|

|

| Rating: 4.2 | Downloads: 500,000+ |

| Category: Business | Offer by: Veryable, Inc. |

Veryable: Work. Next Day Pay is a financial management platform designed specifically for contract and gig workers, freelancers, and independent contractors. The app streamlines the process of creating invoices, managing payments, and tracking expenses—all with the goal of getting workers paid faster, often the very next business day—a significant departure from the typical 30 or even 60-day payment cycles common in traditional work arrangements. It caters primarily to those who need cash flow stability and want more control over their billing and payments rather than being beholden to slow invoicing processes.

The key appeal of Veryable: Work. Next Day Pay lies in its focus on accelerated payments and simplified financial administration for non-traditionally employed workers. Instead of juggling spreadsheets and chasing late payments, users can send professional invoices directly through the app that automatically calculates due dates, integrates with payment methods, and ensures timely payouts. This practical tool helps reduce administrative overhead and provides a reliable way to budget and manage finances, directly addressing the cash flow challenges faced by many gig and contract employees who rely on prompt payments to cover ongoing expenses.

App Features

- Create & Send Professional Invoices: Easily generate customized invoices in seconds, adding your branding, payment details, and due dates. This feature saves time compared to manually creating spreadsheets, reduces payment processing friction, and helps ensure you get paid on time—making it ideal for busy professionals who want to focus on their work rather than tedious administrative tasks.

- Next-Day Payouts Integration: Seamlessly connect with services like PayPal, Stripe, or direct deposits to enable same-day or next-day payment processing. This isn’t just about sending bills—it actively facilitates faster payment cycles by automating reminders and payment routing for gig workers who need reliable cash flow to cover living expenses.

- Expense Tracking Simplified: Categorize and record business expenses directly within your invoices or separately, automatically categorizing costs like equipment purchases or software subscriptions for tax purposes. This helps independent contractors maintain organized financial records, reducing the stress of tax season and ensuring accurate deductions for self-employed income.

- Payment & Time Tracking: Track hours worked on specific projects, link them to client jobs, and automatically calculate payment amounts based on agreed rates. This functionality is invaluable for freelancers managing multiple concurrent projects, preventing underpayment or double-billing while ensuring fair compensation for all work delivered.

- Client Management Dashboard: Organize client information, job statuses, and outstanding invoices in one centralized location, complete with automated reminders for due dates. This organized approach helps contract employees manage their diverse client relationships efficiently, preventing administrative overload when juggling multiple short-term assignments.

- Multi-Platform Compatibility [Optional]: Veryable: Work. Next Day Pay offers web-based access plus dedicated mobile applications for iOS and Android, enabling workers to manage their invoices and payments from anywhere. For field workers or remote professionals, this cross-device functionality means you can process payments, track time, or follow up on overdue invoices even when away from your desk, enhancing accessibility and responsiveness.

Pros & Cons

Pros:

- Accelerated Payments

- Simplified Invoicing

- Expense Tracking Integration

- Multi-Payment Network Support

Cons:

- Potential Transaction Fees

- Basic Expense Tracking Limits

- No Advanced Tax Features

- Limited Project Collaboration Tools

Similar Apps

| App Name | Highlights |

|---|---|

| CashU for Business |

Focuses heavily on same-day funding for businesses and contractors. Includes features like automated invoice reminders and simple expense categorization. Best for users prioritizing immediate access to funds over advanced project management. |

| Paymerang |

Specializes in recurring billing cycles and late-payment penalties automation. Ideal for service providers with ongoing client relationships. Offers robust invoicing templates and payment dunning tools not found in Veryable. |

| Bill.com |

Designed for small to medium-sized businesses, offering comprehensive accounts payable and receivable management. Includes advanced reporting features suitable for larger freelance operations or agencies rather than solo contractors. |

Frequently Asked Questions

Q: How does Veryable guarantee “Next Day Pay”?

A: We integrate directly with select payment processors (like Stripe or PayPal) and bank accounts to facilitate same-day or next-day settlement. Once we receive payment from your client, the transaction is typically processed within 24 hours of receiving the funds. This is enabled through partnerships and direct routing, bypassing traditional multi-day banking delays.

Q: Can I use Veryable to manage projects with multiple team members?

A: Currently, Veryable is focused primarily on individual contractor invoicing and expense tracking. While you can create detailed invoices for project costs, built-in collaborative project management features like task assignments or team billing aren’t available. For larger projects involving teams, consider integrating with separate project management software.

Q: Are there any setup or transaction fees when using the app?

A: Setup is free. Transaction fees vary based on your payment method (typically 1–3% of the transaction value). These are standard payment processor fees, which may be reduced by choosing direct deposit options. There are no additional monthly subscription costs—just transaction-based fees to cover payment processing.

Q: What happens if my client doesn’t pay through Veryable’s platform?

A: The platform automatically sends reminders and escalation notices according to your configured settings. If the client still doesn’t pay, you’ll need to manually issue a new invoice or contact them directly. Veryable’s system flags late payments but doesn’t automatically force payment—reliance still lies with the client relationship management.

Q: Is Veryable compatible with international payments?

A: Yes, Veryable supports payments in multiple currencies and integrates with international payment processors like Wise or TransferWise. However, currency conversion rates may vary, and international transaction fees could be higher depending on your location and the receiving currency. We’re continuously expanding our global payment capabilities based on user demand.

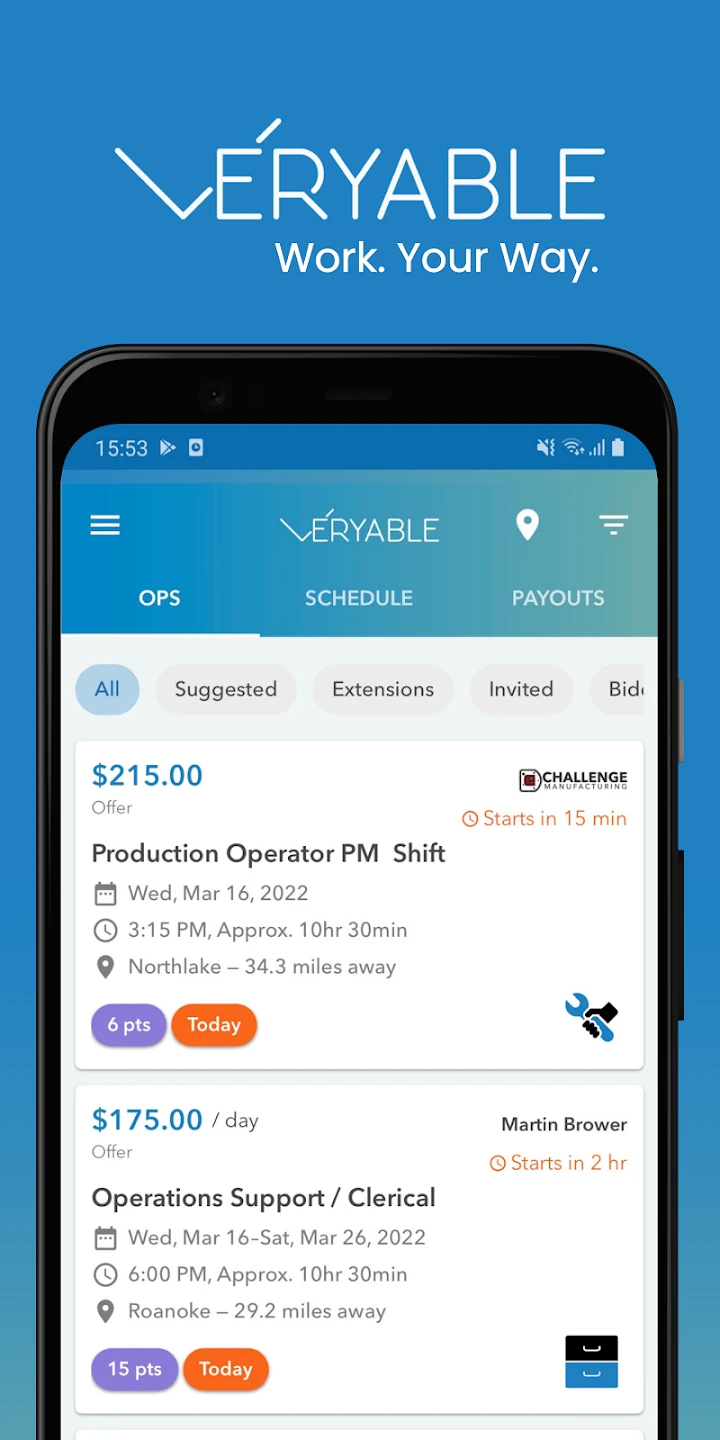

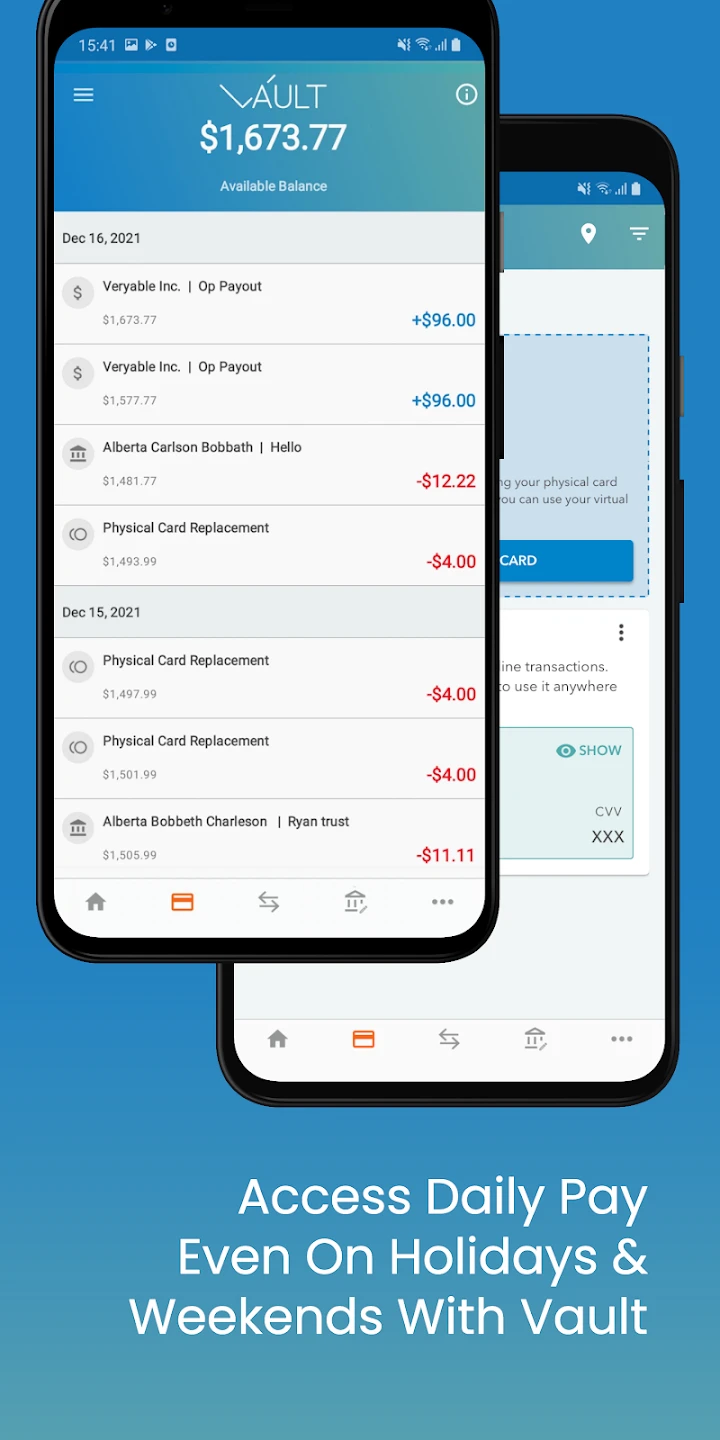

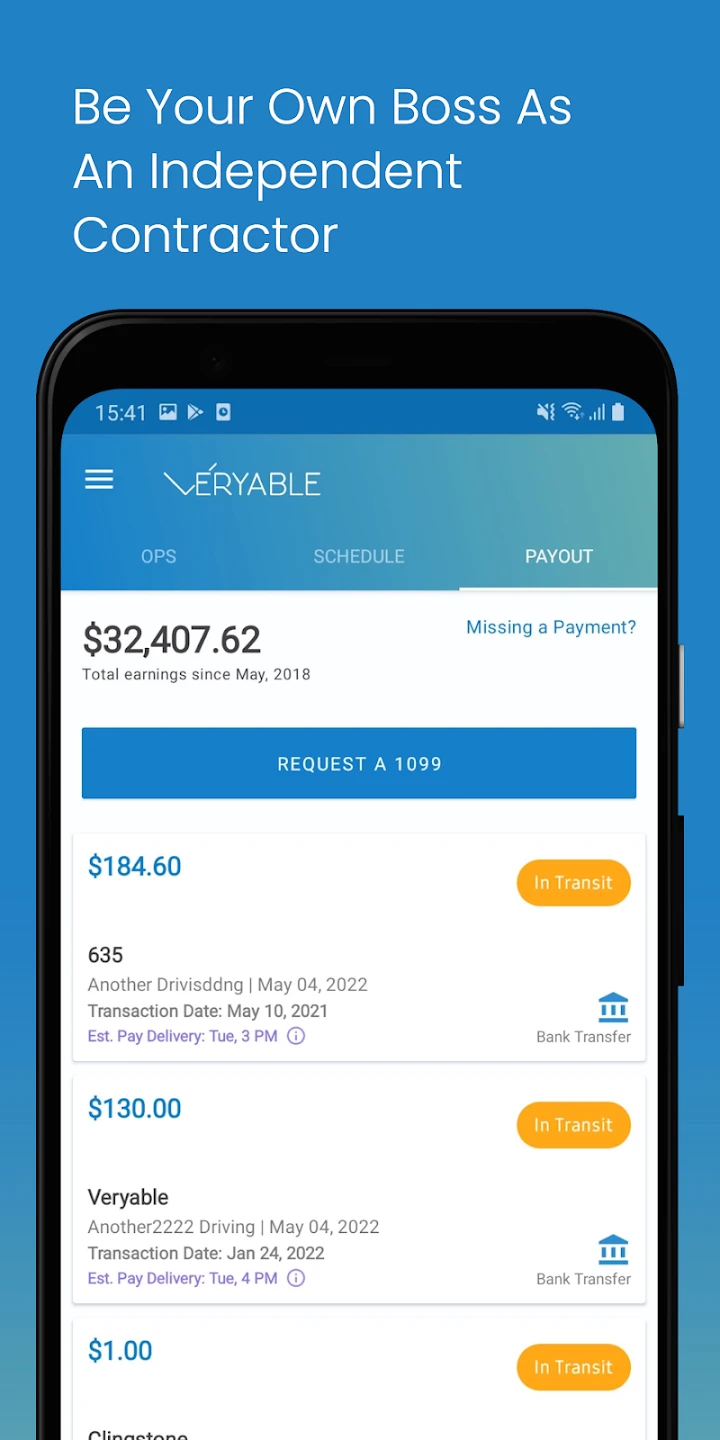

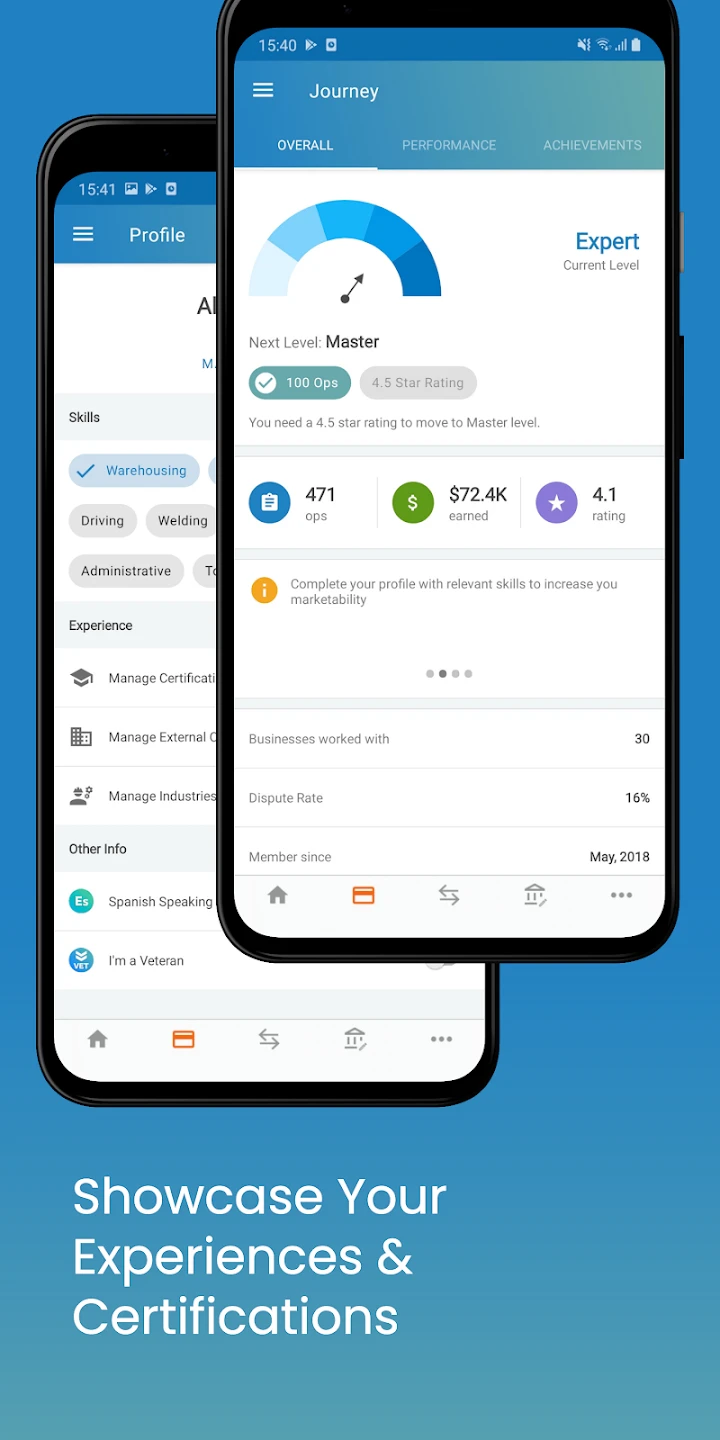

Screenshots

|

|

|

|