|

|

| Rating: 4.1 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: Venmo |

Venmo is a digital payments app developed by PayPal that enables users to send, receive, and manage money online and via mobile. Primarily used for peer-to-peer transactions, it allows easy splitting of bills, settling debts, and making payments for everyday purchases. It caters to individuals and small groups looking for a convenient way to handle personal financial exchanges with friends, family, or even businesses.

Its core appeal lies in its simplicity and integration with a social feed where friends can post transaction details and comments, adding a personal touch to financial interactions. Venmo streamlines personal spending management by consolidating payments and bill splits, offering a practical and often faster alternative to checks or physical cash for everyday needs.

App Features

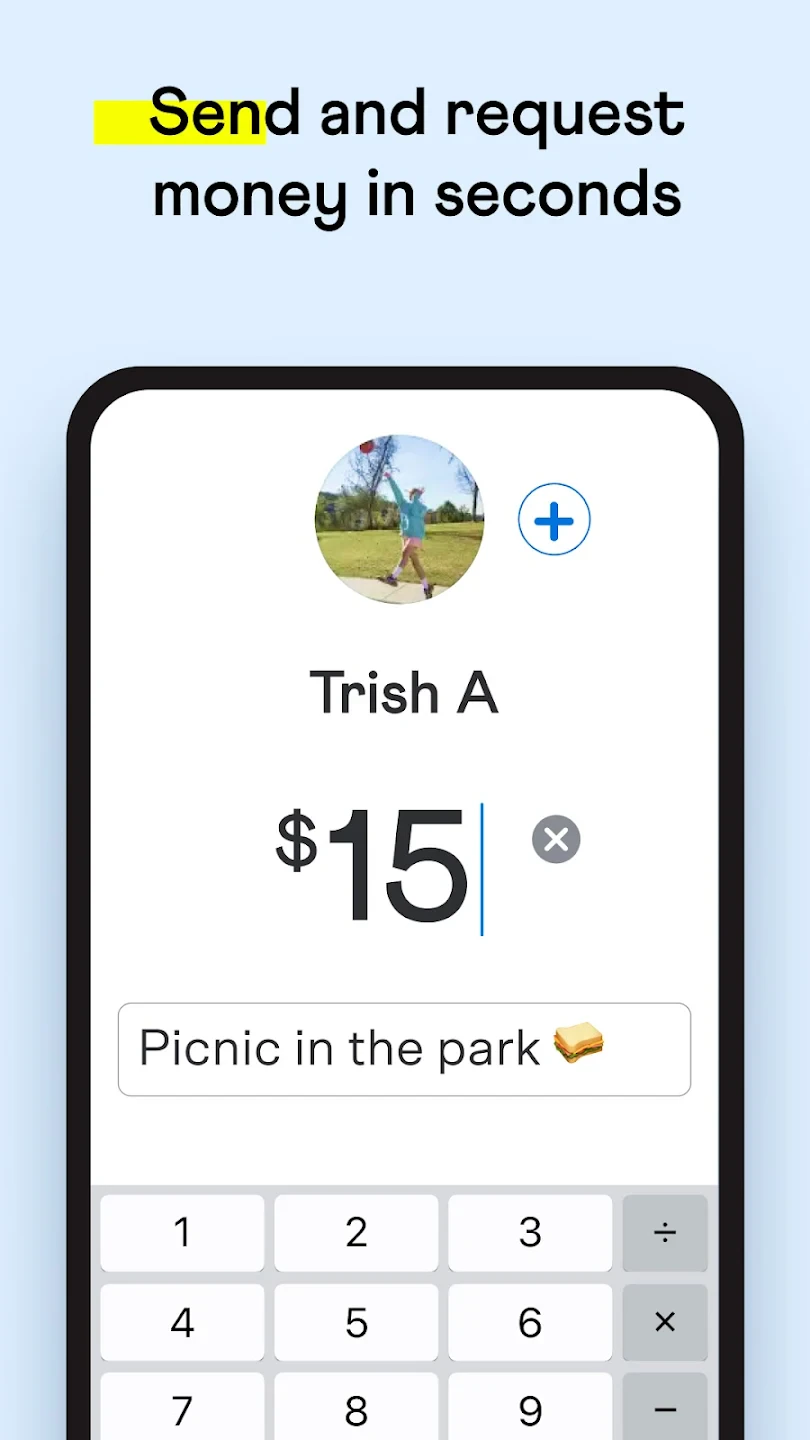

- Core Money Transfer: Easily send or request money to anyone you know via email address, phone number, or username, with the option to split the cost among friends. This feature simplifies settling up after a group meal or event, ensuring funds are distributed quickly and easily.

- Pay with Venmo at Stores: Use your Venmo balance to pay directly at participating retail locations, often with a discount compared to standard credit card offers. The integration provides a seamless checkout experience, combining the convenience of your phone with potential savings for users.

- Scan to Pay: Quickly add money to your Venmo balance by scanning a QR code from participating apps or websites, bypassing traditional checkout methods. This solves the hassle of remembering credit card details or navigating complex payment gateways, speeding up online transactions.

- Mobile Check Deposit: Deposit checks by simply taking a picture with your phone’s camera, converting them electronically into available funds. Key benefits include convenience for remote deposits and faster processing compared to waiting for check clearance through the mail.

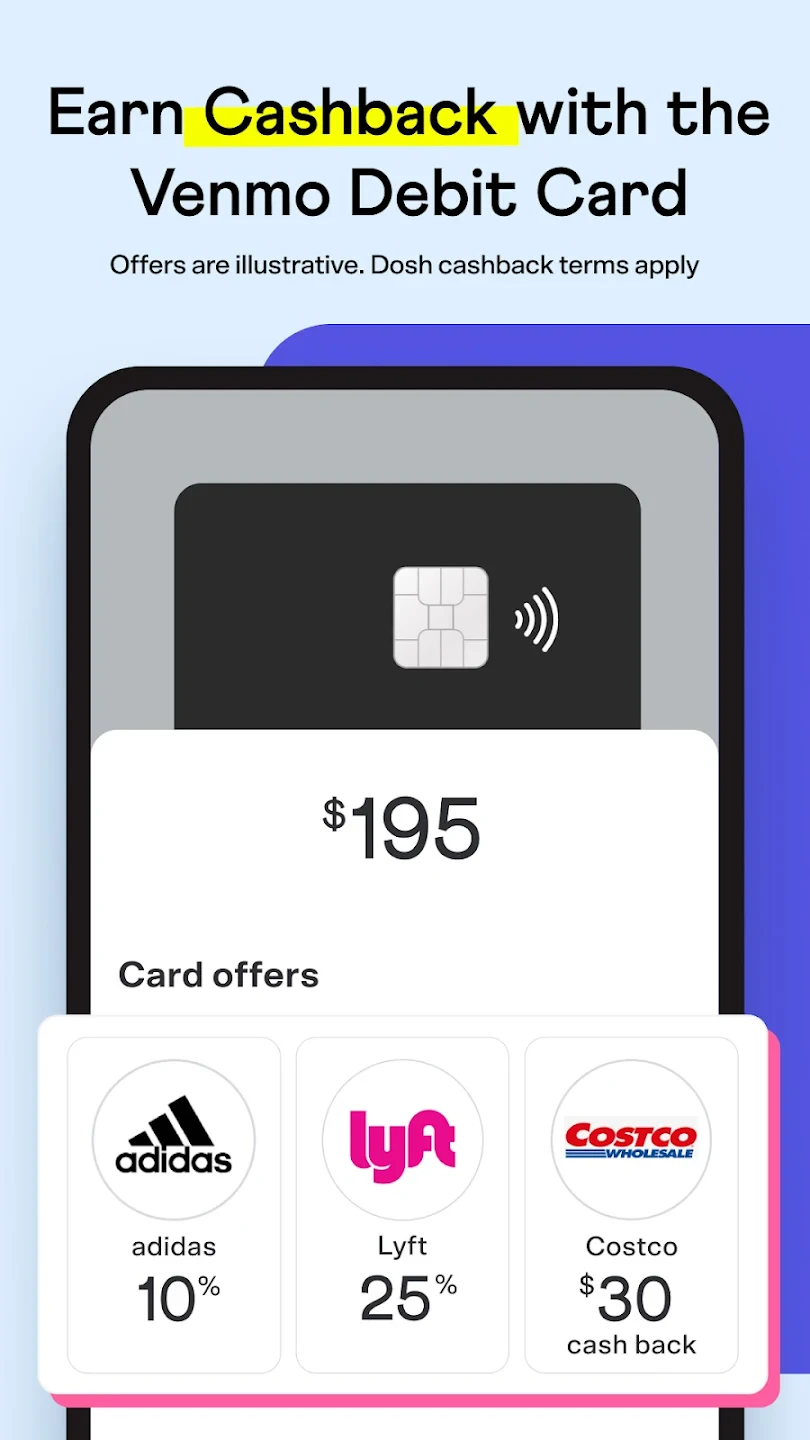

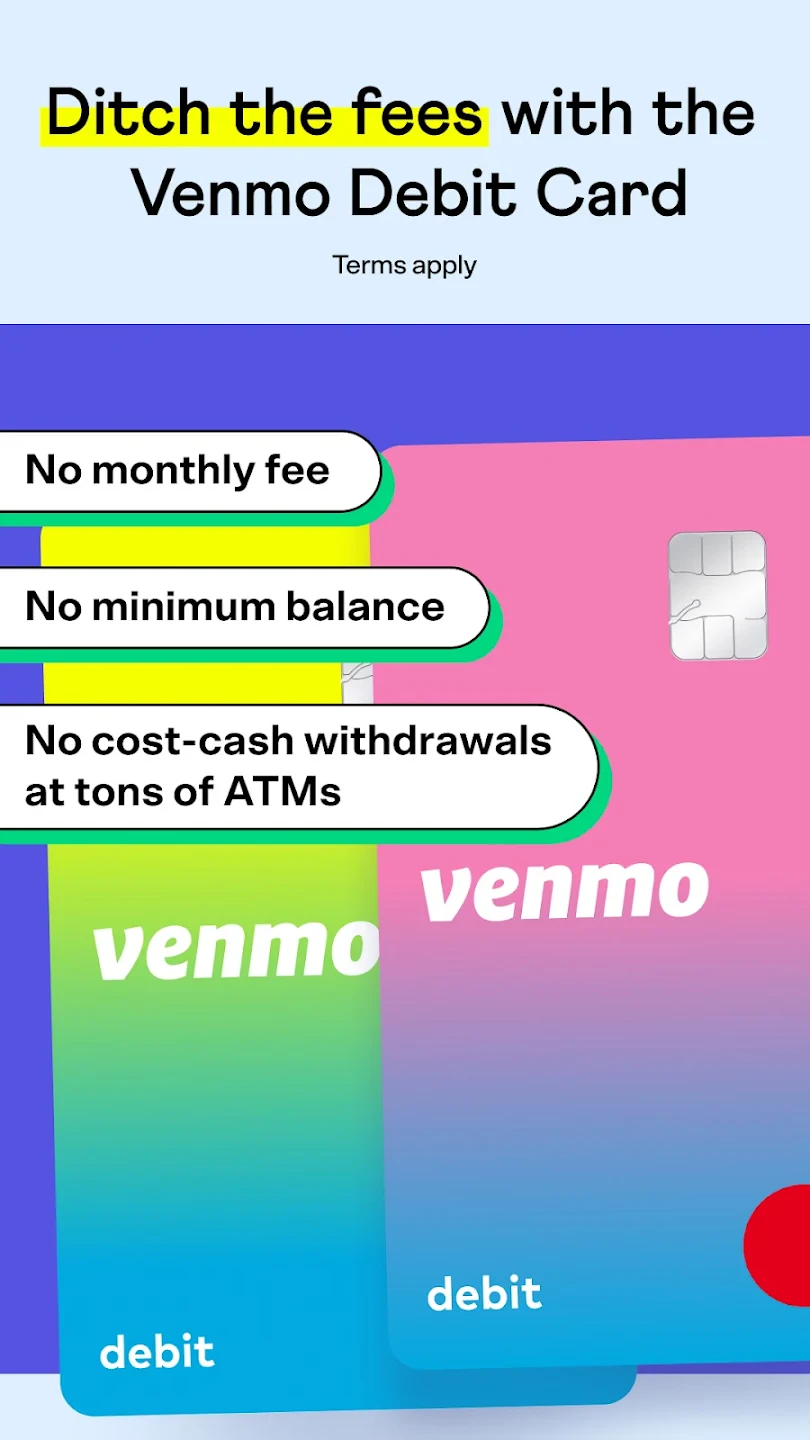

- Venmo Card: Link a physical Venmo card to your account for spending and receiving money, usable anywhere Mastercard is accepted, either in person or online. Venmo offers a cash-back rewards program and the flexibility of contactless payments, making it a versatile payment tool for various user needs.

- Activity Feed & Notifications: Transactions appear in a social feed where friends can react, comment, or even donate, along with customizable push notifications for payment confirmations and requests. Important terms like ‘requesting money’ or ‘splitting a bill’ are highlighted within the notifications, enhancing user awareness.

Pros & Cons

Pros:

- User-Friendly Interface

- Social Interaction Layer

- Quick Mobile Deposits

- Seamless Bill Splitting

Cons:

- Occasional Transaction Limits

- Potential Hidden Fees

- Verification Requirements

- Deposits Can Take Time

Similar Apps

| App Name | Highlights |

|---|---|

| PayPal |

Offers robust international transfers, extensive merchant services, and investment options alongside personal payments. Known for strong buyer protections and versatile use cases. |

| Cash App |

Known for its simple UI, direct deposit features, and Bitcoin investing capabilities. Includes guided steps for sending/receiving and quick access to a Venmo-like feed. |

| Apple Pay |

Focuses on secure, contactless payments using Apple devices. Includes biometric authentication (Touch ID/Face ID) and is widely accepted globally. |

| Zelle® |

Primarily for fast, direct bank-to-bank transfers between users with US bank accounts. Includes real-time money movement and a focus on speed. |

Frequently Asked Questions

Q: How exactly do I send money through the Venmo app?

A: Initiate a transfer by tapping the ‘Pay’ or ‘Request’ tab, entering the recipient’s name or email/phone, the amount, adding notes or tags if needed, and confirming the payment using your linked bank details or balance.

Q: Are there any fees to use Venmo, and what are they?

A: Venmo has no charges for sending money to friends or requesting funds from them. However, standard bank transfer fees may apply if deposits take longer, and there might be small processing fees when using your Venmo Card at certain businesses or cashing out.

Q: How long does it typically take for money sent via Venmo to appear in the recipient’s account?

A: Funds requested via Venmo typically arrive almost instantly, often within seconds, drawn directly from the sender’s account. However, sending money using the bank account linked to your Venmo might require a few business days for the bank transfer to process.

Q: Is my financial information and transactions secure with Venmo?

A: Yes, security is a priority. Venmo uses bank-level encryption, requires login credentials, offers optional PIN or Touch ID/Face ID for payments, and monitors accounts for suspicious activity to protect your funds and personal details.

Q: What is the primary difference between the Venmo card and just using my regular debit card elsewhere?

A: The Venmo card is a Mastercard credit card linked to your Venmo balance or bank account. It provides benefits like cash-back rewards, the ability to deposit checks (not typically a direct debit card function), and easy access for online and in-store purchases without needing to log into the Venmo app each time.

Screenshots

|

|

|

|