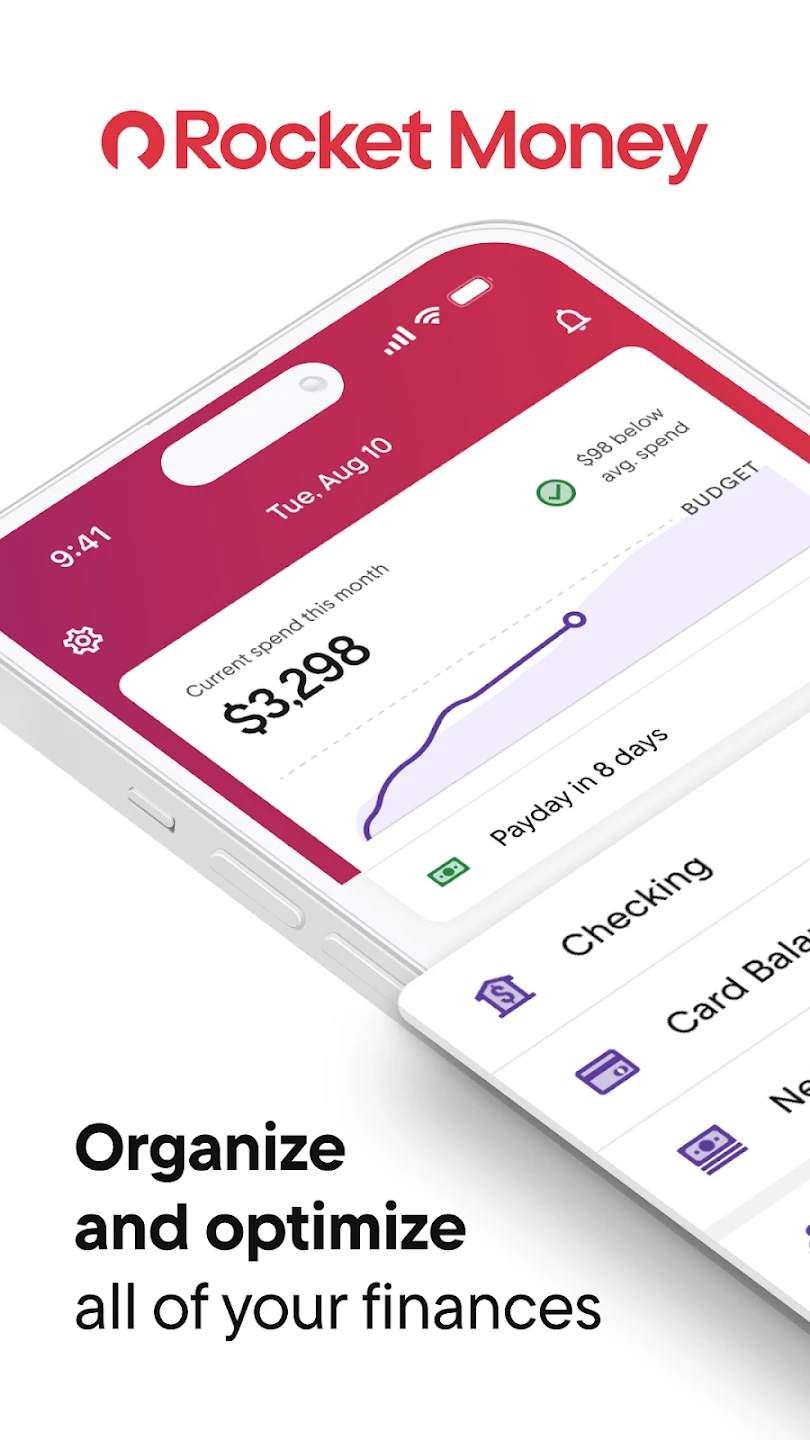

Rocket Money Bills & Budgets is an intuitive mobile app that helps users manage their finances by tracking expenses, setting budgets, and organizing bill payments. The app is designed for everyday individuals and families looking to gain better control over their spending habits and financial health. It combines simplicity with powerful tools to make money management accessible to all skill levels.

Rocket Money Bills & Budgets simplifies budgeting by offering real-time spending insights and automated bill reminders, helping users avoid late fees and stay within their means. Its practical value lies in empowering users to visualize their financial situation through interactive reports and personalized recommendations, making it perfect for anyone aiming for financial stability while balancing daily expenses.

App Features

- Smart Dashboard: The main dashboard provides a clear overview of spending patterns with visual charts, allowing users to quickly identify categories where they overspend. For example, if dining out consistently exceeds budget limits, the interface highlights this trend so users can adjust habits accordingly, fostering more conscious spending decisions.

- Budget Builder Tool: This feature lets users create customized spending limits across different expense categories like groceries, entertainment, or utilities, incorporating inflation adjustments. The system automatically tracks progress with notifications, making it easier to adhere to financial plans without constant manual input.

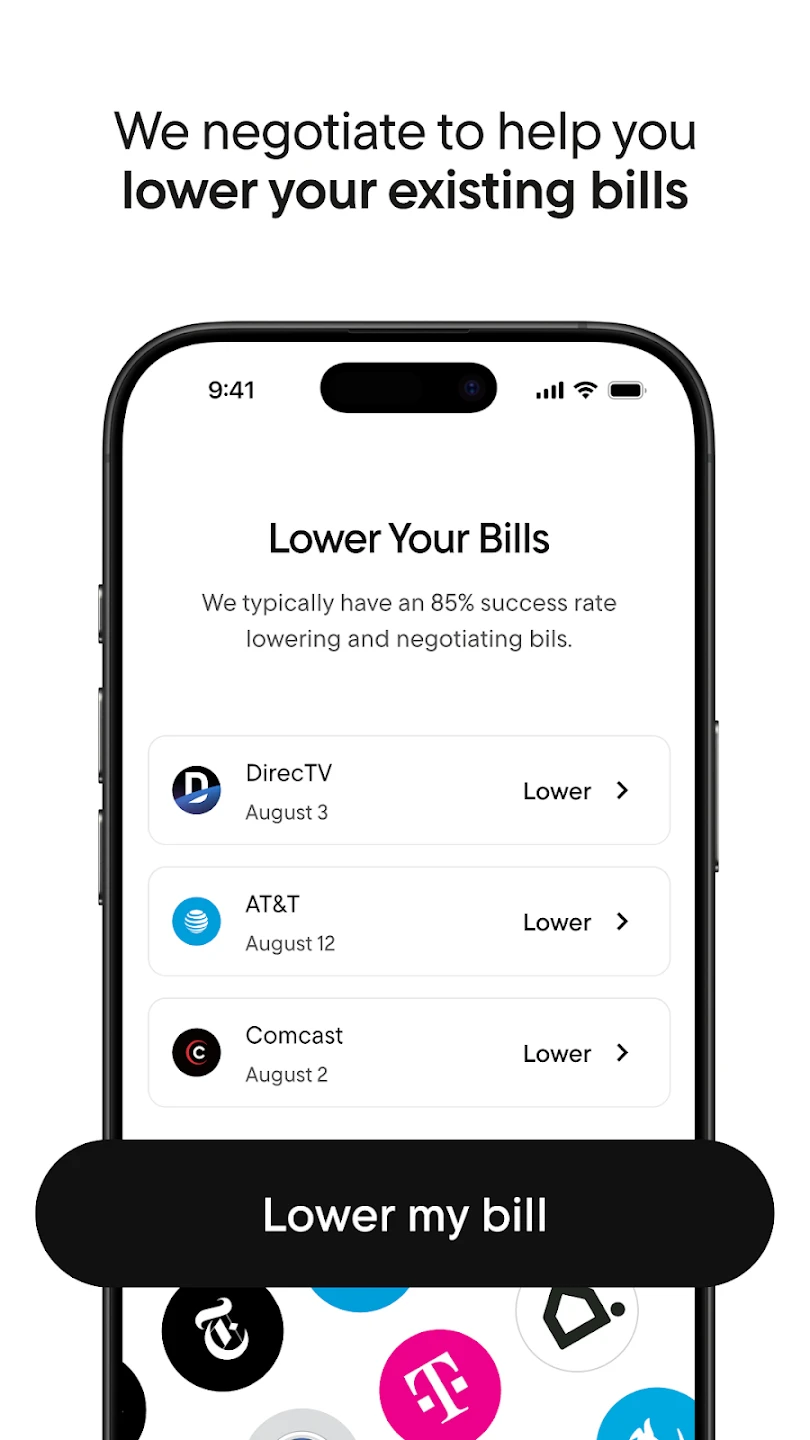

- Bill Sync Integration: By connecting to bank accounts and utility providers, the app pulls payment due dates and balances, reducing missed payments and simplifying cash flow tracking. This integration saves time by centralizing all financial obligations in one place, eliminating the need for multiple reminder systems.

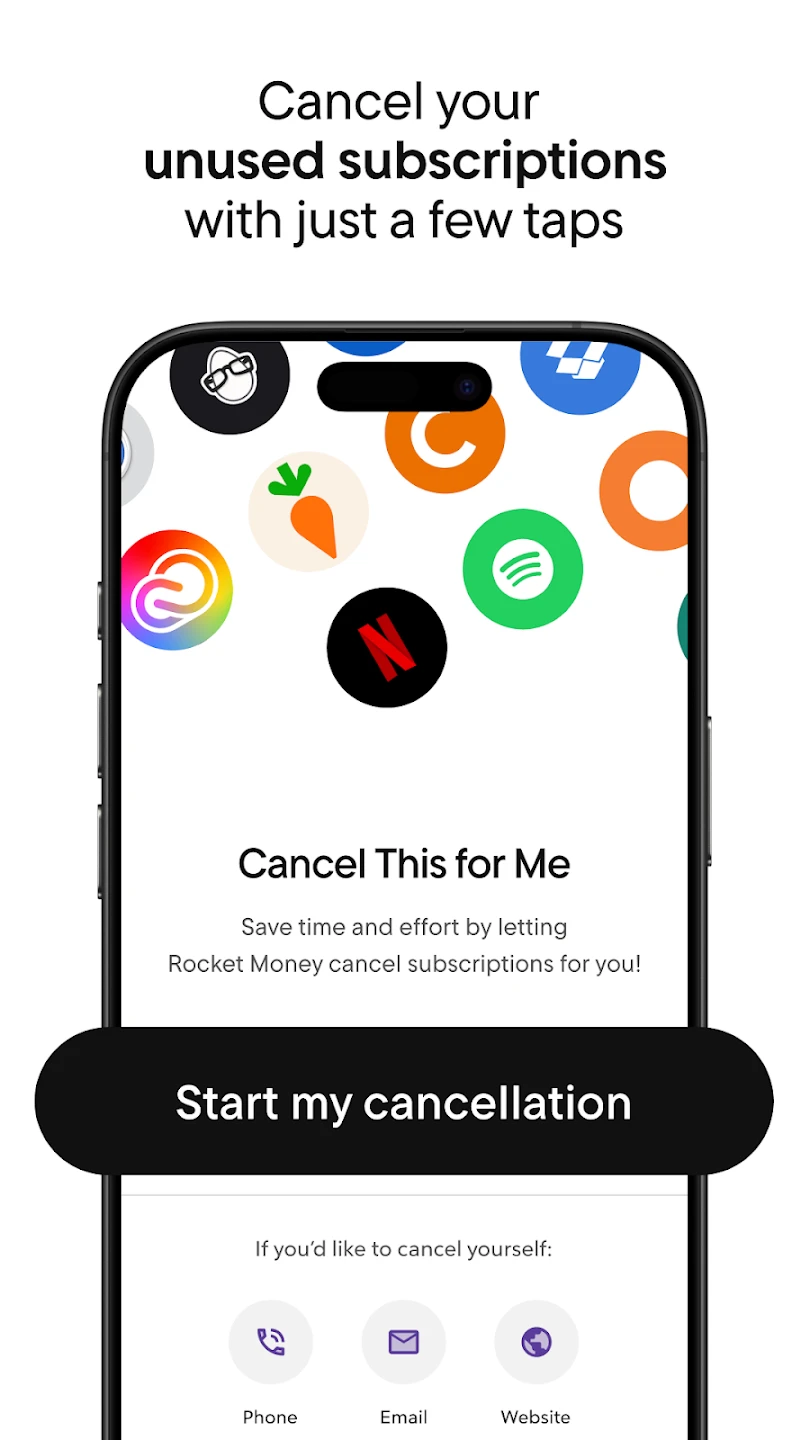

- Spending Insights Engine: Using AI algorithms, the app analyzes purchase history to suggest adjustments like reducing subscriptions or finding cheaper alternatives for frequently bought items. For instance, it might highlight an opportunity to save 25% on grocery delivery by suggesting a discount code.

- Family Sharing Portal: Users can invite family members to share financial goals with different permission levels, allowing parents to monitor teen spending while teens gain practical budgeting experience through gamified challenges.

- Emergency Fund Builder: This optional premium feature guides users in accumulating savings for unexpected expenses, calculating optimal deposit amounts based on income and risk tolerance.

Pros & Cons

Pros:

- Simplified Budget Creation

- Real-time Transaction Sync

- Intuitive Bill Organization

- Visual Spending Reports

Cons:

- Limited investment tracking

- Credit score monitoring not included

- Advanced reporting costs extra

Similar Apps

| App Name | Highlights |

|---|---|

| Mint by Intuit |

Connects to multiple accounts, provides financial goal tracking, includes bill payment features. |

| YNAB (You Need A Budget) |

Zero-based budgeting system, robust envelope method, detailed transaction categorization. |

| NOW Finance |

Focuses on goal savings through automated savings goals, expense tracking, and debt payoff tools. |

Frequently Asked Questions

Q: What payment methods are supported for bills?

A:

Q: How accurate is the spending analysis?

A:

Q: Can I link investment accounts?

A:

Q: What happens with data privacy?

A:

Q: Are there premium features available?

A:

Screenshots

|

|

|

|