|

|

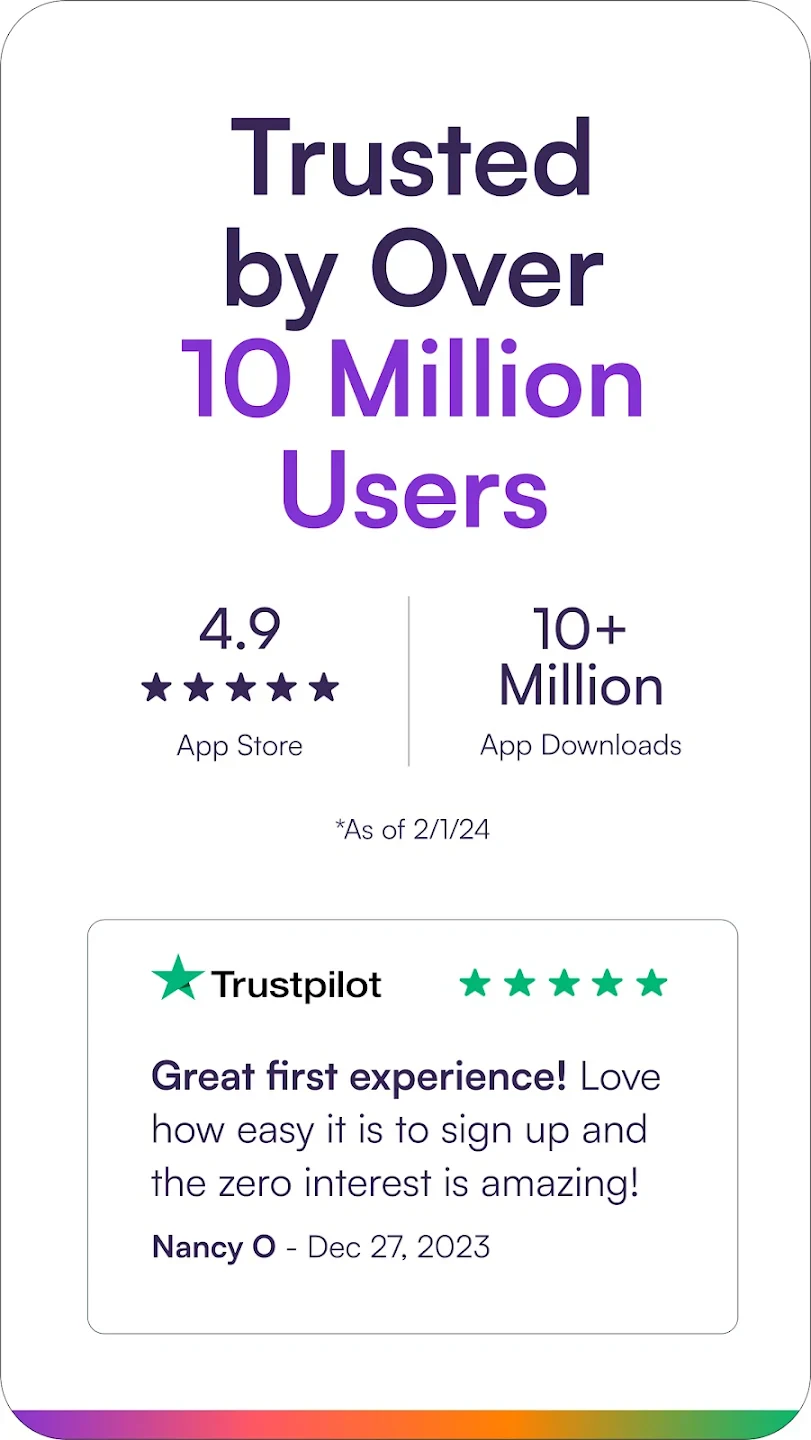

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Shopping | Offer by: Sezzle Mobile |

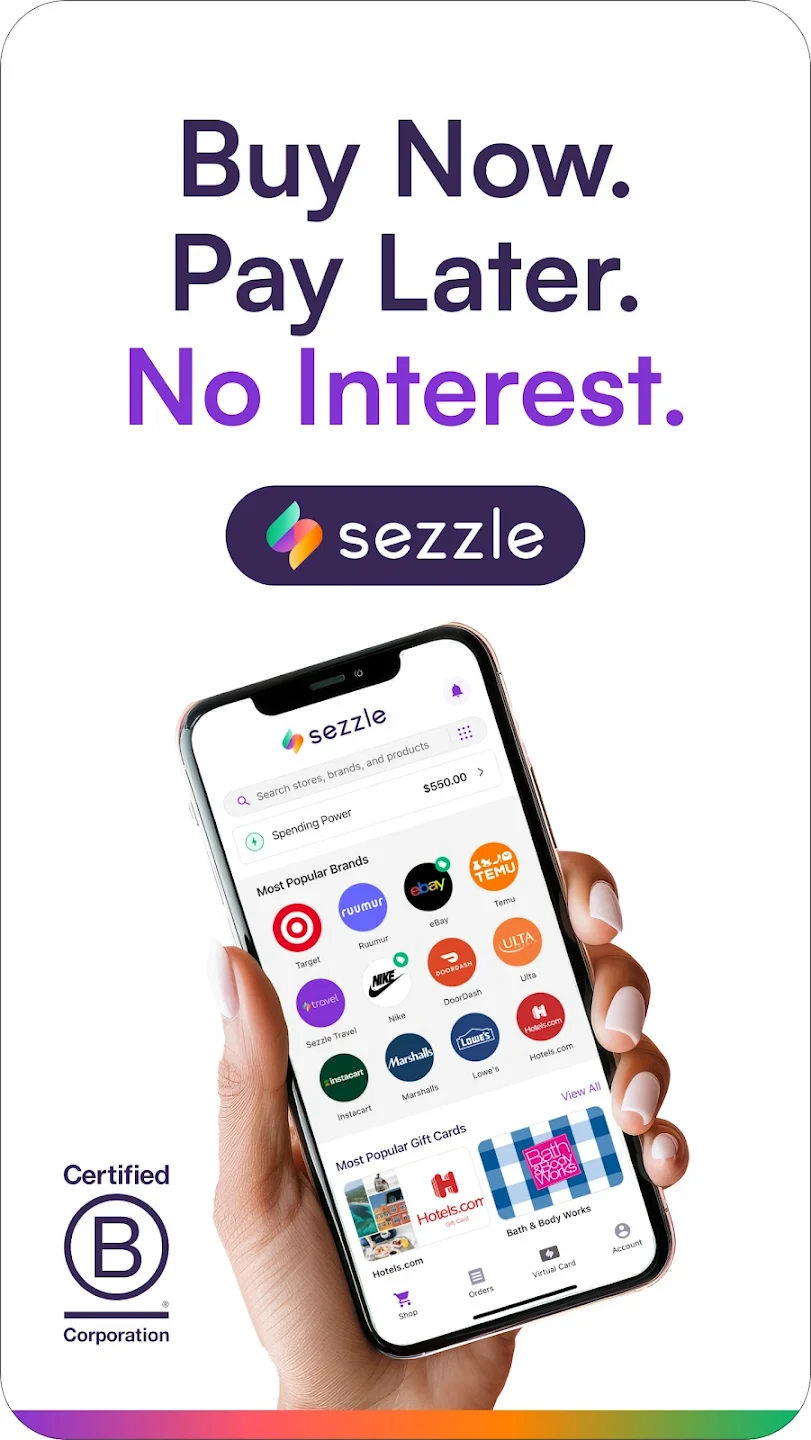

The Sezzle – Buy Now, Pay Later app enables users to make immediate purchases online but pay them off over several weeks instead of right away. It integrates directly with participating merchant apps and websites during checkout. Perfect for individuals who want to secure items they love but prefer not to spend their entire budget all at once.

Sezzle simplifies budgeting by spreading purchase costs over time, making big buys feel more manageable. It’s an excellent tool for impulse purchases, essential electronics, furniture, or anything else that can be paid in installments, helping users avoid carrying large amounts of cash or credit card debt immediately.

App Features

- Interest-Free Installments: Sezzle allows you to split your purchase cost into four equal payments with no interest. This means you get the item now but pay it back gradually, benefiting from improved cash flow without accruing finance charges, saving you money compared to typical credit cards. For example, buying a $400 coffee table lets you pay $100 every two weeks for four weeks.

- Simple Checkout Process: When shopping at a participating merchant, select ‘Buy Now, Pay Later’ during checkout. Sezzle handles the payment splitting, integrating smoothly so the process is quick and doesn’t require navigating a separate app, enhancing overall shopping speed and usability. It often appears as a familiar checkout option, reducing friction.

- Sezzle Account Management & Tracking: You can easily view all your upcoming payments, track when each is due via the app notifications, and manage your account details. This feature provides clear visibility and control over your finances, preventing missed payments and offering peace of mind, making budgeting with Sezzle much simpler.

- Spending Control Features: Set a budget limit specifically for your Sezzle spending and receive alerts or warnings when approaching your spending threshold. This helps prevent uncontrolled spending, promoting better financial discipline and preventing purchases that strain your immediate finances, especially during holiday sales.

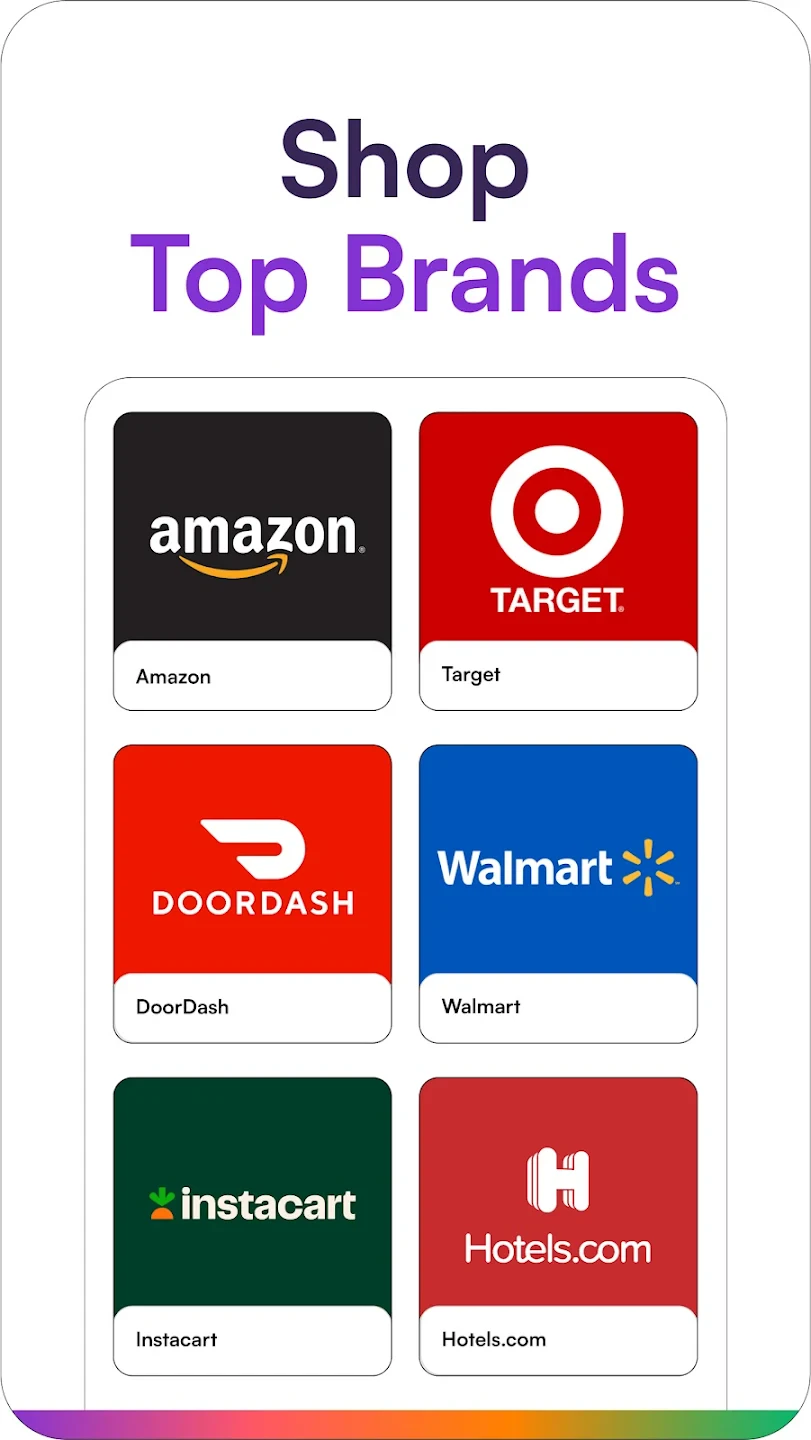

- Wide Merchandise Range & App Integration: Sezzle partners with a vast number of retailers across fashion, electronics, home goods, and more. Its app is designed for easy integration during checkout flows, meaning you can often find the Sezzle option right on the merchant’s site or app, offering flexibility to users across different shopping platforms.

- Schedule & Notifications: You can view and adjust (if within terms) your payment schedule, and the app sends reminders as payment dates approach. This proactive communication helps ensure timely payments, avoiding late fees and potential negative credit impacts, keeping your financial record clean automatically.

Pros & Cons

Pros:

- Convenient & Fast Purchase Process

- No Interest Charges (Initially)

- Helps Manage Large Purchases Budgetarily

- Transparent Payment Schedule

Cons:

- Potential Credit Check required for new users to assess repayment ability.

- Late Payment Fees can apply if payments are delayed.

- Merchant Participation Required; not all stores offer the Sezzle option.

- Potential for Unintended Debt if spending habits are not managed responsibly.

Similar Apps

| App Name | Highlights |

|---|---|

| Klarna |

A popular global BNPL service offering various installment plans and a digital ‘purchase protection’ feature. Also allows deferred interest financing on larger purchases. |

| Afterpay |

Another widely adopted BNPL app known for its simple two-week installment plans. Focuses on ease of use with minimal setup required. |

| Afford |

An alternative BNPL app focusing on budgeting features alongside payments, often offering lower minimum purchase amounts. |

Frequently Asked Questions

Q: How long does it take to receive my first payment notice after using Sezzle?

A: You should typically see the first payment due date appear within a few weeks after completing your initial purchase. The exact schedule depends on the merchant and your chosen plan, which you agreed to upfront.

Q: Are all purchases through Sezzle interest-free?

A: Yes, all Sezzle plans are currently interest-free. The service allows splitting the cost of a transaction over several weeks (usually 4 weeks) without any added interest charges.

Q: Can I change my payment schedule after I’ve used Sezzle?

A: You can often adjust your payment dates via the Sezzle app if you need flexibility, but changes must comply with your specific plan terms (usually requiring at least one payment already posted). It’s designed to be user-friendly.

Q: Is there a limit on the number of items or amount I can buy with Sezzle?

A: Minimum purchase amounts can vary slightly by merchant, but typically start around $25-$50. There isn’t usually a hard limit on the number of items, though very high-value purchases might be subject to a credit check depending on your country and payment history.

Q: What happens if I miss a Sezzle payment?

A: Missing a payment may result in late fees and, importantly in some regions, could trigger a soft inquiry on your credit file. Sezzle usually sends reminders, but prompt payment is always best. Repeated failures might affect your future borrowing options.

Screenshots

|

|

|

|