|

|

| Rating: 4.8 | Downloads: 1,000+ |

| Category: Books & Reference | Offer by: Josh Lefler |

Introducing TCA Plus (TCA 2024), the latest evolution in tax compliance automation designed for accountants, tax professionals and financial advisors. It offers streamlined workflows, accurate calculations, and powerful reporting directly from your preferred device.

The key value of TCA Plus (TCA 2024) lies in its ability to significantly reduce manual work, minimize errors, and provide insightful data, making complex tax scenarios more manageable and efficient for professionals.

App Features

- Tax Calculation Engine: This powerful engine automatically calculates complex tax scenarios using updated rules and regulations, saving significant time compared to manual spreadsheets, with emphasis on accuracy and regulatory compliance.

- Multi-Entity Management: Seamlessly manage tax calculations, filings, and reports for multiple entities from a single dashboard, improving organizational efficiency and providing centralized oversight.

- Customizable Templates & Rules: Create and save specific calculation logic and reporting layouts tailored to common client situations, enhancing consistency and allowing users to define their workflow precisely.

- Real-Time Collaboration: Work simultaneously with team members on specific tasks or client files, using secure cloud-based storage for documents and calculations, which accelerates project completion.

- Seamless Data Import/Export: Connect directly to common tax software, banking APIs, or upload spreadsheets, ensuring data integrity and simplifying the process of gathering source information.

- Advanced Scenario Planning: Model different “what-if” tax situations by adjusting variables like deductions, credits, or income levels to forecast impacts and strategic planning.

Pros & Cons

Pros:

- Significant Time Savings

- High Accuracy Rates (compared to manual methods)

- Enhanced Data Organization

- Better Client Reporting

Cons:

- Requires Internet Connection

- Initial Learning Curve for Complex Features

- Subscription Cost vs. Free Alternatives

- Limited Customization for Highly Specific Scenarios

Similar Apps

| App Name | Highlights |

|---|---|

| TaxPro Suite X |

This comprehensive suite offers robust tax preparation, audit management, and client communication tools with strong integration options. |

| FinanceFlow Tax |

Focused on financial modeling and tax implications within broader business planning, known for its analytical depth and forecasting. |

| QuickCalc Tax Suite |

Popular for its simplicity and fast calculation speeds across basic to intermediate scenarios, often praised for user-friendly interfaces. |

| GovTax Navigator |

Emphasizes direct access to government forms and regulations, with a focus on guided filing processes and compliance updates. |

Frequently Asked Questions

Q: Can TCA Plus (TCA 2024) integrate with my existing accounting software?

A: Yes, TCA Plus (TCA 2024) offers direct integrations with major platforms like QuickBooks, Xero, and Sage through its API. This allows for automatic synchronization of client data, transaction histories, and generated reports, reducing manual data entry significantly.

Q: Is the data stored by TCA Plus (TCA 2024) secure?

A: Absolutely. TCA Plus (CA 2024) utilizes enterprise-grade encryption for data both at rest and in transit. We adhere strictly to data privacy regulations and provide granular control settings for user permissions and data access.

Q: Does TCA Plus (TCA 2024) support international tax calculations?

A: Yes, TCA Plus (TCA 2024) is designed to handle complex international tax scenarios, including multi-jurisdictional filings and transfer pricing calculations, based on user-configured parameters and country-specific regulations.

Q: Can multiple team members work on the same client file simultaneously using TCA Plus (TCA 2024)?

A: Definitely. The app includes built-in real-time collaboration features that allow multiple users to access, edit, and review specific aspects of the same client file securely, greatly improving team efficiency and workflow.

Q: What happens if a new tax regulation is announced after I’ve prepared a return using TCA Plus (TCA 2024)?

A: TCA Plus (TCA 2024) automatically updates its calculation engine and rule sets when new regulations are released. If a change significantly impacts previously calculated results, the app flags the relevant calculations and provides guidance notes for review and adjustment.

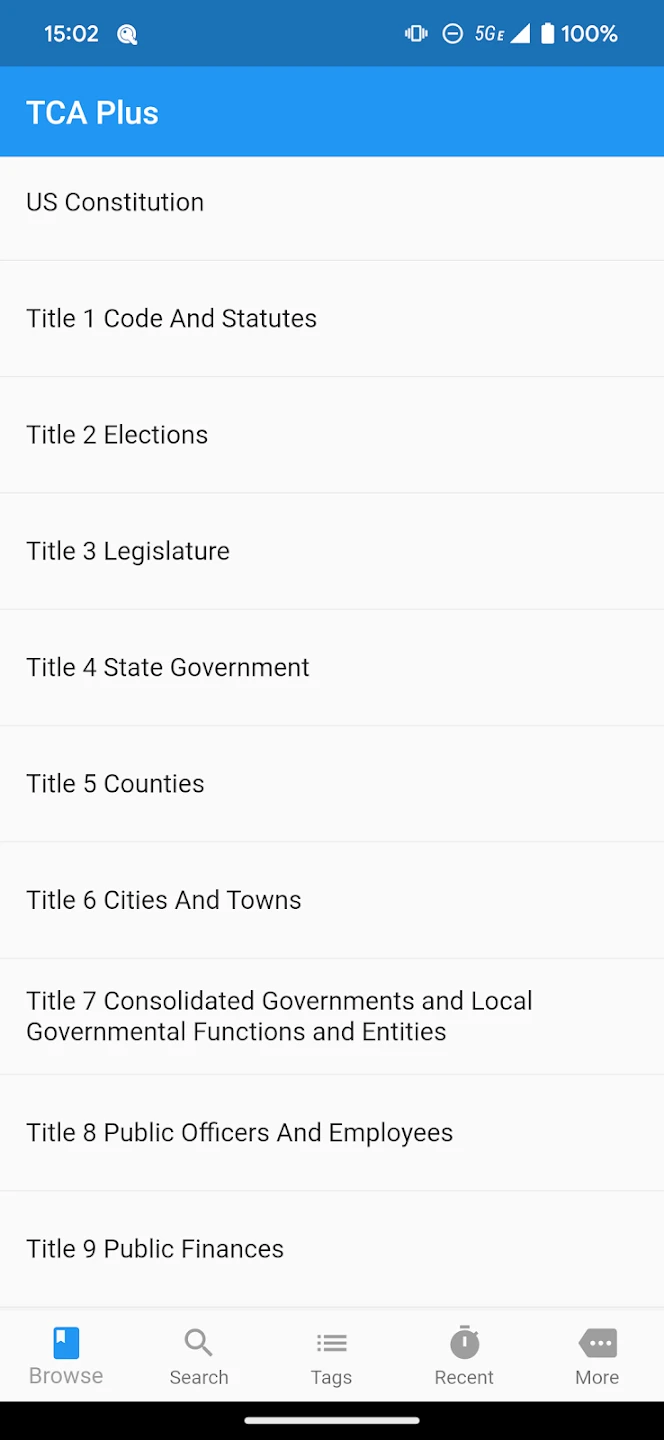

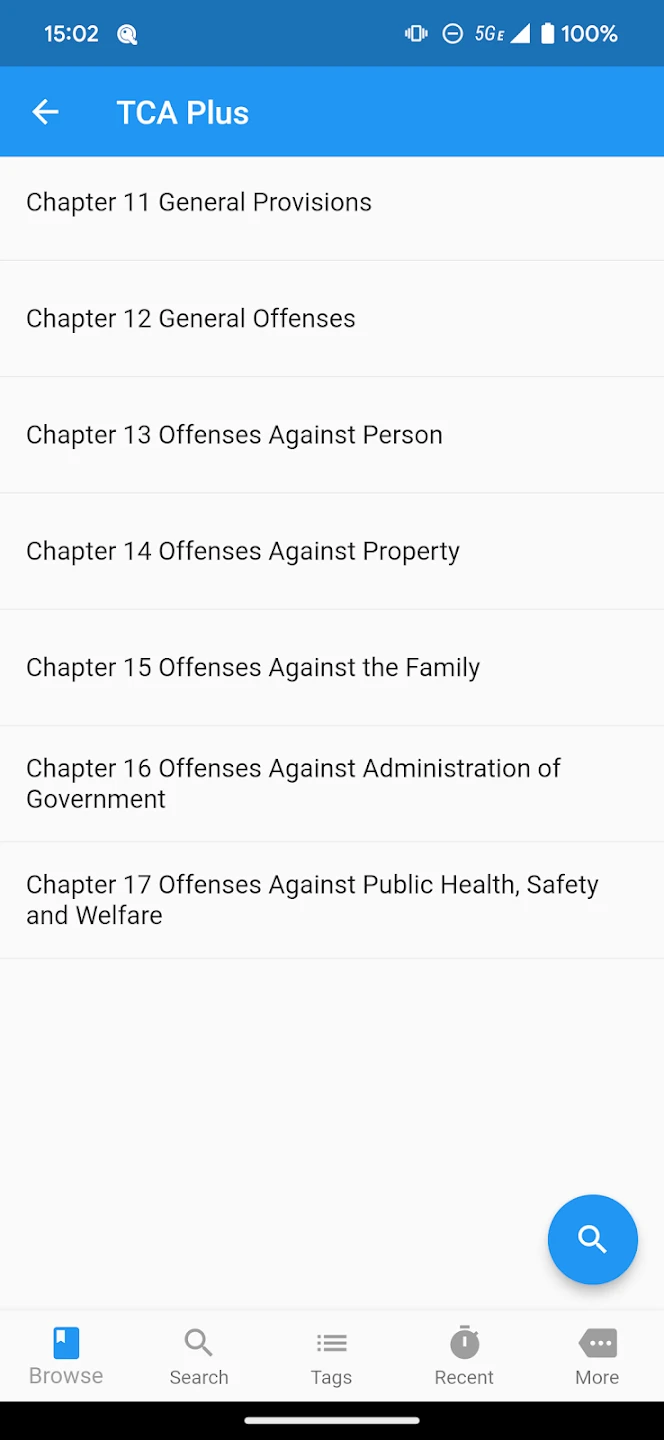

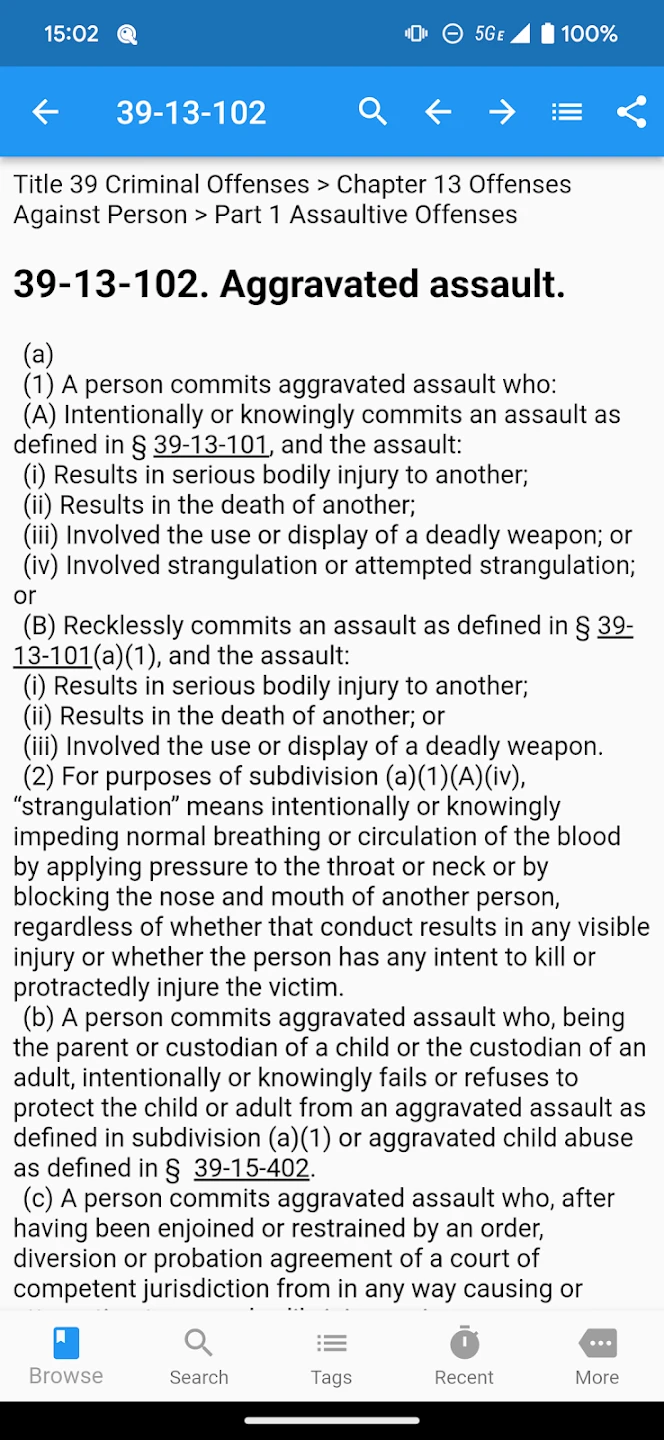

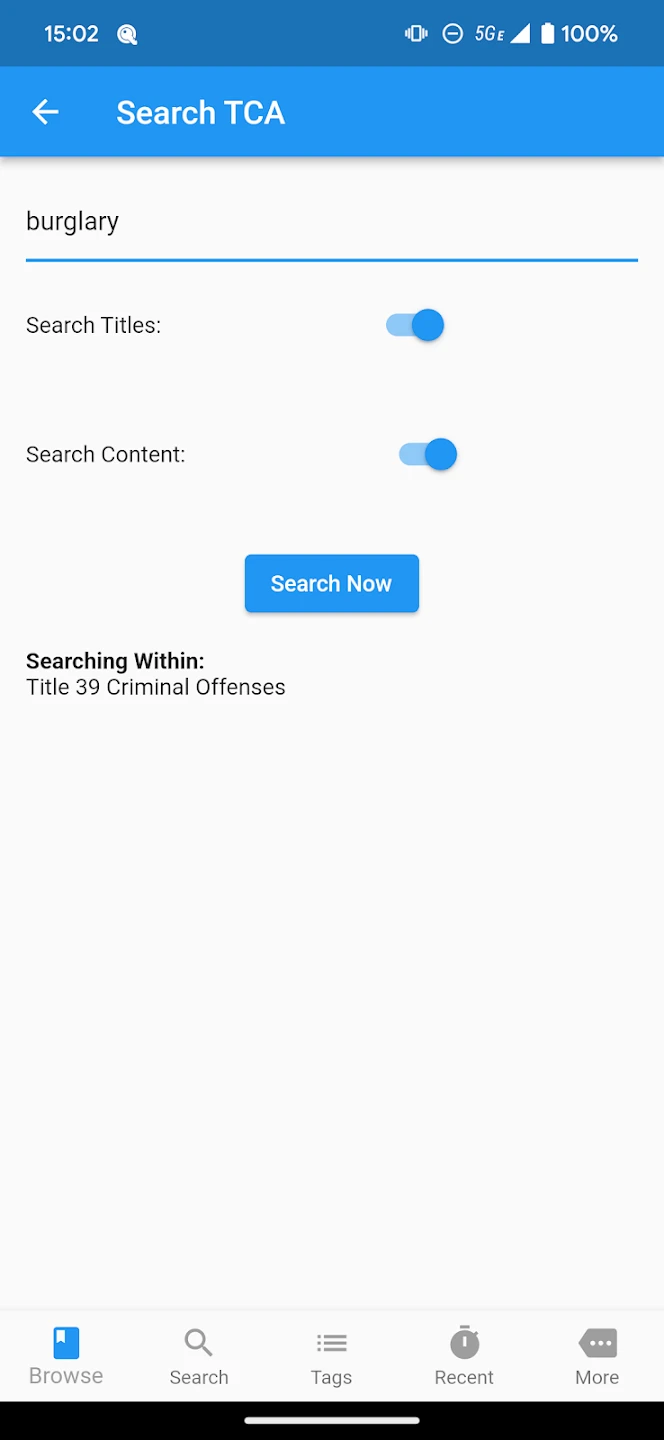

Screenshots

|

|

|

|