|

|

| Rating: 4.7 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Acorns |

Acorns: Invest For Your Future is an intuitive mobile and web application designed to make saving and investing accessible to everyday individuals, particularly beginners. It connects to your bank account to automatically transfer small, specified sums of money directly into diversified investment portfolios. This service targets anyone looking to build long-term financial security and grow their wealth, offering a straightforward path for passive investing without requiring deep financial expertise.

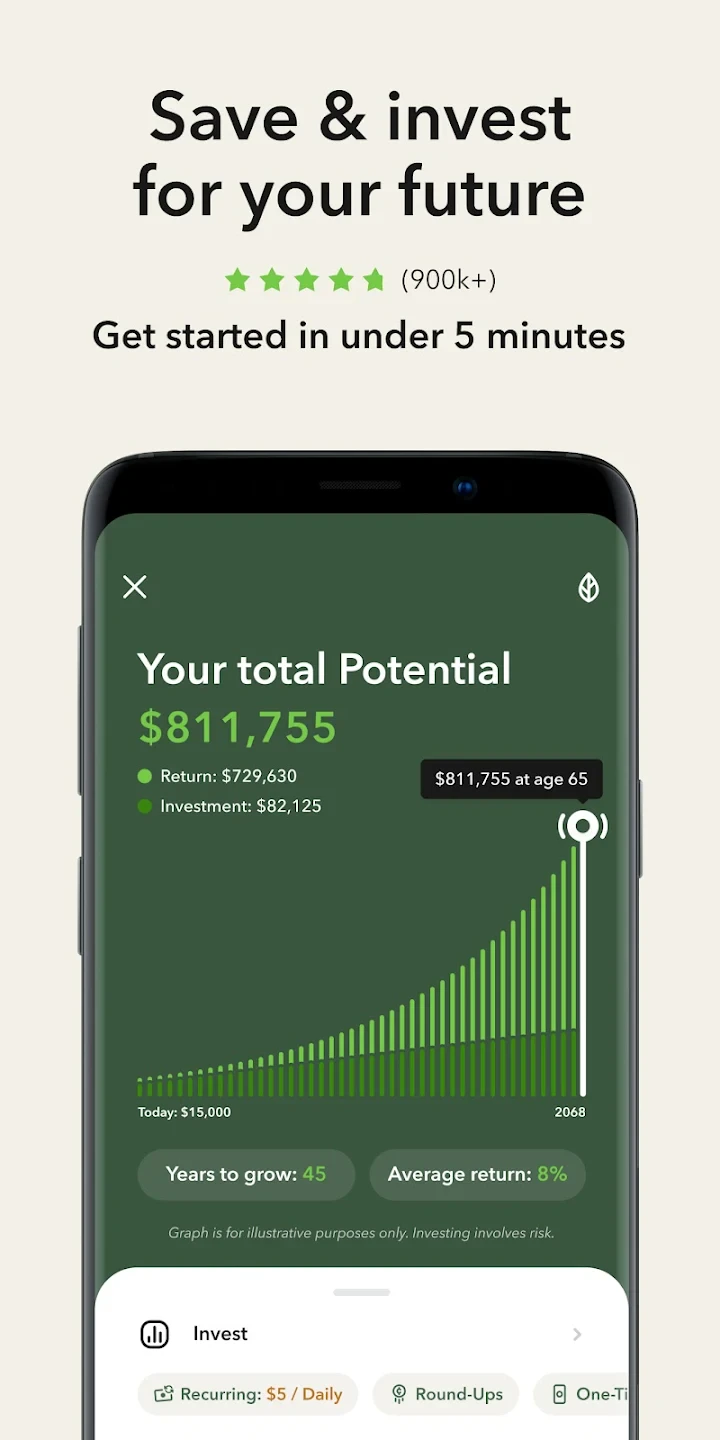

The core appeal of Acorns lies in its simplicity and automation, turning saving and investing into effortless habits. Its key value is enabling users to start and consistently grow their investments with minimal effort, potentially benefiting significantly over time through compound interest, even with very small contributions. Using Acorns: Invest For Your Future helps users systematically work towards larger financial goals, making market investing feel less intimidating and more achievable on a regular basis.

App Features

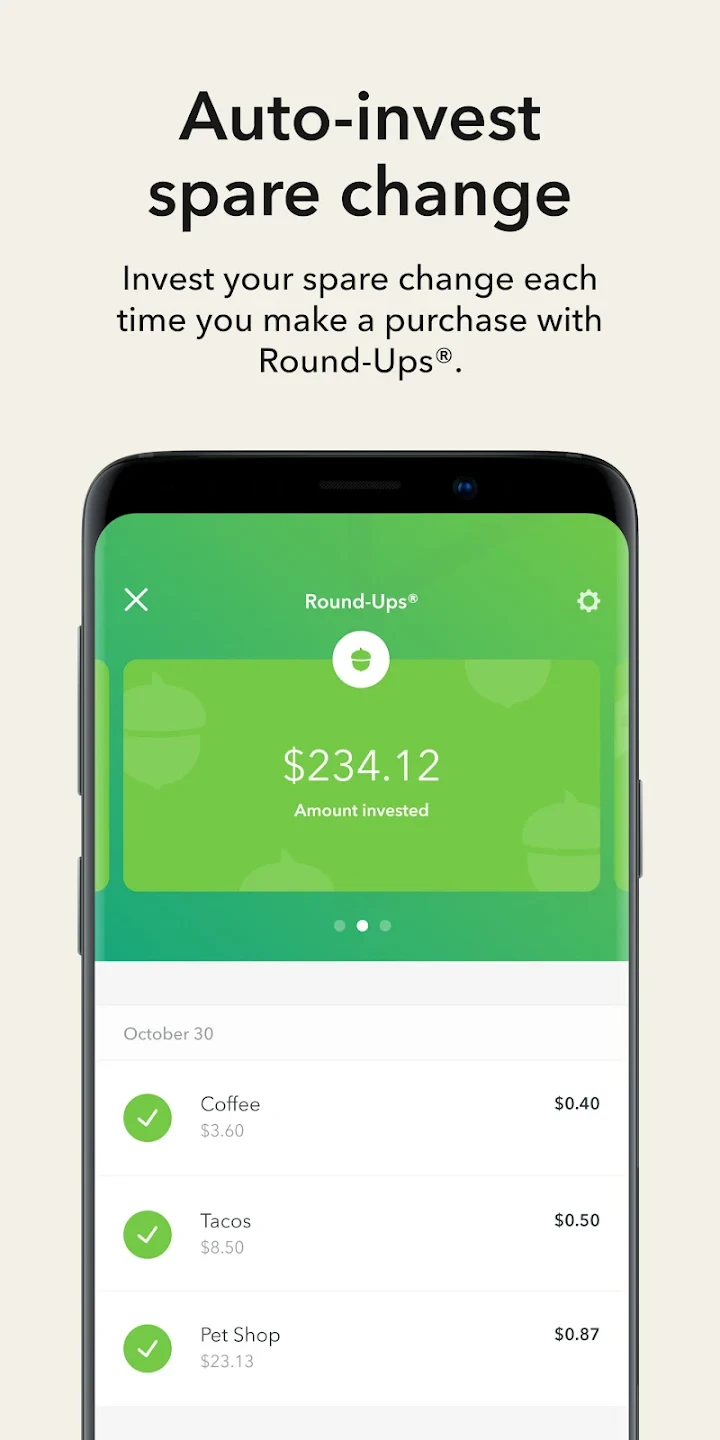

- Automatic Transfers & Investing: This feature links your external bank account, allowing Acorns to automatically move small, predefined amounts of your money into investment accounts each time your account balance exceeds a set threshold. This saves time and removes the temptation to hoard cash, ensuring consistent market participation even from modest budgets or unexpected windfalls.

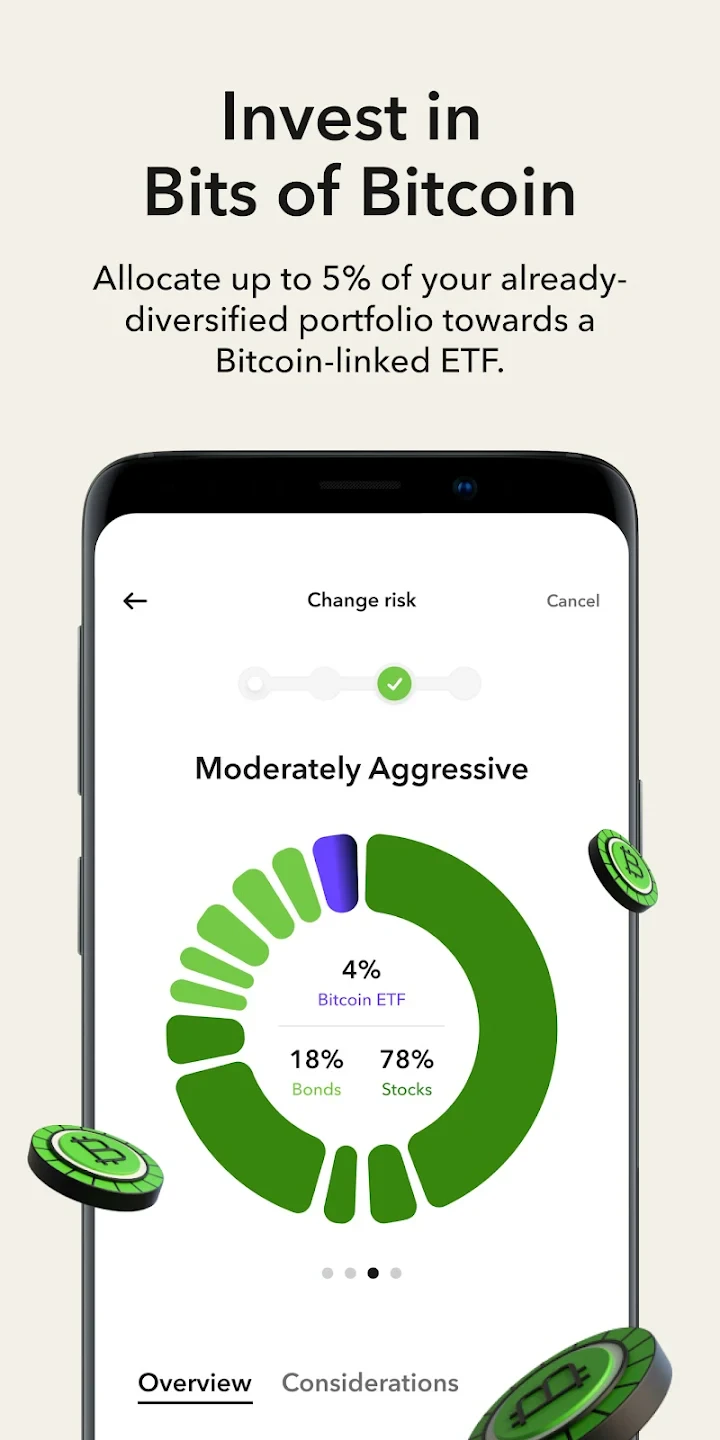

- Acorns Portfolio Options: Users can select from a range of pre-defined, diversified portfolios tailored for different risk profiles and goals, such as Aggressive, Moderate, or Balanced. These portfolios are built with a blend of low-cost exchange-traded funds (ETFs) representing various asset classes. The automated rebalancing keeps your portfolio aligned with your chosen strategy, simplifying long-term financial strategy management without needing frequent manual adjustments.

- In-App Learning & Education: Acorns provides a comprehensive library explaining investment basics, market insights, financial goals, and relevant news. This educational content is designed to help users understand portfolio performance and investment strategies in accessible language. Learning resources like this demystify financial jargon and build user confidence, making informed investment decisions more approachable for beginners.

- Performance Tracking & Insights: Users can easily monitor the value of their Acorns investments and see the progress they are making toward any specific financial goals they’ve set up within the platform. This feature offers clear visualizations of gains and performance metrics. Accessing this information anytime is crucial for staying motivated and tracking the real-world results of your passive saving and investing strategy.

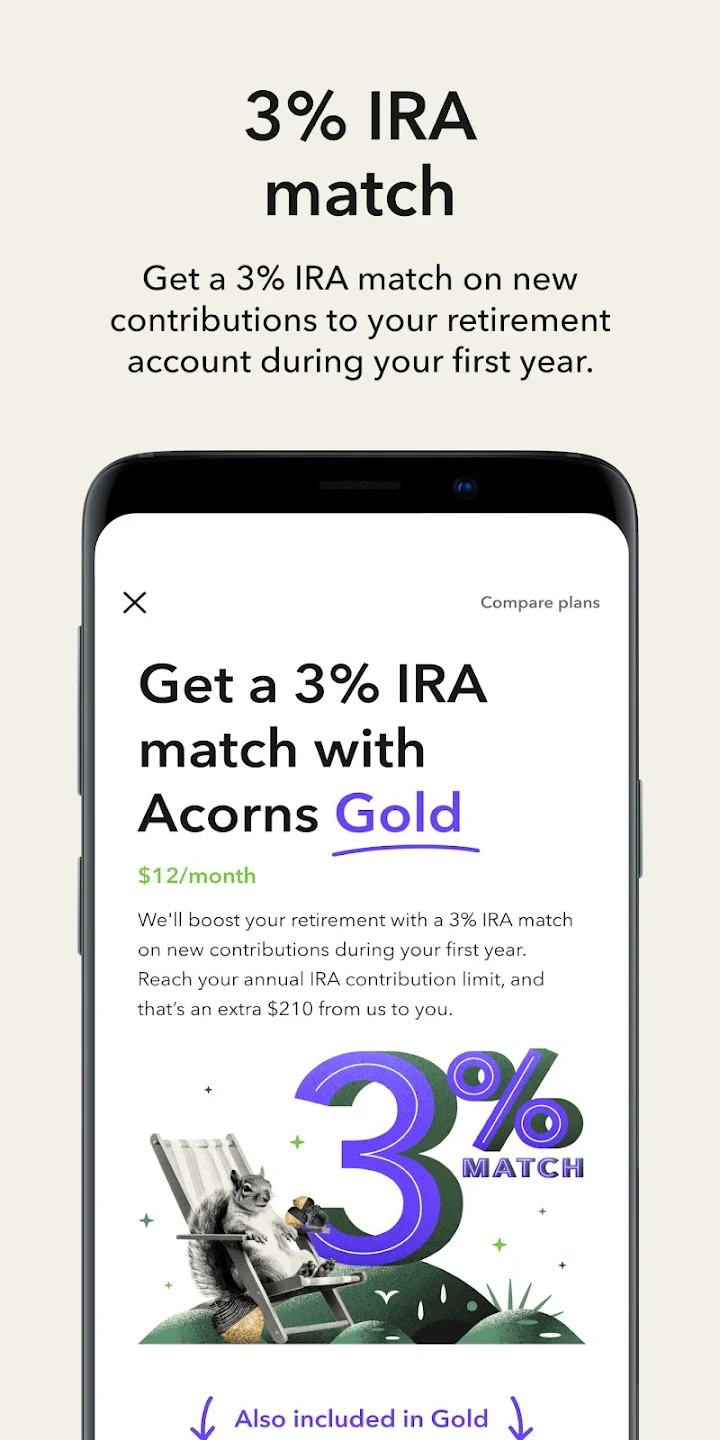

- Acorns Goals: A dedicated tool for setting specific financial objectives, like saving for a down payment on a house or retirement planning. Acorns helps users break these larger goals into smaller, automatic contributions. This structured approach turns vague aspirations into a concrete financial plan, making large goals less overwhelming and easier to achieve systematically.

- Security & Authentication: The app prioritizes user funds and data security, requiring robust login credentials and implementing encryption for data transfer. It often uses two-factor authentication (2FA) as an optional security layer. This focus on protection is essential for users trusting the platform with their money and personal financial details, ensuring peace of mind with their investments.

Pros & Cons

Pros:

- Accessibility for Beginners

- Automatic Investing Simplifies Saving

- Robust Educational Resources

- Multiple Portfolio Options

Cons:

- Minimum Balance Requirement

- Potential Fees from Underlying Banks or Funds

- Limited Customization Compared to Brokers

- No Direct Stock/ETF Picking

Similar Apps

| App Name | Highlights |

|---|---|

| PersonalWealth |

Focuses on comprehensive portfolio management and advanced charting tools. Offers detailed financial reporting and support for a wider range of investment types beyond typical diversified baskets. |

| InvestSmart |

Emphasizes guided investment education and step-by-step goal planning. Includes interactive learning modules and personalized recommendations based on user risk tolerance surveys. |

| FutureSaver |

Specializes in automated budgeting linked with investing. Features spending categorization and predictive analytics to suggest optimal contribution amounts for different goals. |

Frequently Asked Questions

Q: Who can use Acorns: Invest For Your Future?

A: Acorns is primarily aimed at novice and occasional investors, but it’s accessible to experienced individuals looking for automated, low-maintenance investing. There isn’t a strict upper limit on knowledge, but the app excels at explaining concepts for those new to investing. Users need to meet the minimum balance requirement and be 18 or older.

Q: How exactly does the automatic transfer work?

A: Once connected via their secure bank account settings, the Acorns app monitors your specified external account for balances exceeding a preset threshold (usually $1 or a small amount). When this threshold is met, a small, predefined amount is automatically moved into your Acorns portfolio. This typically happens within one to three business days.

Q: Are there any fees associated with using Acorns?

A: Acorns itself charges an annual portfolio fee, typically a small percentage (around 0.25%). However, users should also be aware of potential bank transfer fees from their linked external bank or account maintenance fees. Always review all associated costs with your bank and Acorns’ fee schedule.

Q: Can I change my investment portfolio once it’s set up?

A: Absolutely. You can review and change your portfolio allocation at any time within the Acorns app. Options usually include Aggressive, Moderate, Balanced, and Cash Cow (which holds your money as cash). Adjusting your strategy is easy to do based on your evolving risk tolerance or financial goals.

Q: Is my money and personal data secure with Acorns?

A: Acorns implements several security measures. Your funds are held by Acorns Investment Management, Inc., often through custodians like Fidelity, segregating user assets. Account access is protected by strong passwords, and data is encrypted during transfer and storage. While security is robust, users should still practice good cybersecurity habits and enable any available two-factor authentication for extra protection.

Screenshots

|

|

|

|