|

|

| Rating: 4.1 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Green Dot |

The Walmart MoneyCard app is your digital wallet powered by Walmart, designed for users who prefer cash-like spending options. It allows you to make purchases, pay bills, and manage your funds directly from your smartphone, offering a convenient alternative to traditional bank accounts or physical cards. Whether you’re a student, someone building credit, or managing a household budget, the Walmart MoneyCard provides accessible financial tools tailored for everyday needs.

The key appeal lies in its simplicity and integration with Walmart services. It offers an easy way to build credit history, make secure payments online and in-store (via compatible retailers), and access your funds without needing direct bank account details. For practical usage, it’s ideal for quick, everyday transactions, online shopping with major retailers, and managing your finances on the go, making budgeting and payments more streamlined.

App Features

- Instant Funding Approval: You can often get approved for a Walmart MoneyCard line of credit quickly, sometimes within minutes. This feature is beneficial for people needing immediate access to funds for unexpected expenses or specific purchases, providing faster access compared to traditional credit applications and allowing you to manage your cash flow more effectively.

- Seamless Bill Payments: The app enables direct payment for utility bills, rent, and other recurring expenses. It uses technical terms like “direct routing” for funds, simplifying the payment process and reducing the need for checks or cashier’s checks. This saves time and ensures timely payments, helping maintain good standing with service providers without the worry of missed payments.

- Online Shopping Purchases: Easily use your Walmart MoneyCard for shopping with thousands of major retailers that accept Visa or Mastercard. This feature solves the problem of needing cash or a traditional credit card, offering flexibility for impulse buys or specific online needs, enhancing your shopping experience by allowing convenient payment methods for everyday items.

- Account Management Dashboard: Access your balance, recent transactions, and spending insights through an intuitive user interface. This feature provides real-time financial clarity, helping users track expenses and manage their credit responsibly, using detailed transaction breakdowns to understand spending patterns and make informed financial decisions.

- Compatibility & Flexibility Settings: The app allows you to customize spending limits, set up alerts, and configure payment preferences according to your needs. This flexibility is crucial for different user types, like parents monitoring teens or individuals building credit, ensuring safe usage and tailored control over financial activities without compromising necessary functions.

- Walmart App Integration (Optional): You can easily link your Walmart MoneyCard to your Walmart Pay account within the Walmart shopping app. This advanced feature streamlines in-store payments using Near Field Communication (NFC) technology, enhancing security and speed during transactions, particularly valuable for frequent Walmart shoppers who want a seamless checkout experience without needing cash or other cards.

Pros & Cons

Pros:

- Build Credit History Easily

- Simple Application Process

- Wide Range of Accepted Payment Locations

- Low Minimum Balance Requirement

Cons:

- Higher Interest Rates Than Credit Cards

- Potential for Overdraft Fees if Not Managed Carefully

- Not a Checking Account, Only a Line of Credit

- Credit Score Check is Required

Similar Apps

| App Name | Highlights |

|---|---|

| Chime Credit Builder |

This app helps build credit quickly with a secured line of credit and offers features like early direct deposits. Known for its user-friendly interface and transparent fee structure focused on helping users establish credit history. |

| PayPal Credit |

Offers interest-free financing for purchases and bill payments with a simple online account. Includes automatic payment options and is widely accepted online and over 20 million in-store locations, providing convenience for everyday spending. |

| Discover Cash Back |

An app designed for users wanting to earn rewards while building credit. Offers a flexible payment plan system and robust account management tools to track spending and improve credit scores effectively. |

Frequently Asked Questions

Q: How quickly can I get approved for a new line of credit on the Walmart MoneyCard app?

A: Approval for a new line of credit can often be completed within minutes, sometimes even instantly, depending on the information provided and your creditworthiness. The app provides immediate feedback on approval status, making the process efficient.

Q: What is the minimum credit score required to get approved for the Walmart MoneyCard?

A: While there isn’t one single fixed score requirement, the general expectation is that most applicants have a credit score of at least 600. However, factors like income and debt-to-income ratio also play a significant role in the approval decision.

Q: Can I use the Walmart MoneyCard for online shopping with small retailers?

A: Yes, the Walmart MoneyCard (Visa or Mastercard) is accepted by thousands of online retailers nationwide. You can check the retailer’s website to confirm acceptance or use the app’s built-in feature to find participating stores for in-store purchases.

Q: Are there any fees associated with the Walmart MoneyCard besides interest on the outstanding balance?

A: Apart from potential interest charges, common fees may include an annual fee (though often waived initially or with good standing), late payment fees, and possibly a foreign transaction fee if used internationally. It’s best to review the app’s fee schedule for specifics.

Q: How do I dispute a transaction on my Walmart MoneyCard statement through the app?

A: You can dispute transactions directly within the app. Simply go to your transaction history, select the disputed item, and follow the prompts to file a dispute. The process uses secure channels and is designed to be user-friendly, typically initiating an official inquiry with the issuing bank.

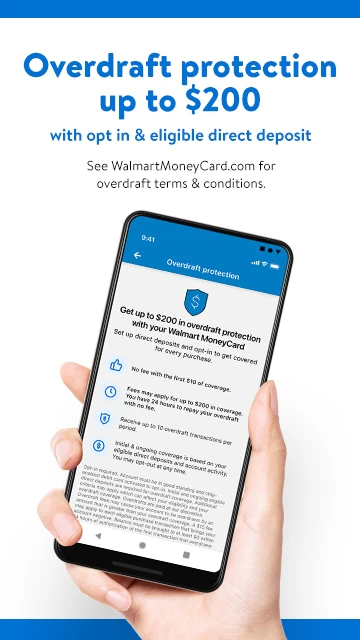

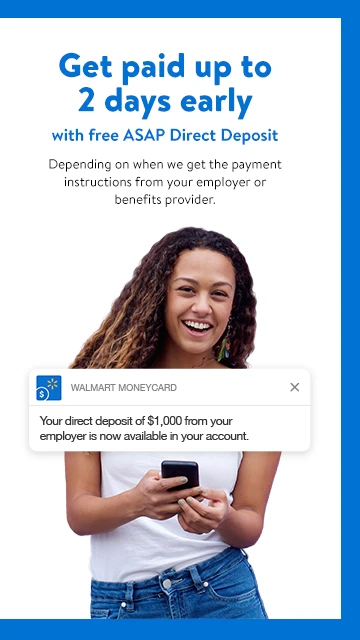

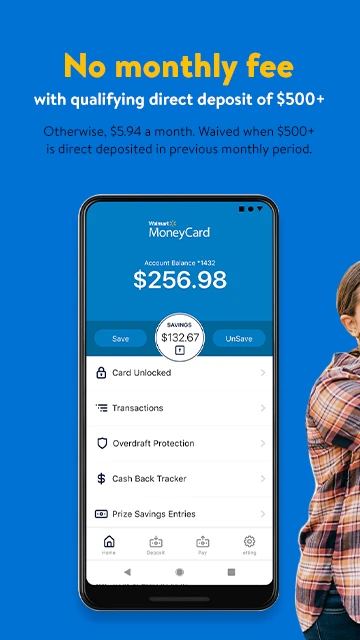

Screenshots

|

|

|

|