|

|

| Rating: 4.4 | Downloads: 1,000,000+ |

| Category: Entertainment | Offer by: Cash-Cow |

Cash Cow is an intuitive mobile application designed to help users manage their personal finances efficiently. It allows individuals to track income, expenses, and investments all in one place, offering tools to create budgets and analyze spending habits. Ideal for anyone seeking better control over their money, from students to busy professionals.

Its key value lies in simplifying complex financial tasks and providing actionable insights through visual reports. Cash Cow empowers users to make informed decisions about their money, potentially leading to significant savings and a more secure financial future by highlighting spending patterns and progress towards goals.

App Features

- Account Aggregation: Seamlessly connect your bank accounts, credit cards, and investment accounts directly within the app, eliminating the need to manually transfer information. This feature saves time and reduces errors, giving you a complete financial snapshot at a glance.

- Smart Categorization: Automatically classify transactions into predefined or user-defined categories like groceries, entertainment, or utilities; users can fine-tune classifications. This significantly simplifies budgeting and expense tracking, offering deeper insights into spending habits and making budget adherence easier.

- Budget Builder & Alerts: Set monthly budgets for different categories and receive notifications when spending approaches or exceeds limits. For example, it could alert you if you’re close to your entertainment budget halfway through the month, helping prevent overspending and providing a proactive approach to financial control.

- Expense Tracker: View detailed breakdowns of spending by date, category, or merchant, complete with visual charts. This tool is invaluable for understanding consumption patterns and identifying areas for potential cost reduction or increased savings, making personal finance management more transparent.

- Financial Goals: Establish specific savings objectives, like saving for a vacation or building an emergency fund, and track progress visually towards their achievement. Users can easily set recurring contributions and see a clear path forward, providing motivation and a structured approach to reaching financial aspirations.

- Detailed Reports & Analytics: Generate comprehensive reports analyzing income vs. expenses, spending trends over time, and savings progress. This advanced feature transforms raw data into meaningful insights, helping users understand their financial situation thoroughly and make better long-term financial plans.

Pros & Cons

Pros:

- User-Friendly Interface

- Automatic Data Sync

- Robust Budgeting Tools

- Visual Data Presentation

Cons:

- Basic Investment Tracking

- Limited Advanced Charting

- Some Bank Integrations Not Direct

- Mobile-Only Platform

Similar Apps

| App Name | Highlights |

|---|---|

| MoneyWiz |

This app offers fast processing, budgeting tools, and multi-account support. Known for customizable reports and secure online backup. |

| YNAB (You Need A Budget) |

Designed around zero-based budgeting principles. Focuses on predictability and detailed expense categorization. |

| Personal Capital |

Offers comprehensive investment analysis, goal setting, and retirement planning alongside expense tracking. |

Frequently Asked Questions

Q: Is Cash Cow free to use, or are there premium features?

A: Cash Cow offers a fully functional free version with core features. Some advanced tools, higher transaction limits, and premium support may be available through in-app purchases or a subscription model.

Q: What types of accounts can Cash Cow connect to?

A: Cash Cow typically integrates with major banks and credit unions for accounts like checking, savings, and credit cards. Investment accounts like stocks and retirement funds might require manual entry or specific integrations depending on the provider.

Q: How often is my data backed up with Cash Cow?

A: Data synchronization occurs frequently based on your account connections (e.g., transactions may update daily) or manually initiated by you. We recommend enabling cloud backup options if available to secure your data against loss.

Q: Can I use Cash Cow for managing business finances?

A: Yes, Cash Cow can manage business finances, but it’s primarily optimized for personal use. Users can create separate personal and business accounts. For dedicated business accounting, exploring specialized options might be beneficial.

Q: What should I do if I suspect fraud on one of my linked accounts?

A: Immediately contact your bank or credit card provider. While Cash Cow relies on data from your financial institutions, it does not monitor transactions for fraudulent activity itself and depends on the security measures provided by your banks.

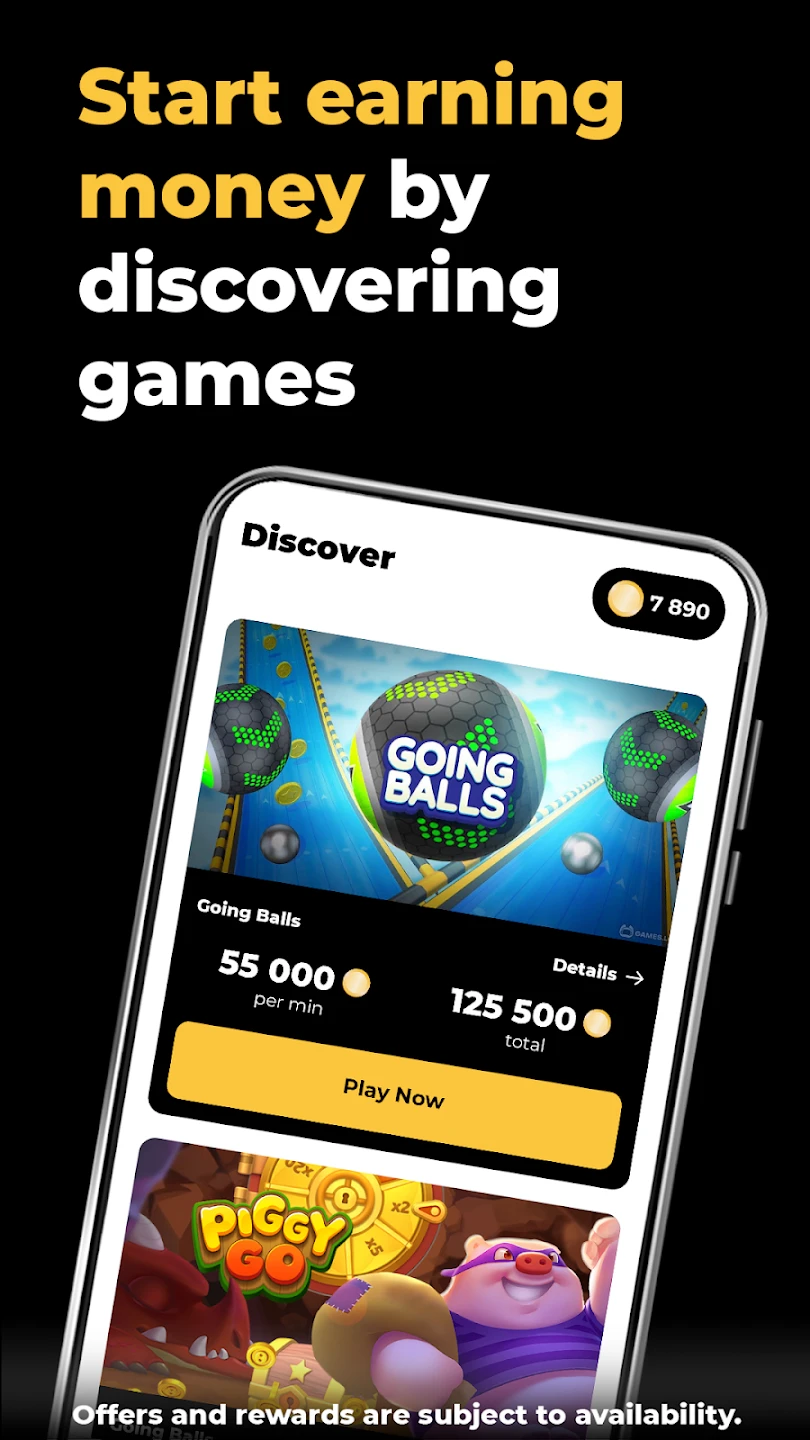

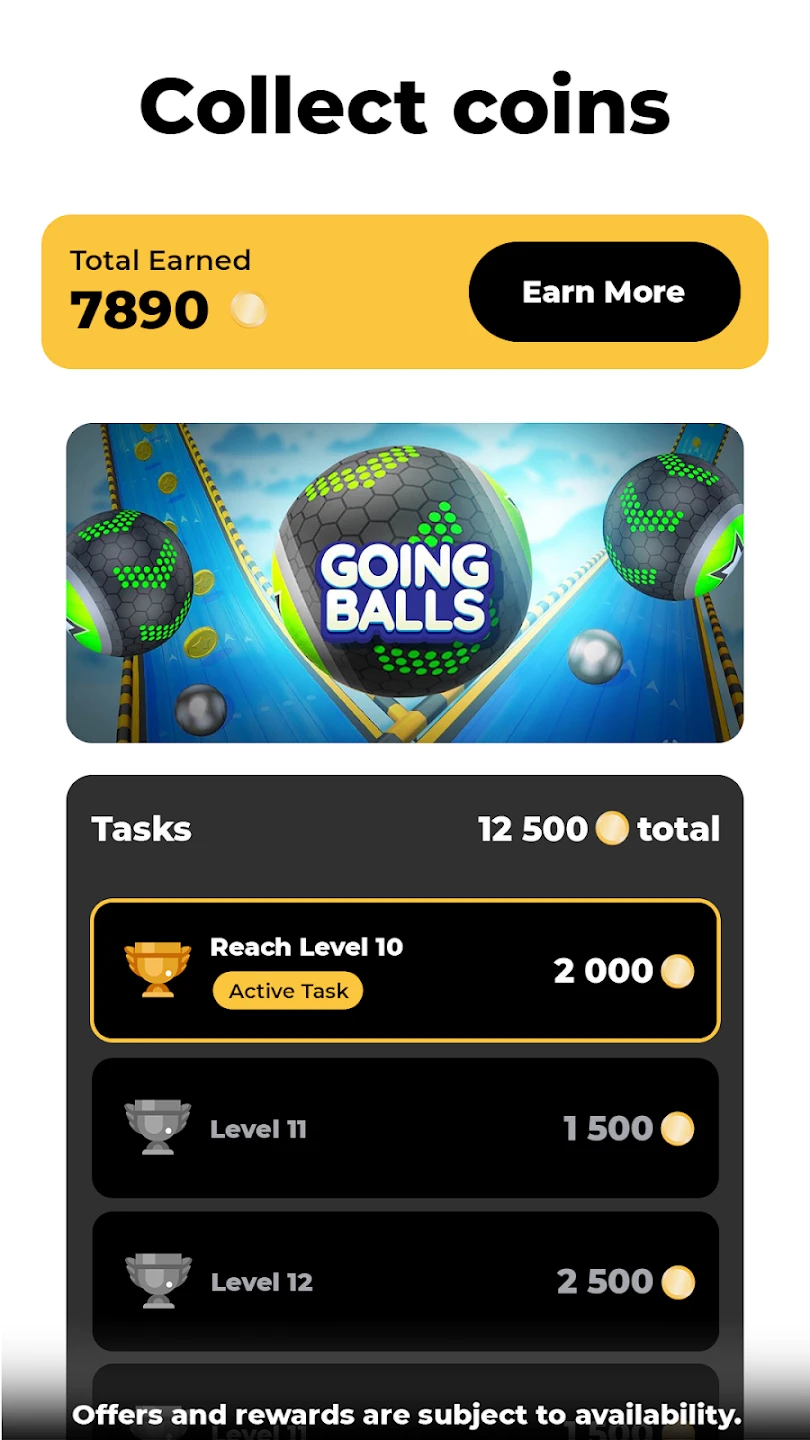

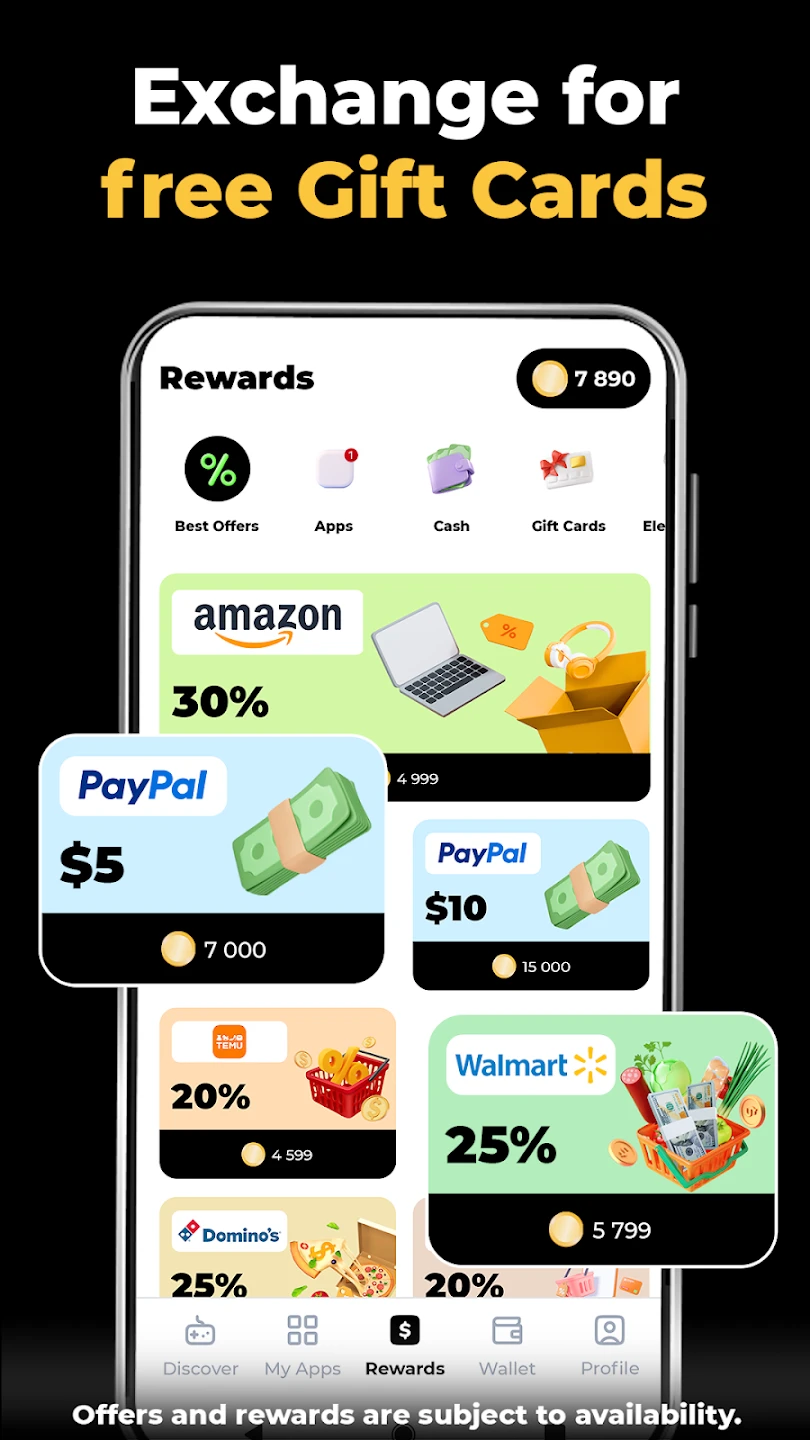

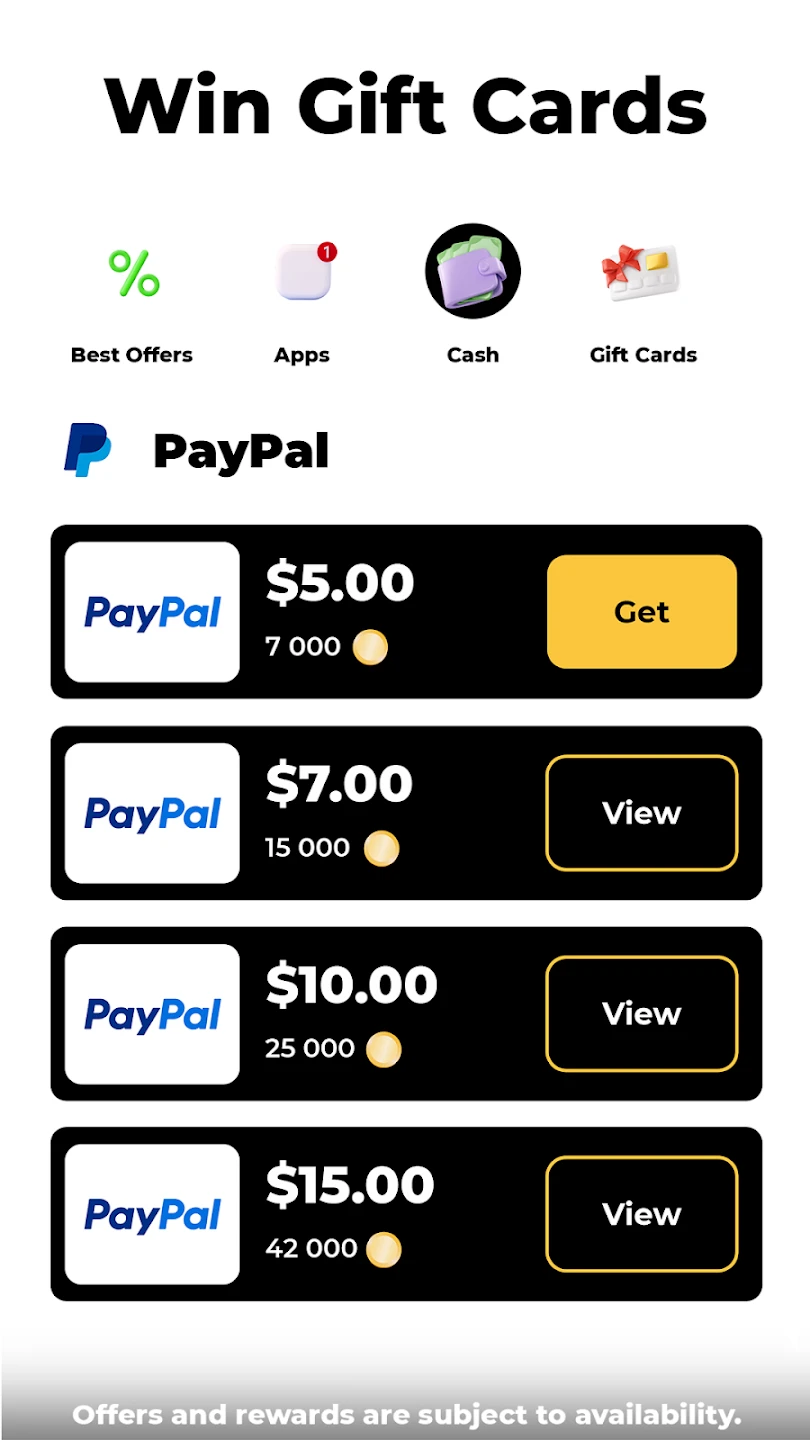

Screenshots

|

|

|

|