|

|

| Rating: 4.8 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Truist Financial Corporation |

The Truist Mobile app is a powerful banking platform offering users comprehensive financial management through their smartphones. It combines security features with convenient tools like account transfers, bill payments, and mobile check deposit, designed specifically for Truist customers. Whether managing daily transactions or monitoring investments while on the go, this application caters to both personal and business banking needs.

In today’s fast-paced world, Truist Mobile provides practical value by offering immediate access to financial services anytime, anywhere. It appeals to users seeking efficiency in banking through its streamlined interface and useful features like budgeting tools, which simplify financial tracking. This app transforms how people interact with their finances, making banking tasks quicker and more accessible than ever before.

App Features

- Mobile Check Deposit: Easily deposit checks without visiting a branch by simply taking a clear photo of the front and back. This saves considerable time and effort, especially beneficial for users who frequently manage physical checks, making banking errands less frequent.

- Account Alerts & Notifications: Receive real-time updates for transactions, low balances, and security alerts via customizable push notifications or SMS. This feature incorporates technical terms like “two-factor authentication” for enhanced account monitoring, providing peace of mind and preventing unnoticed suspicious activity.

- Quick Transfer System: Instantly move money between your accounts or to other Truist users without extra steps, featuring an intuitive drag-and-drop interface for simplified transfers. For users juggling multiple accounts, this eliminates cumbersome processes, saving both time and frustration during daily banking.

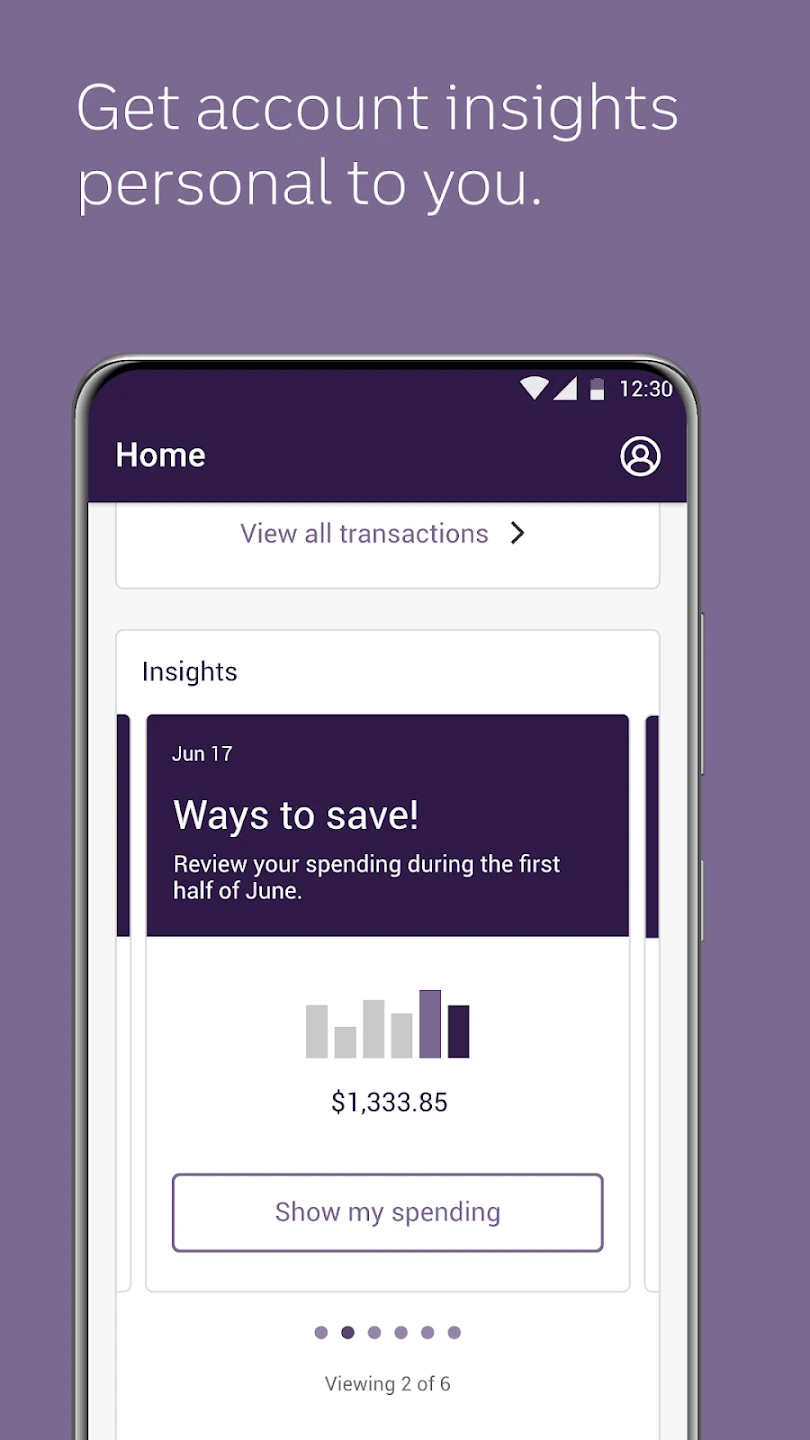

- Expense Tracker: Automatically categorizes spending patterns and provides personalized spending reports based on transaction history. Users benefit from this feature by gaining clear insights into their finances, enabling informed budgeting decisions or identifying unexpected expenses quickly.

- Secure Remote Banking: Offers document upload capabilities for account updates, loan applications, or identity verification, eliminating the need to physically visit a branch for many routine banking tasks. This feature is especially valuable for customers with mobility challenges, allowing them to manage their finances independently.

- Market Updates Integration: Provides access to market news, stock performance, and investment opportunities directly within the app interface. This advanced feature helps users who manage investment accounts make informed decisions based on current financial trends, all while staying within a familiar banking environment.

Pros & Cons

Pros:

- Extremely user-friendly interface

- Robust mobile deposit system

- Comprehensive security features

- Seamless transaction tracking

Cons:

- Limited investment portfolio options

- Occasional sync delays with older accounts

- Some advanced features behind premium subscription

- Notification overload if not customized carefully

Similar Apps

| App Name | Highlights |

|---|---|

| Chase Mobile |

Known for digital wallet integration and extensive retail partner discounts, offering robust banking features. |

| Wells Fargo App |

Focuses on home banking solutions with mortgage tools and investment tracking capabilities for comprehensive financial management. |

| Bank of America Mobile |

Emphasizes AI-driven insights through Erica and comprehensive investment services for a holistic banking experience. |

Frequently Asked Questions

Q: How secure is the mobile check deposit feature?

A: The deposit process utilizes end-to-end encryption and digital watermarking for enhanced security, making it extremely safe while providing convenience.

Q: Can I manage joint accounts directly through Truist Mobile?

A: Absolutely, the app supports joint account management with customizable viewing options and transaction histories for co-owners.

Q: What should I do if my account shows an incorrect balance?

A: Our system processes transactions instantly, but if discrepancies appear, use the “Report an Issue” feature within the app for immediate investigation.

Q: Are there any specific requirements for depositing checks?

A: For the best results, ensure your smartphone camera is clear, the check is front/back readable with no folds, and you have sufficient light when taking photos.

Q: Does Truist Mobile work seamlessly across all device types?

A: Yes, the application is optimized for iOS (iPhone/iPad) and Android devices, providing consistent performance on most modern smartphones regardless of brand.

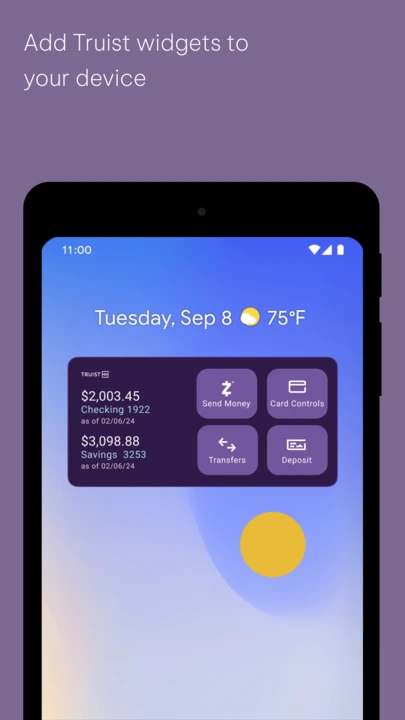

Screenshots

|

|

|

|