|

|

| Rating: 4.6 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Sendwave |

Sendwave—Send Money is a mobile banking application designed for fast international money transfers between users worldwide. It enables quick and secure cross-border payments to friends, family, or businesses at competitive exchange rates, primarily serving non-resident Indians who need to send remittances back to India efficiently. The app simplifies complex financial processes into an intuitive interface accessible to both tech-savvy users and those new to digital banking.

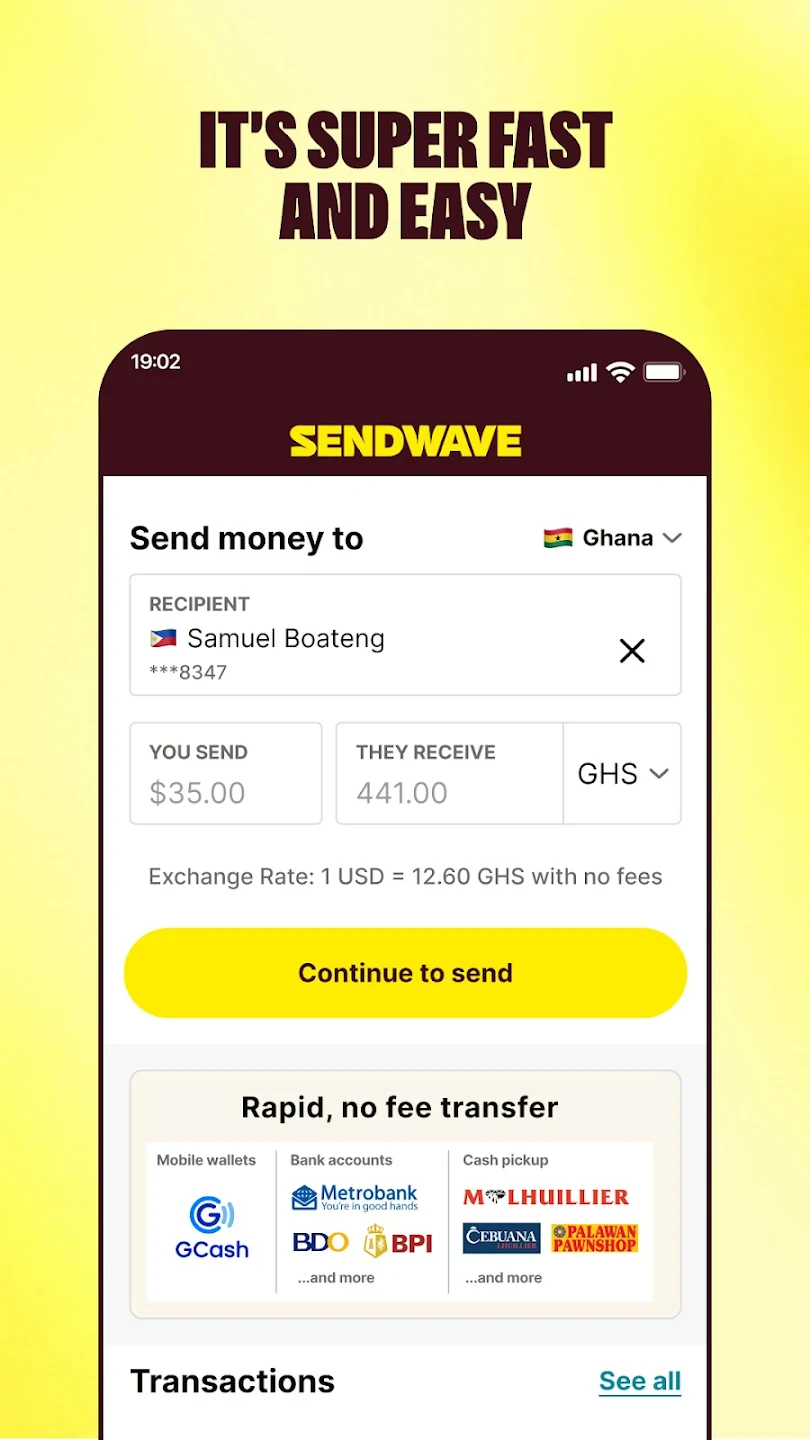

The core value of Sendwave—Send Money lies in its combination of speed, cost-effectiveness, and regulatory compliance. Users can send money in just a few clicks with low foreign transaction fees compared to traditional banks, making it ideal for regular remittances or urgent business transfers, while ensuring funds reach recipients securely and reliably across international borders.

App Features

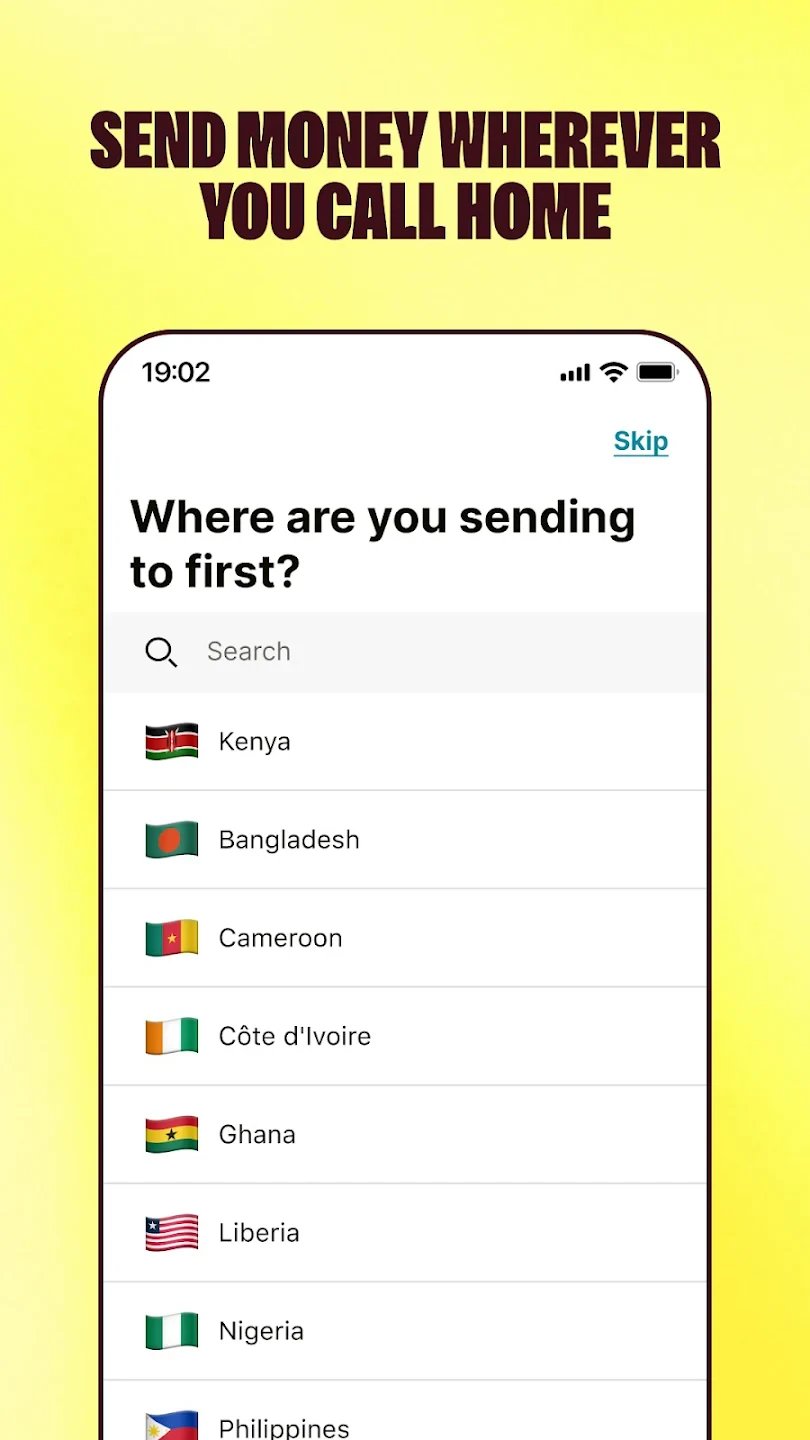

- Instant Global Transfers: Quickly send money across over 150 countries in minutes instead of days. This feature saves valuable time for expatriates needing to support dependents or for businesses handling time-sensitive payments, with real-time tracking showing the status from initiation to final credit.

- Multi-Currency Wallet: Seamlessly convert between currencies like USD to INR with minimal spread, supporting up to 20 popular global currencies simultaneously for complex international transactions. The intuitive interface displays current exchange rates and allows multi-step currency conversions to optimize sending amounts.

- Resident Abroad Registration: Streamlined onboarding specifically tailored for Non-Resident Indians with dedicated verification steps for NRE/FCNR accounts, reducing approval time to under 15 minutes. This solves the cumbersome paperwork involved in traditional banking systems, allowing faster transfers without account freezes.

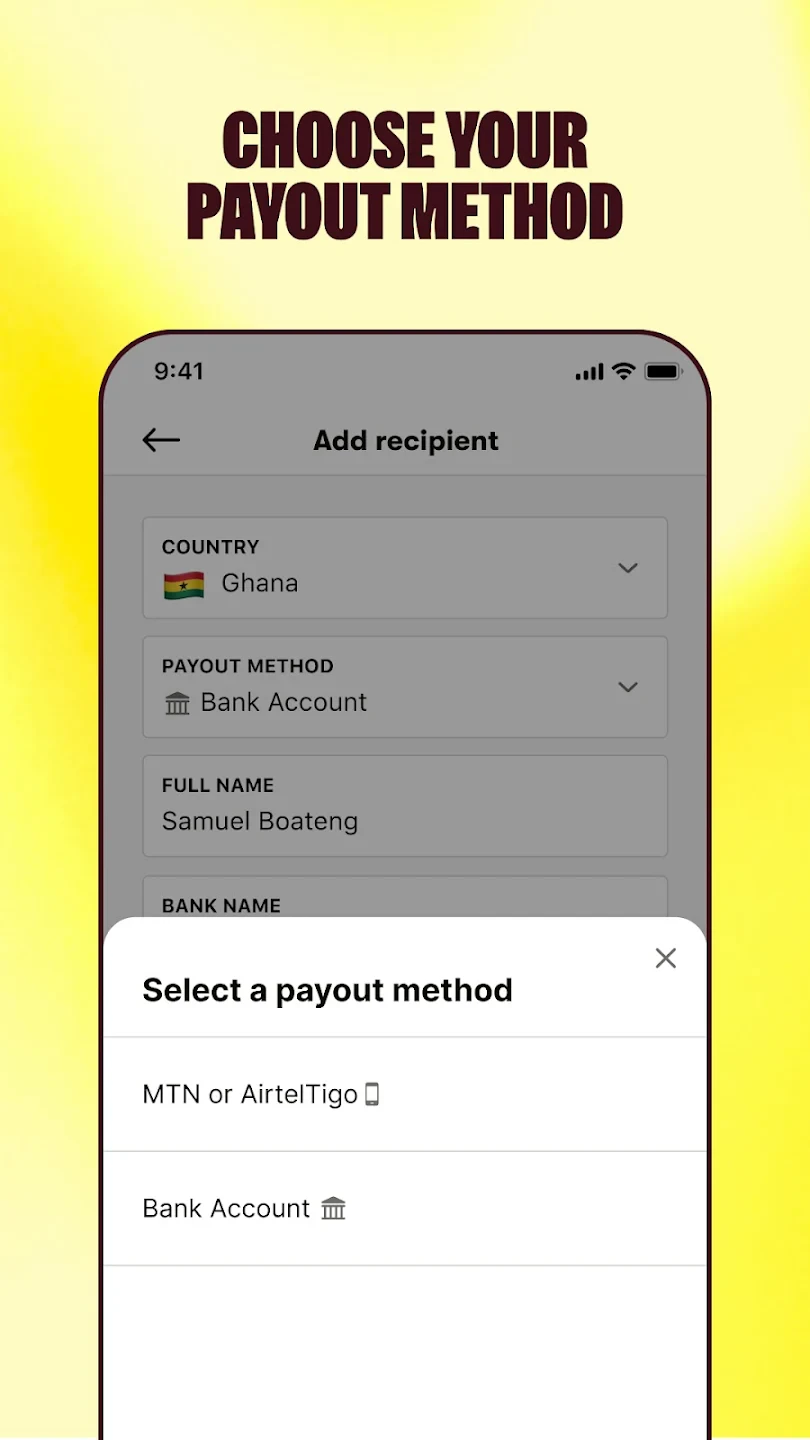

- Bank Account Linking: Directly link to Indian savings, NRE, or FCNR accounts through IFSC codes or UPI for instant deposits. This eliminates the need for NEFT/RTGS processing delays, ensuring funds appear in recipient accounts within seconds rather than waiting for banking hours to pass.

- Transaction Analytics Dashboard: Visualize spending patterns, transfer frequency, and currency performance through an interactive chart interface. This feature helps users budget for regular remittances while tracking compliance with tax regulations for business transfers over time.

- Biometric Authentication: Secure logins via fingerprint or facial recognition, meeting global security standards while simplifying access. The multi-layer encryption supports RBI compliance for sensitive transactions, offering peace of mind for users handling significant business amounts.

Pros & Cons

Pros:

- Significantly Faster Processing

- Low International Transaction Fees

- Streamlined NRI Account Setup

- User-Friendly Mobile Interface

Cons:

- Country Coverage Limitations

- Minimum Send Amount Restrictions

- Verification Delays for New Users

- Occasional Exchange Rate Variations

Similar Apps

| App Name | Highlights |

|---|---|

| Axis Bank MoneyGram Remit |

Offers RBI-approved transfers with dedicated NRE/FCNR options. Includes guidance for new users navigating Indian remittance rules. |

| PayPal Person-to-Person |

Enables currency conversion between 20+ currencies with global reach. Known for quick US-to-India transfers with transparent fees. |

| MoneyGram India |

Specializes in urgent cash pickups at partner stores. Provides tracking for time-sensitive business payments across borders. |

Frequently Asked Questions

Q: Can I send money from the US to my parents in India using Sendwave—Send Money?

A: Yes, Sendwave—Send Money supports direct transfers from over 150 countries to Indian beneficiaries. You’ll need a USD or other supported currency account, though multi-currency conversion may incur small fees depending on the originating currency.

Q: Are there any limits on how often I can send money?

A: Individual transfers have no time frequency restriction, but there are daily caps of ₹50,000 INR per recipient. Business users may need to verify higher transaction volumes through separate documentation for larger amounts.

Q: How quickly are taxes handled for business transfers?

A: Sendwave—Send Money automatically calculates applicable taxes (like TDS) based on recipient PAN details during registration. For NRE/FCNR accounts, tax benefits under Section 89 are preserved, and we issue Form 16B for business transactions exceeding ₹50,000 INR.

Q: Can I cancel a transfer initiation once it’s submitted?

A: You can cancel pending transfers within 5 minutes of initiation, but once processed, reversals are only possible via bank-level chargebacks (subject to standard banking fees). For critical changes like recipient details, contact support immediately before the transfer is finalized.

Q: Does the app support sending money using UPI ID to an Indian bank account?

A: Absolutely! Sendwave—Send Money enables direct transfers from any UPI-linked account to Indian bank accounts. After converting to INR via our regulated exchange rate, the money lands instantly in the recipient’s account without needing NEFT or RTGS processing, typically within 2 banking seconds.

Screenshots

|

|

|

|