|

|

| Rating: 4.1 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Early Warning Services, LLC |

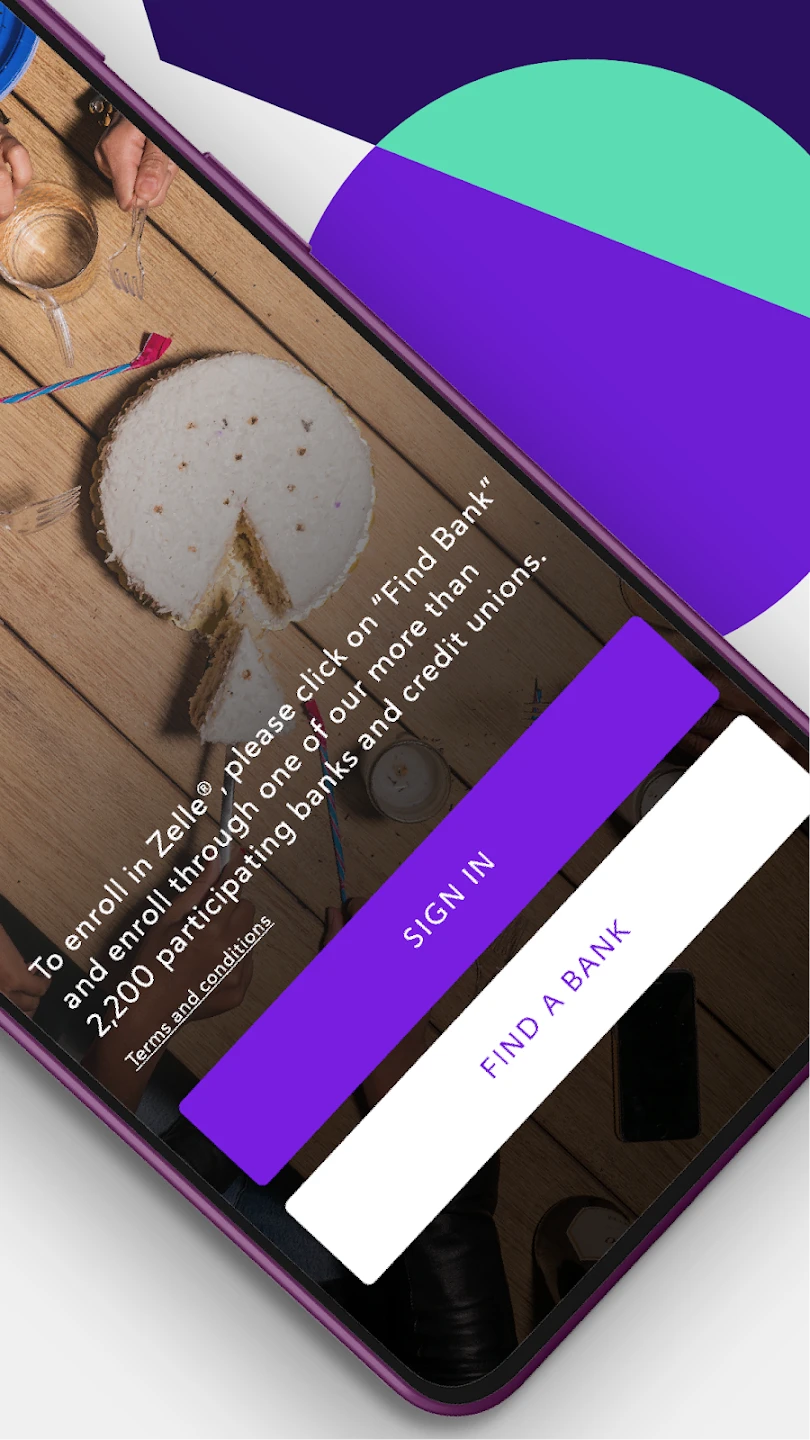

Zelle® is a digital payment app that enables instant money transfers between bank accounts, designed primarily for sending and receiving funds with people you know directly through a user-friendly mobile interface.

Its key value lies in its speed and simplicity, allowing users to complete transactions almost immediately without needing checks, cash, or cards, making everyday money exchanges between friends, family, and acquaintances significantly easier.

App Features

- Instant Transfers: Send money across participating banks almost right after initiating a transaction. For instance, you can quickly repay a friend for groceries, and they receive funds directly into their bank account in a fraction of the time compared to traditional methods. This saves time and eliminates the need for cumbersome alternative payment methods.

- Request Money: Easily ask someone for payment using their name or email, integrating directly with their bank details for seamless processing. This feature simplifies settling debts or covering shared expenses, ensuring transactions happen smoothly and securely within the Zelle® network.

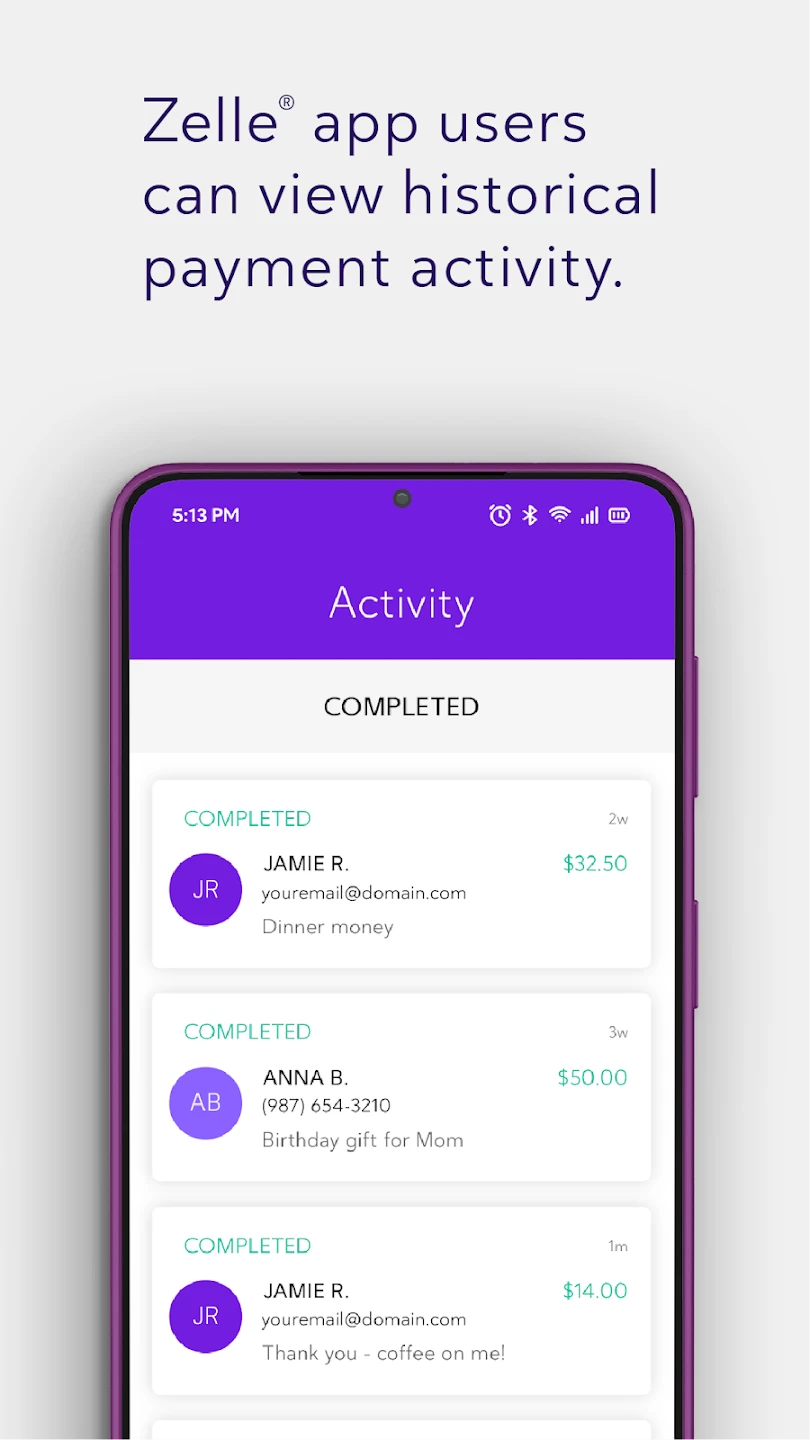

- Transaction History: Access a complete record of all sent and received payments, including dates, amounts, and transaction types. This organized history helps users manage their finances effectively and provides a clear audit trail for all money exchanges facilitated through Zelle®.

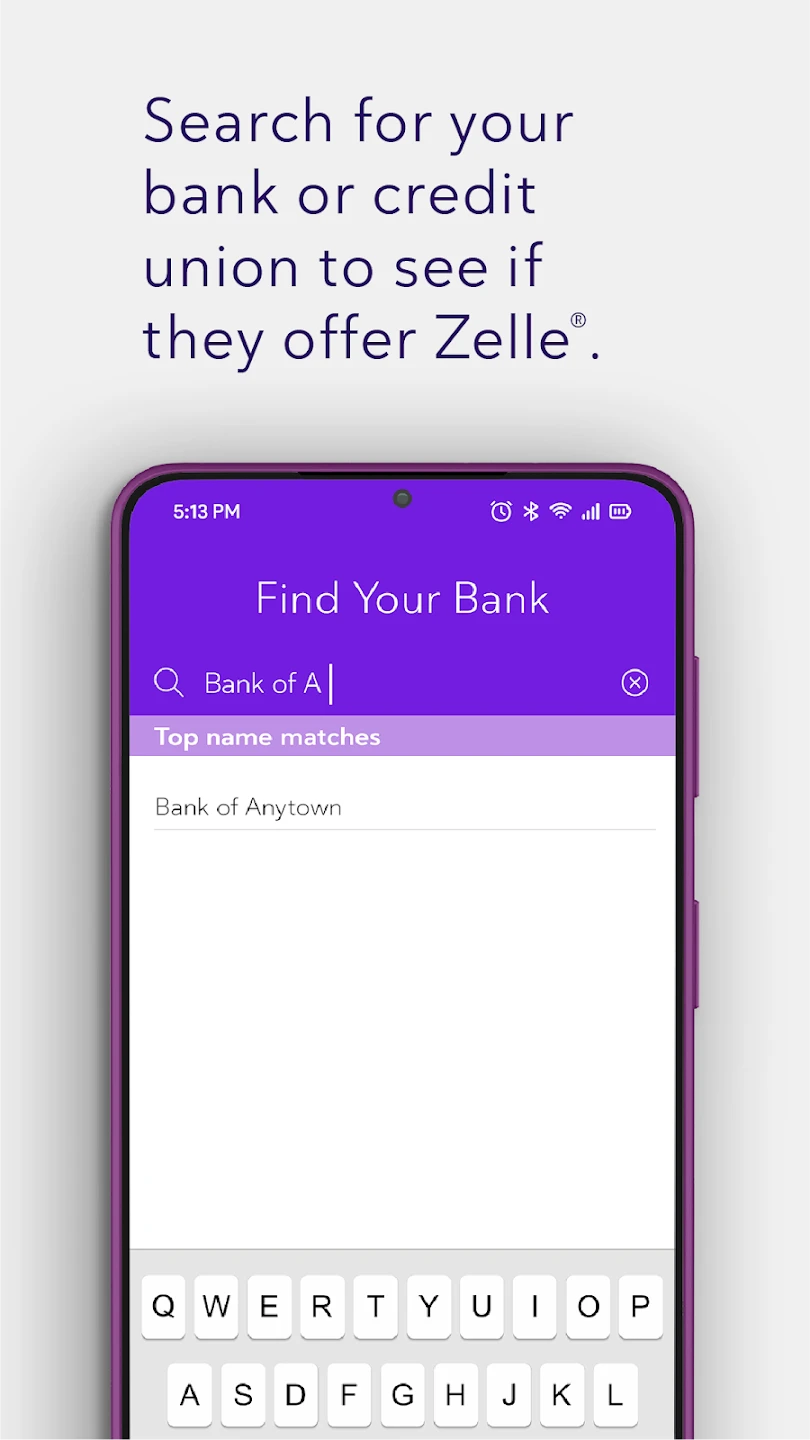

- Bank Account Linking: Set up your bank account securely with just a routing and account number to start sending and receiving money. This straightforward integration with your financial institution ensures funds move directly between accounts, offering a secure and efficient way to handle payments without needing separate accounts or complex setups.

- Security Focus: Implement PIN locks and requires confirmation for outgoing transfers, providing a protective layer against unauthorized access. These built-in safety features help maintain control over your financial activities, adding peace of mind to everyday transactions managed through the app.

- Broad Bank Participation: Leverage a wide network of US financial institutions to send and receive funds across different banking platforms. This extensive connectivity ensures that users can transact with most major banks in the country, maximizing the utility of the service and minimizing compatibility issues.

Pros & Cons

Pros:

- Speed

- Low Fees

- Bank Account Integration

- Wide US Bank Acceptance

Cons:

- Limited International Use

- Potential Bank Compatibility Issues

- No Merchant Payment Options

- Dependent on Recipient Enrollment

Similar Apps

| App Name | Highlights |

|---|---|

| PayNearMe |

This app offers quick cash deposits and bill payments at retail locations. Known for accessibility for unbanked users and location-based services. |

| MoneyGram |

Designed for global money transfers and person-to-person payments. Includes international sending and secure tracking. |

| Chime |

Offers free banking and instant deposit features. Provides advanced spending insights, no overdraft fees, and direct deposit options. |

Frequently Asked Questions

Q: How long does a Zelle® transfer take?

A: Most Zelle® payments between participating banks settle within minutes, typically by the end of your banking day.

Q: Can I receive money from anyone, or do they need a bank account?

A: To receive payments via Zelle®, the sender must know your email address or phone number associated with your bank account. International users outside the US generally cannot receive Zelle® transfers.

Q: What is the difference between Zelle® and PayPal?

A: Zelle® focuses primarily on sending and receiving money between bank accounts in the US, while PayPal handles a broader range of functions like online payments and merchant services. Zelle® emphasizes speed for P2P transactions.

Q: Are there fees to send or receive money with Zelle®?

A: Zelle® transfers between participating banks are typically free; however, your bank might have associated transaction limits or fees for specific services. International transfers are not supported.

Q: What happens if my recipient’s bank doesn’t support Zelle®? Can I still send them money through another method?

A: If Zelle® isn’t available for a recipient, you might use alternative methods like ACH transfers (which take several days), cash apps, or other payment services. Always verify the recipient’s banking capabilities before attempting a transfer.

Screenshots

|

|

|

|