|

|

| Rating: 4.5 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Albert – Budgeting & Banking |

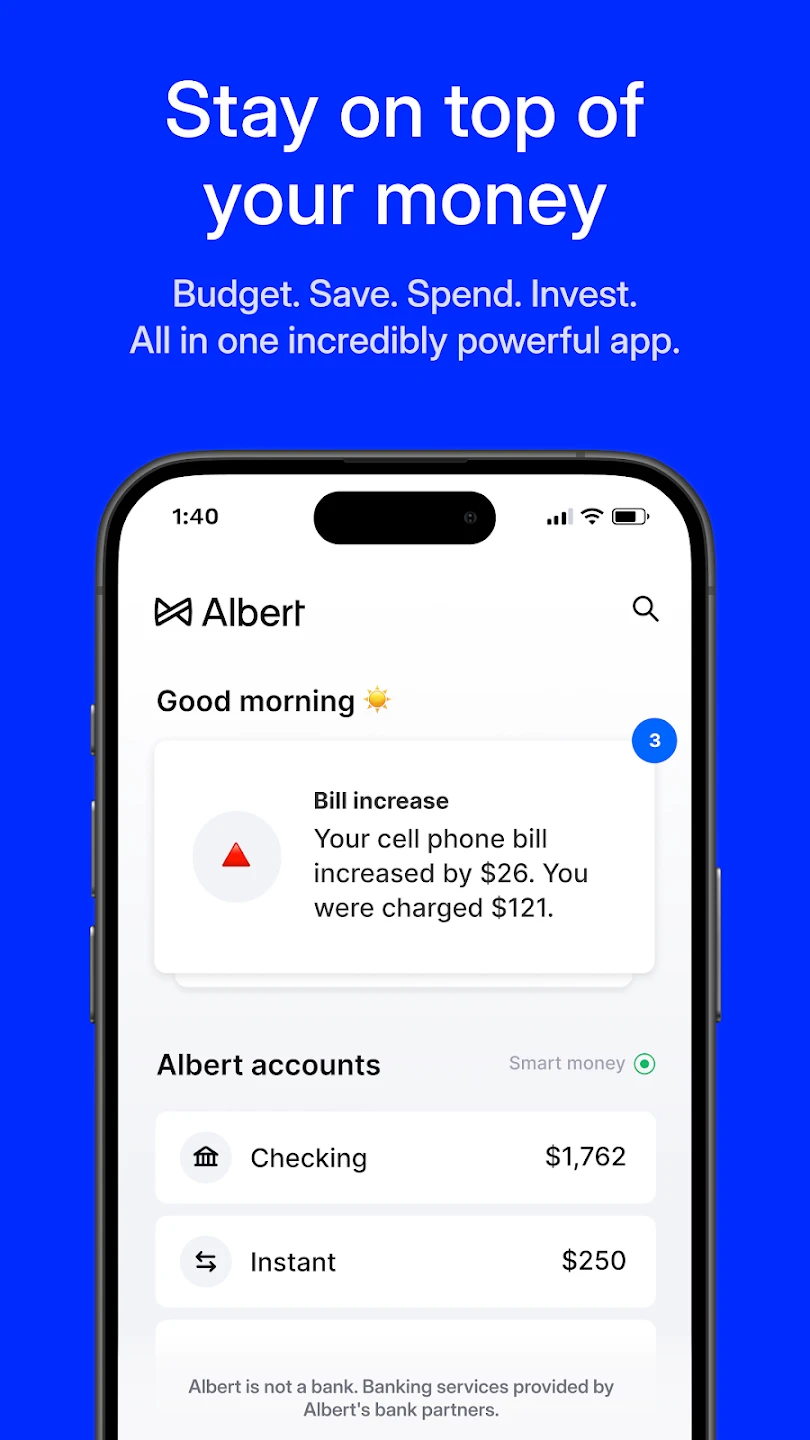

Albert: Budgeting and Banking is a comprehensive financial management application designed to simplify personal banking, investing, and budgeting tasks. This all-in-one platform enables users to monitor accounts, manage budgets, track expenses, and explore investment options—all within a single interface that syncs with financial institutions. Perfect for both beginners establishing financial habits and experienced investors managing complex portfolios.

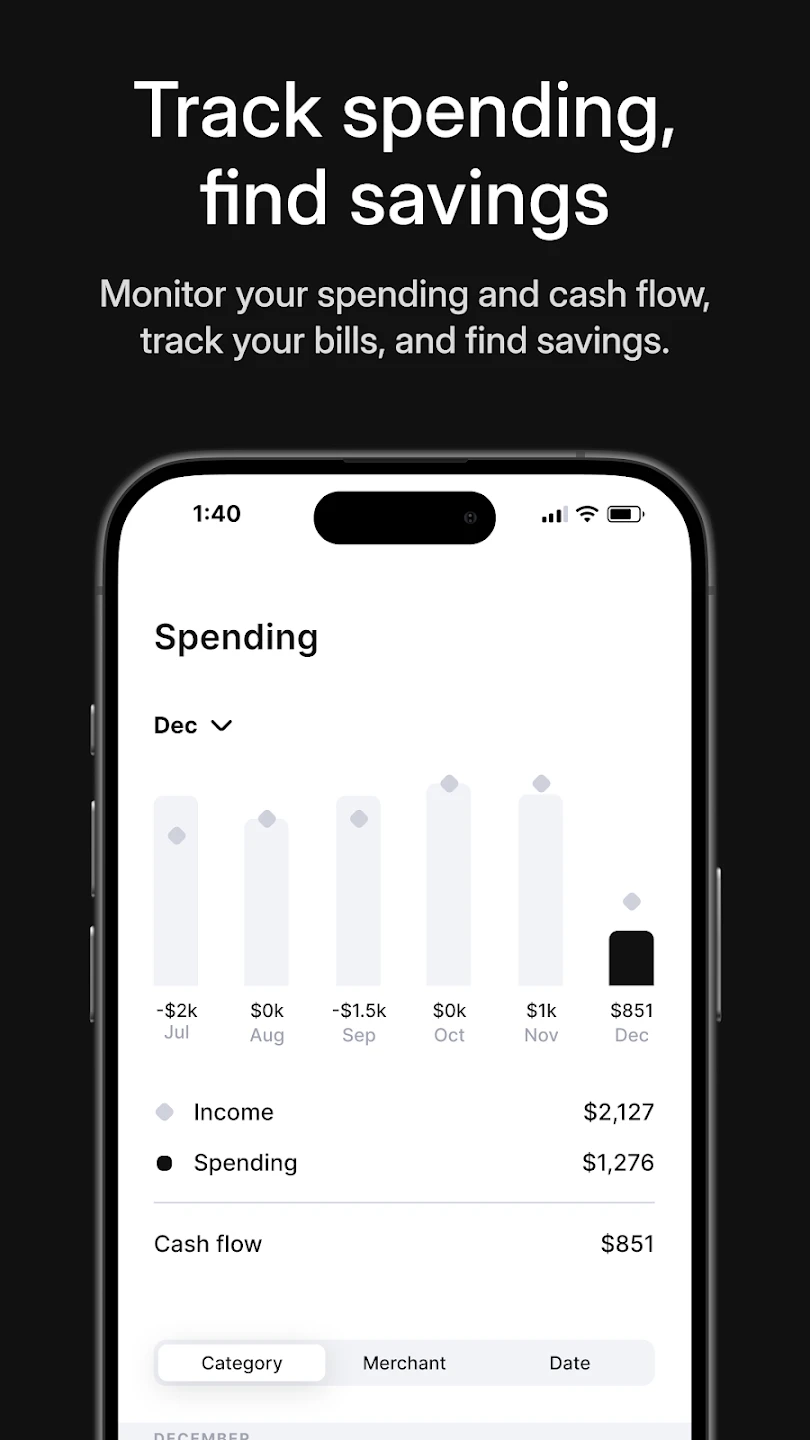

Its appeal lies in transforming complicated financial processes into intuitive daily actions. Albert: Budgeting and Banking helps users visualize spending patterns and identify savings opportunities, offering practical tools that turn abstract financial concepts into actionable steps toward achieving personal economic goals.

App Features

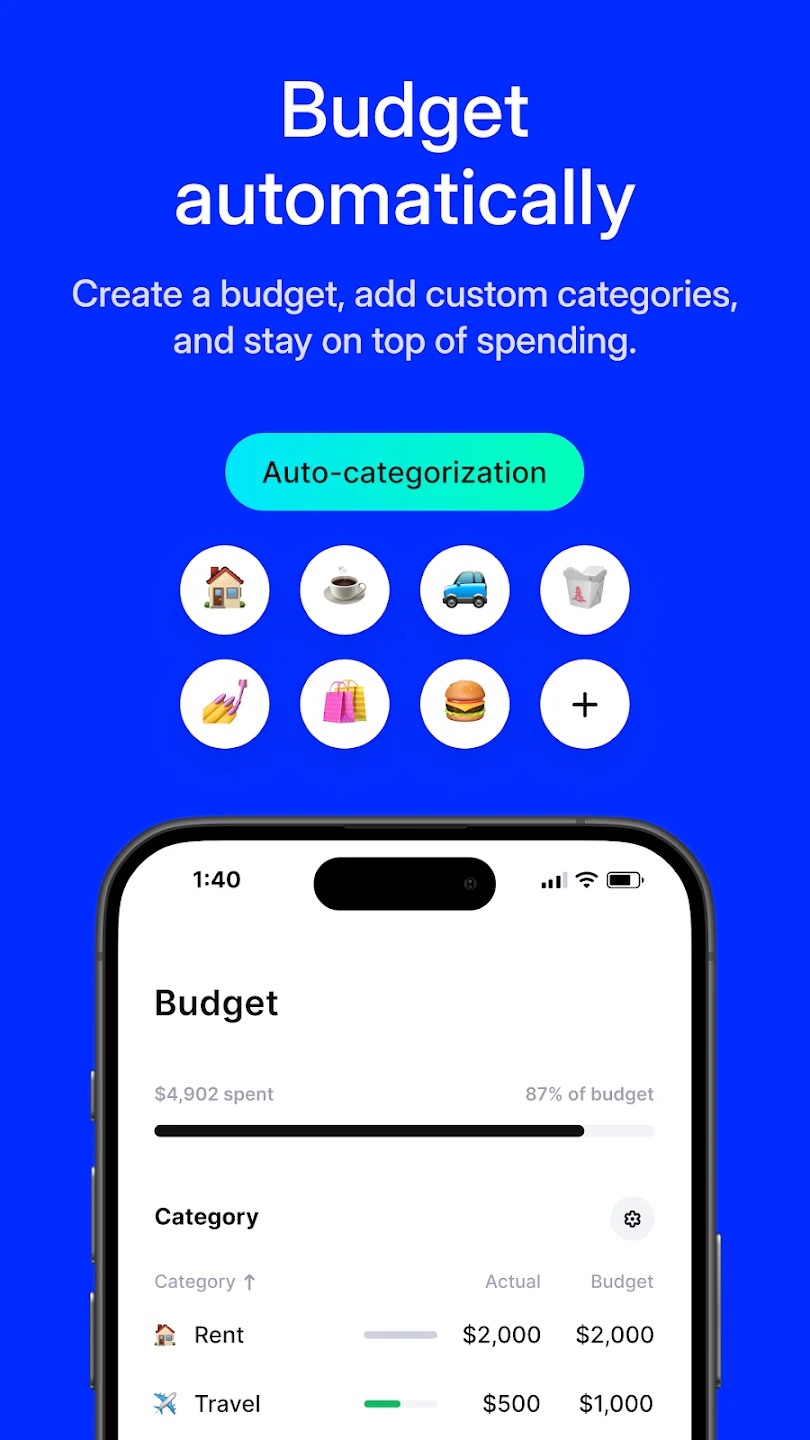

- Budget Tracking & Forecasting: Automatically categorizes expenses and creates projections, helping users understand spending habits before problems arise. This feature empowers informed decision-making, like noticing recurring subscriptions during early-stage debt elimination.

- Seamless Banking Integration: Directly connects with over 10k financial institutions for real-time balance monitoring, transaction categorization, and statement management, significantly reducing manual data entry compared to spreadsheet methods.

- AI-Powered Investment Insights: Provides personalized recommendations based on market trends and user-defined risk tolerance. This tool helps novice investors discover opportunities while offering experts deeper market context for better portfolio diversification.

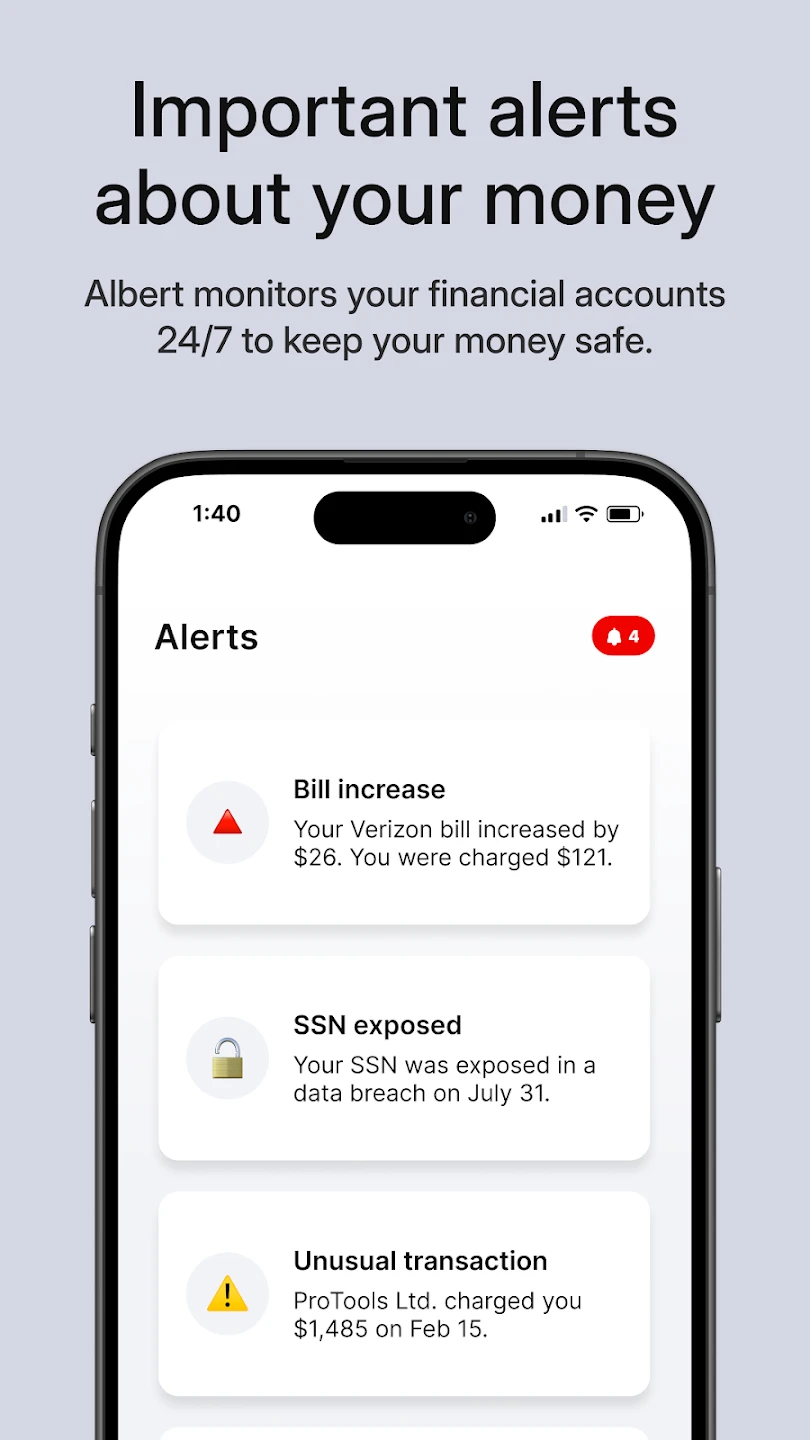

- Customizable Expense Alerts: Users can set personalized notifications for spending thresholds or account balances, preventing overdraft fees during unexpected expenses. This feature particularly helps busy professionals manage finances without constant active monitoring.

- Goal-Based Saving Systems: Enables users to create automated savings goals for specific purposes like vacations or emergencies. The system breaks down large objectives into manageable monthly contributions, ideal for families tackling significant future expenses.

- Multi-Account Portfolio Analysis: Compares performance across checking, savings, investment, and credit accounts. This comprehensive overview helps identify optimization opportunities across different financial segments.

Pros & Cons

Pros:

- Comprehensive financial ecosystem in one place

- AI-driven insights that adapt to user habits

- Extensive bank integrations reduce setup time

- Intuitive visual dashboards for quick understanding

Cons:

- Steeper learning curve for beginners

- Occasional sync delays with certain institutions

- Premium features limit basic functionality

- Data security concerns with third-party integrations

Similar Apps

| App Name | Highlights |

|---|---|

| YNAB (You Need A Budget) |

Focuses on zero-based budgeting principles. Known for ruthless envelope system and excellent transaction categorization. Ideal for debt recovery programs with detailed tracking. |

| Mint by Intuit |

Popular budgeting tool with simple interface. Includes debt payoff calculators and goal tracking features. Strong social media integration for sharing financial progress. |

| Personal Capital |

Premium investment management platform with detailed portfolio analysis. Offers retirement planning tools and fee calculators beyond basic budgeting. |

Frequently Asked Questions

Q: Does Albert: Budgeting and Banking charge transaction fees?

A: No, our core features including balance tracking and basic budgeting are completely free. Premium subscribers gain access to investment guidance and advanced analytics without any extra transaction costs.

Q: Can I use Albert across multiple devices?

A: Absolutely! Our platform syncs seamlessly across web browsers, iOS, and Android apps. Changes made on your smartphone automatically update in desktop views, ensuring your financial data is always current.

Q: How quickly does the app update transaction data?

A: Most institutions sync in real-time or within 15 minutes for immediate transaction visibility. Our system refreshes at configurable intervals (typically hourly), ensuring accuracy without constant notifications.

Q: What happens if I miss a bill payment?

A: Our system flags upcoming bills based on your calendar. We’ll first send automated reminders through your device’s notification system. For missed payments, you can schedule recovery actions directly from Albert, which then generates appropriate follow-up documentation.

Q: Is my financial data secure with Albert?

A: We employ bank-level encryption (AES-256) and comply with all global financial regulations. Our zero-knowledge architecture ensures you never share passwords, maintaining absolute control over your financial narrative.

Screenshots

|

|

|

|