|

|

| Rating: 4.8 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Wells Fargo Mobile |

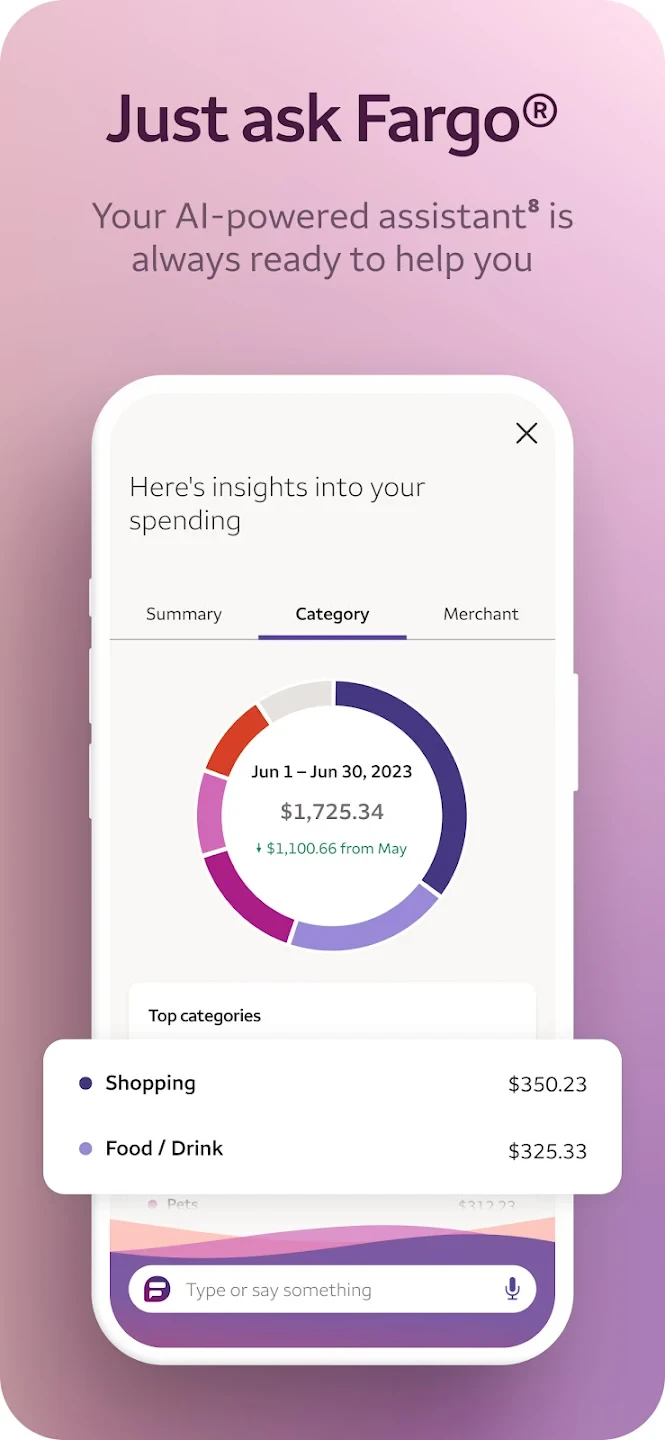

The Wells Fargo Mobile app is a powerful tool allowing customers to manage their finances conveniently via their smartphones or tablets. It offers features like viewing account balances, paying bills, depositing checks remotely, and accessing statements, designed for anyone needing flexible banking solutions on the go.

Its key value lies in providing a secure and fast way to handle everyday banking tasks without visiting a branch. Wells Fargo Mobile empowers users to take control of their finances easily, saving time and offering peace-of-mind features like fraud alerts, wherever they are.

App Features

- Mobile Check Deposit: Deposit checks electronically using your phone’s camera – simply take a clear photo. This saves you the trip to the bank and speeds up accessing your funds, making it incredibly convenient for receiving checks from any source.

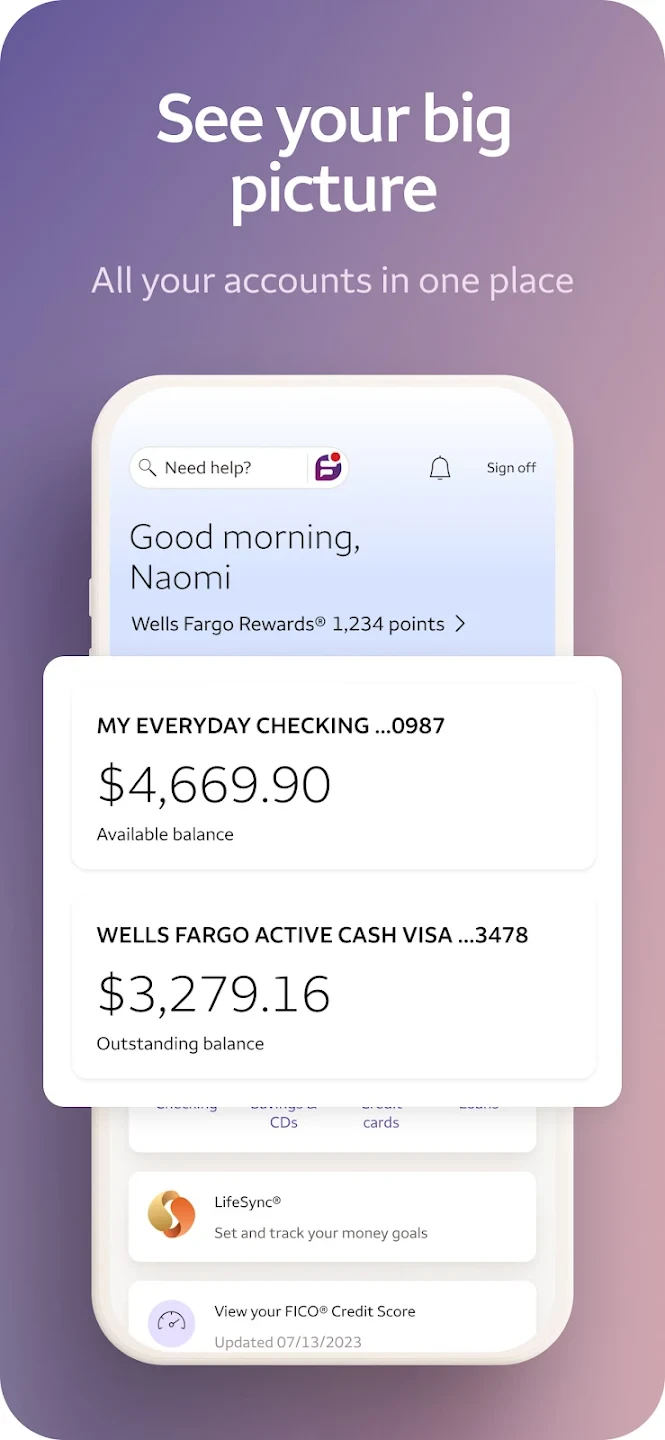

- Account Management & Transfer: View balances across all your accounts instantly and easily transfer funds between them using a user-friendly interface. The improved usability helps avoid manual tracking and speeds up managing your money, whether you’re balancing your budget or saving for a purchase.

- Bill Pay: Set up recurring or one-time bill payments directly from the app. This feature solves the problem of managing numerous payment reminders by integrating payment tracking with your account balances, enhancing your financial oversight and ensuring timely payments.

- Card Management: Manage cards like reporting a lost card, blocking transactions, or viewing recent activity directly from your mobile device. This feature is valuable for immediate action, offering significant time savings and enhanced security compared to waiting for phone support or visiting a branch.

- Online Video Banking: Connect with a banker instantly via video chat for assistance with various questions or transactions. Different users, especially those less familiar with online banking, find this feature helpful, providing flexibility and personalized support without needing to schedule appointments or visit branches.

- Security Features: Wells Fargo Mobile incorporates multi-factor authentication and secure login procedures to protect your information. These technical security measures support the overall safety of your banking activities, providing users with assurance that their sensitive financial data remains protected.

Pros & Cons

Pros:

- Convenience of Mobile Banking

- Quick Access to Account Information

- Efficient Mobile Check Deposits

- Ability to Manage Bills Remotely

Cons:

- Depends on a Stable Internet Connection

- Some Advanced Features May Not Be Directly Accessible (e.g., certain loan processes)

- Camera Quality Affects Check Deposit Success Rate

- Interface May Require a Short Learning Curve for New Users

Similar Apps

| App Name | Highlights |

|---|---|

| Chase Mobile |

Offers comprehensive account management, mobile payments, and deposit features. Known for its user-friendly dashboard and digital wallet integration. |

| Bank of America Mobile |

Provides robust online banking capabilities including stock trading (if applicable) and investment tools. Features secure login options and seamless customer support integration. |

| TD Bank Mobile |

Often praised for its intuitive design and specific offerings like easy investment tracking. Includes advanced budgeting tools and priority support options for premium users. |

Frequently Asked Questions

Q: What do I need to do to start using Wells Fargo Mobile?

A: You typically need a valid Wells Fargo account and access to the internet (Wi-Fi or mobile data) on your smartphone. You’ll download the app from the App Store or Google Play, create a user profile, and verify your identity using security questions or other methods provided by Wells Fargo. Once set up, you can begin accessing your accounts and features.

Q: Can I make changes to my Wells Fargo Mobile app settings?

A: Absolutely. The Wells Fargo Mobile app offers several settings options. You can customize your home screens, set up alerts and notifications for transactions or balances, manage your security preferences, and adjust accessibility features within the app itself for a more personalized banking experience.

Q: Are there any transaction limits for using Wells Fargo Mobile for deposits?

A: While specific limits can vary slightly by account and location, Wells Fargo Mobile typically allows a reasonable number of deposits per month. You can view the specific limits associated with your account directly within the app. If you exceed standard limits, the app usually prompts you about alternative options like visiting a branch or using other deposit methods.

Q: Is my Wells Fargo account information secure when using the mobile app?

A: Security is a top priority for Wells Fargo Mobile. The app uses strong encryption technology to protect data transmission, offers multi-factor authentication (like a unique code sent to your phone), and includes features like fraud alerts. Wells Fargo also monitors for suspicious activity, providing multiple layers of protection to keep your personal and financial information safe.

Q: How do I report a lost or stolen card while using the Wells Fargo Mobile app?

A: You can quickly and securely report a lost or stolen card directly from the Wells Fargo Mobile app. Navigate to the ‘Card Management’ section (usually found under Account or Settings), select the relevant card, and choose the ‘Block Card’ or report loss option. This immediate action helps prevent unauthorized use and is often faster than calling customer service, leveraging technology to empower you during critical situations.

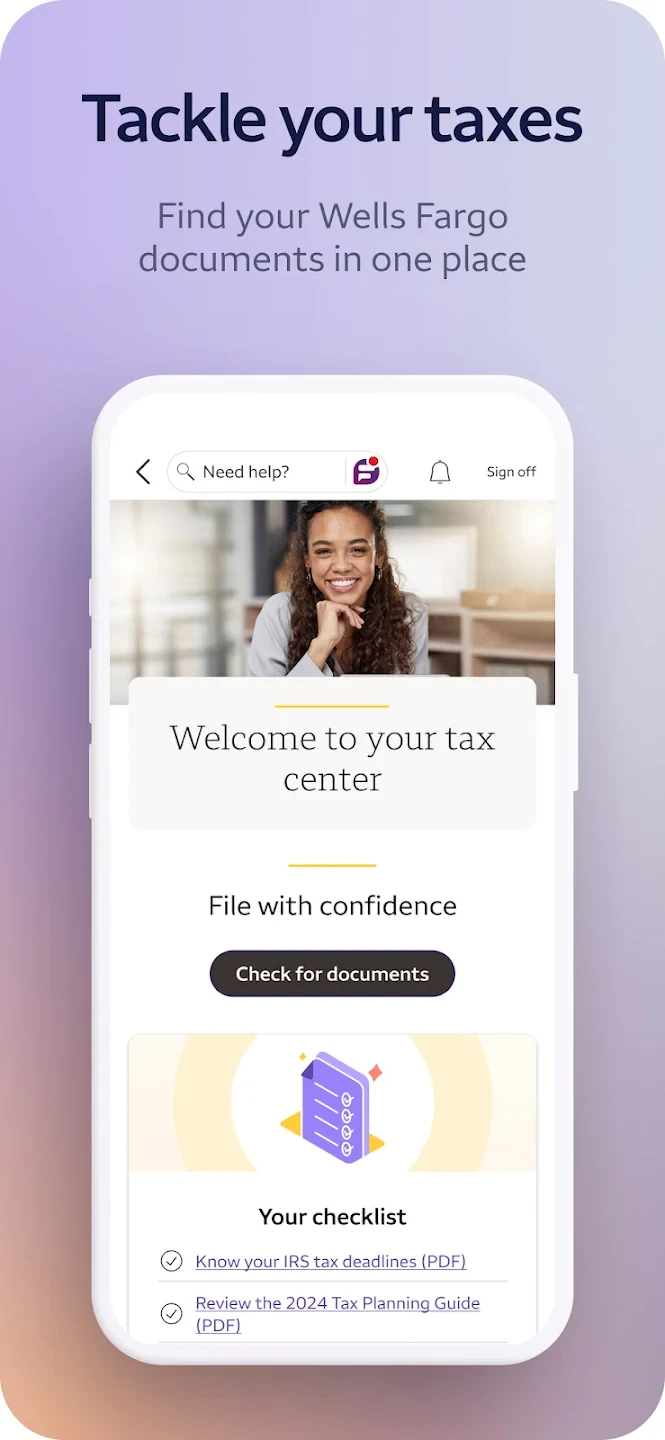

Screenshots

|

|

|

|