|

|

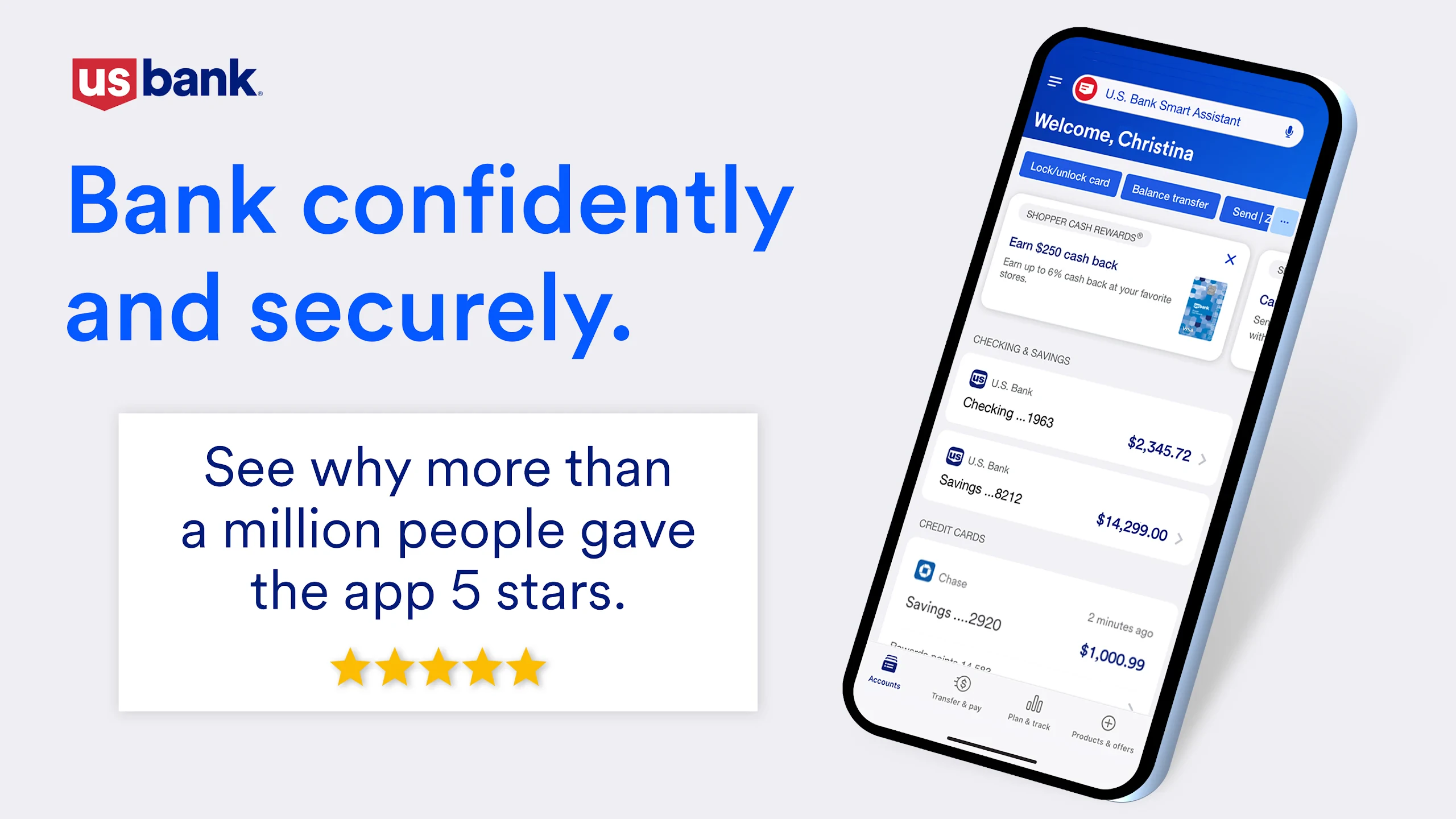

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: U.S. Bank Mobile |

U.S. Bank Mobile Banking is a powerful application designed to give customers control and convenience from their smartphones and tablets. This digital platform allows users to perform core banking functions like checking account balances, viewing transactions, transferring funds between accounts, and paying bills, all without visiting a physical branch. It is primarily for customers who value accessibility and the ability to manage their personal finances anytime, anywhere.

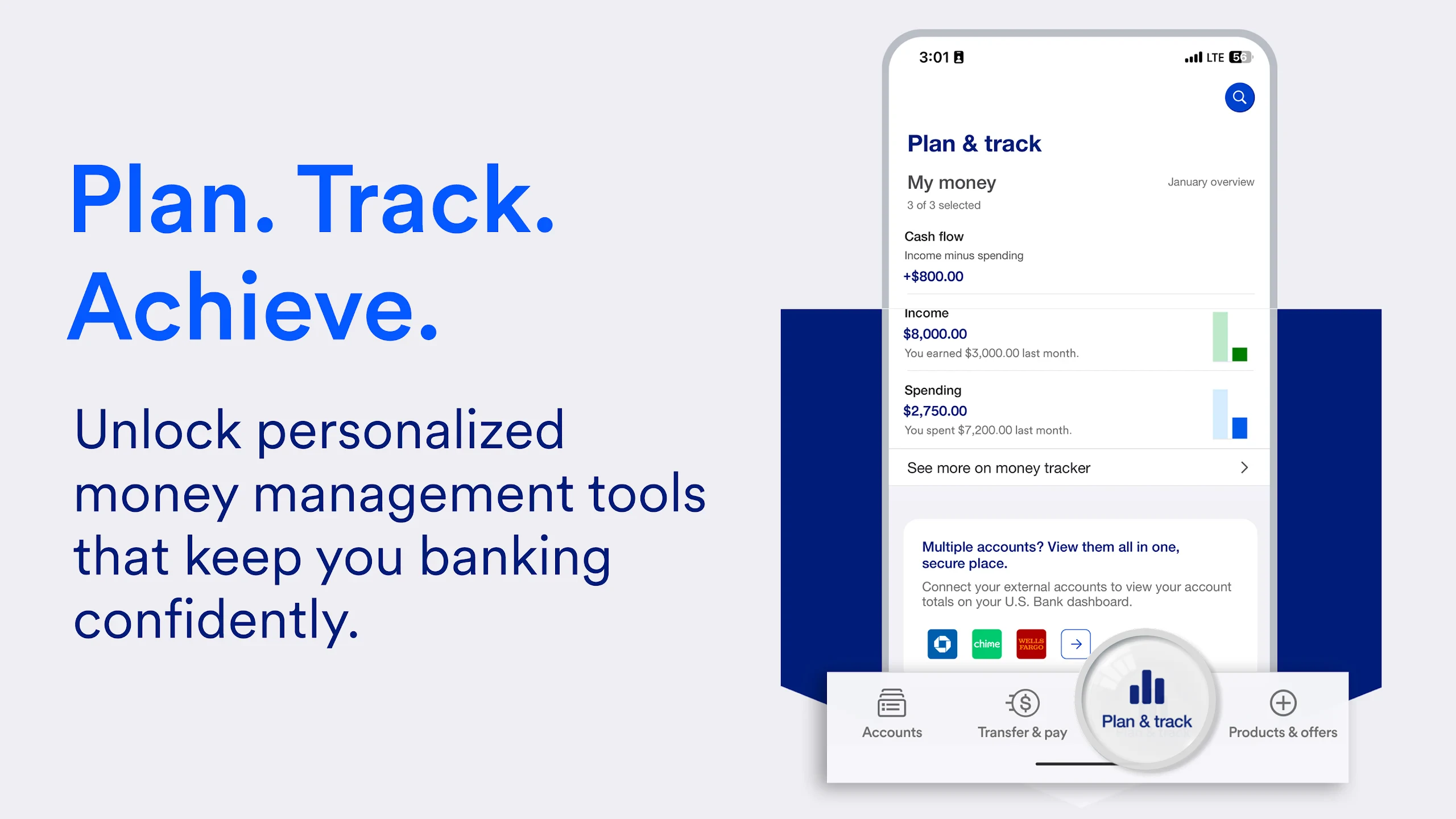

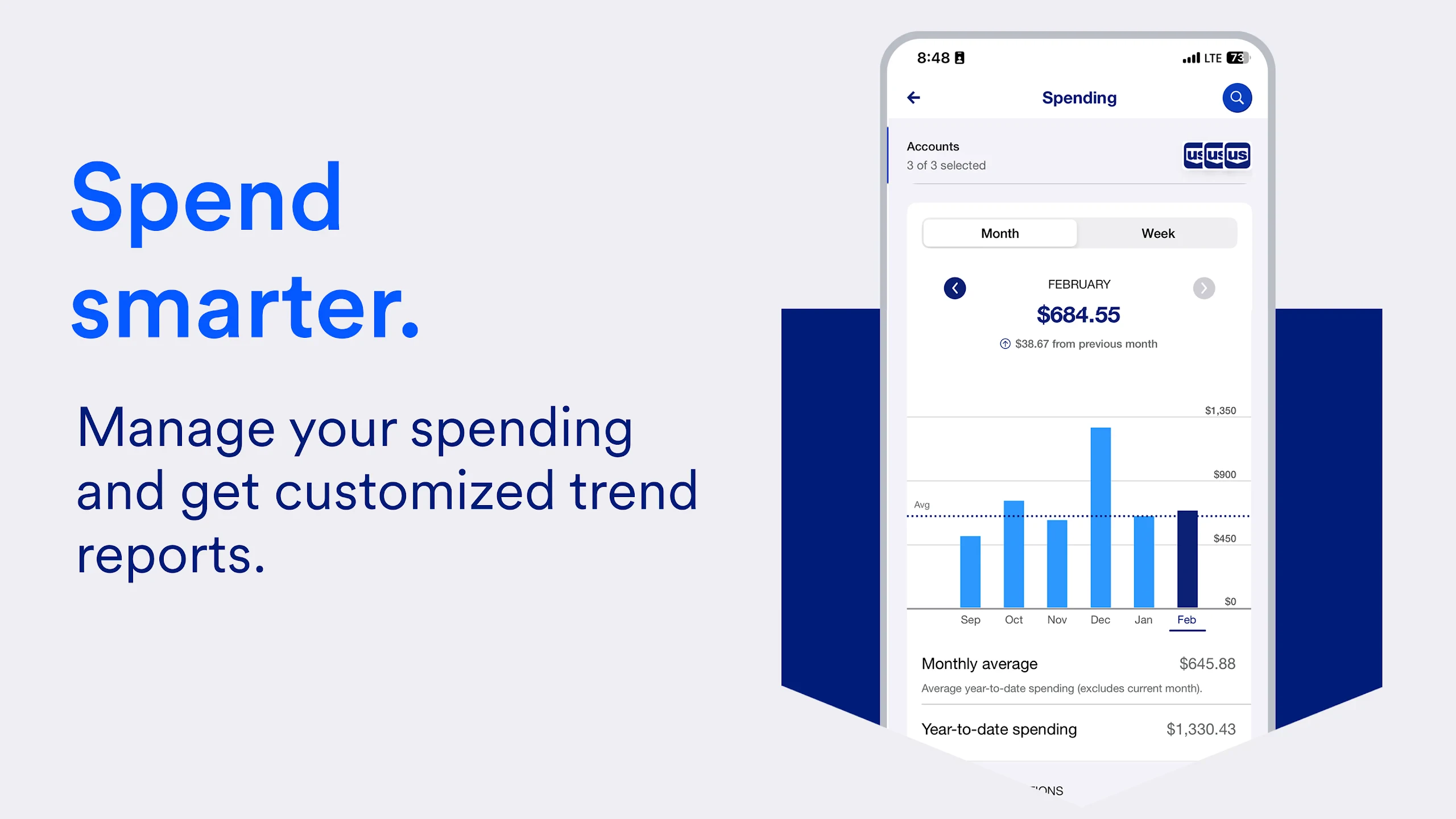

The key value of the U.S. Bank Mobile Banking app lies in its ability to streamline daily financial tasks and provide essential banking information instantly. Users appreciate the practical usage, such as quickly identifying spending patterns through transaction history or securely depositing checks by photo, which saves time and enhances overall banking efficiency.

App Features

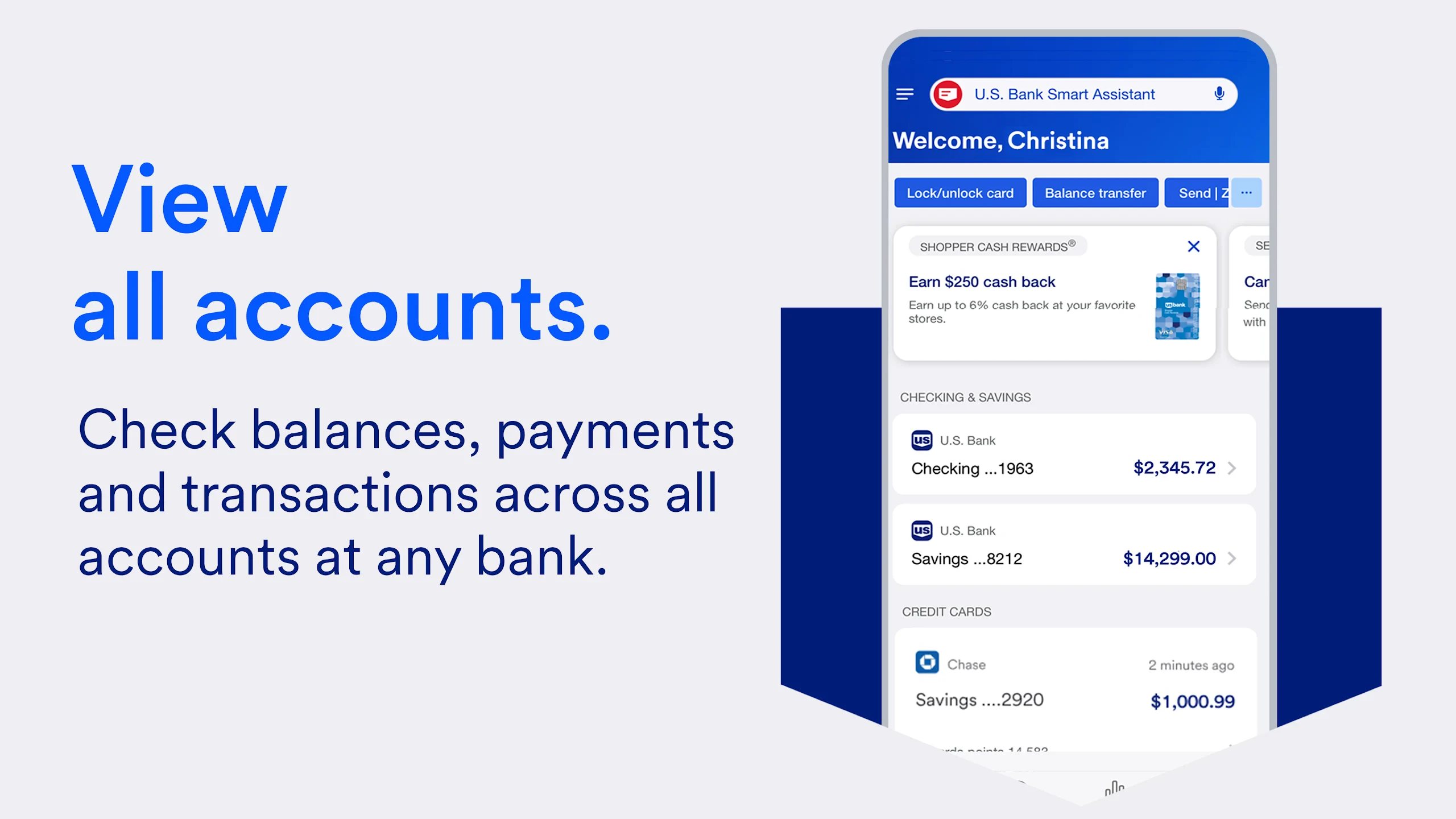

- View Account Information: Instantly check your balances, transaction history, and account details across multiple accounts directly within the app. This provides a clear, real-time snapshot of your financial status, helping you make informed decisions on the go.

- Mobile Check Deposit: Use your device’s camera to scan and securely deposit checks remotely. This feature significantly speeds up the deposit process, allowing your funds to typically be available faster than traditional in-person deposits, offering significant convenience savings for users needing quicker access to cash.

- Fund Transfers Between Accounts: Easily move money between your checking, savings, and investment accounts without needing to visit a branch or call customer service. This feature simplifies budgeting and financial organization, providing a fast way to allocate funds as needed in your daily life.

- Bill Pay Management: Manage your recurring bills and make one-time payments directly through the app. Users can schedule payments, set reminders, and view payment history, making it valuable for maintaining a consistent payment schedule and avoiding late fees.

- App Notifications: Receive timely alerts about account activity, low balances, transaction confirmations, or security alerts directly on your phone. This keeps users well-informed about their accounts and helps them stay proactive, using emphasis like instant alerts for critical events.

- Branch and Service Information: Access details about nearby branches, ATMs, and customer support options directly from the mobile app. This is useful for planning visits or contacting support, especially beneficial when you need specific physical locations or emergency assistance outside standard hours.

Pros & Cons

Pros:

- Enhanced Convenience and Accessibility

- Secure Mobile Check Deposits

- Comprehensive Account Management Tools

- Built-in Notifications for Account Activity

Cons:

- Requires a stable internet connection for full functionality

- Complex tasks or loan applications might still require in-branch visits

- Interface might feel less sophisticated than some leading competitors

- Potential security concerns for sensitive transactions

Similar Apps

| App Name | Highlights |

|---|---|

| JPMorgan Chase App |

This app offers a wide range of services including deposit features, investment tracking, and bill pay. Known for its digital-first approach and extensive feature set for managing complex finances. |

| Wells Fargo Mobile |

Designed for simplicity and robust mobile check deposit. Includes features like savings goals and mobile loan applications. Emphasizes mobile security and straightforward navigation. |

| Messaging with Bank of America |

Often highlighted for its chatbot functionality and ease of use. Offers features like account management and bill pay through a conversational interface, providing an alternative user experience focused on messaging. |

Frequently Asked Questions

Q: What do I need to use the U.S. Bank Mobile Banking app?

A: You typically need a U.S. Bank account, an active data plan or Wi-Fi connection, and access to the internet. Ensure your device meets the app’s system requirements for optimal performance.

Q: How quickly can I access funds after a Mobile Check Deposit?

A: Processing times for deposited checks typically range from 1 to 3 business days, similar to in-branch deposits. You can view the deposit as pending or credited in Your Account Detail once processed.

Q: Is the U.S. Bank Mobile Banking app secure?

A: Yes, security is a top priority. The app uses industry-standard encryption (like SSL) and requires authentication via your username and password, or potentially Touch ID/Face ID/Fingerprint. U.S. Bank also employs fraud monitoring and offers alerting for suspicious activities.

Q: Can I use the app to apply for loans?

A: While the app handles core banking, more complex requests like loan applications are typically managed within Online Banking or may require an in-person visit to a branch. You can initiate some loan inquiries directly from the mobile site.

Q: Are there data charges associated with using the U.S. Bank Mobile Banking app?

A: Data usage depends on features like viewing large transaction history or uploading photos for deposits. While the core app functionality is minimal, frequent use involving media may incur data charges depending on your mobile plan. Using Wi-Fi is recommended for larger downloads or sensitive transactions.

Screenshots

|

|

|

|