|

|

| Rating: 4.6 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Chime |

Chime is a revolutionary mobile banking app that aims to simplify and modernize the way people manage their finances. With Chime, users can enjoy a seamless and user-friendly banking experience right at their fingertips. The app offers a range of features designed to help individuals take control of their money, save effortlessly, and achieve their financial goals. Chime has gained significant popularity for its innovative approach to banking, providing a refreshing alternative to traditional brick-and-mortar banks.

By leveraging the power of technology, Chime eliminates the need for physical branches and offers a purely digital banking experience. From opening an account to managing transactions and tracking spending, Chime provides a comprehensive suite of tools and services that make banking more accessible, convenient, and transparent. Let’s explore the key features and benefits that have made Chime a preferred choice for many.

Features & Benefits

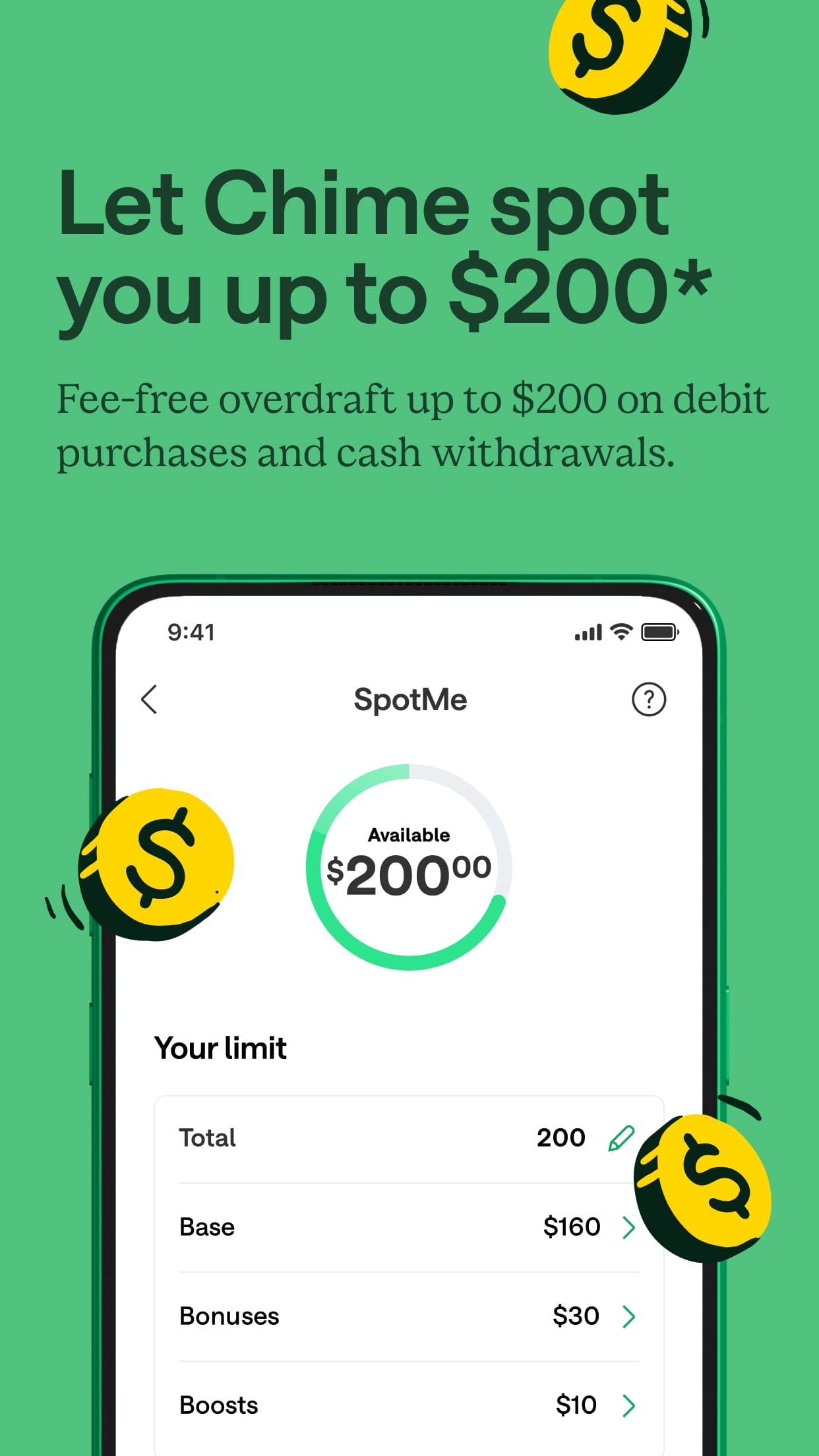

- No Hidden Fees: One of the standout features of Chime is its commitment to transparency. The app does not charge any monthly maintenance fees, overdraft fees, or minimum balance requirements. This fee-free approach makes Chime an attractive option for individuals who want to avoid unnecessary charges and keep more of their hard-earned money.

- Early Direct Deposit: Chime allows users to receive their paychecks up to two days earlier than traditional banks. This feature can be particularly beneficial for those living paycheck to paycheck or needing quick access to funds. By getting paid faster, Chime users have more flexibility and control over their finances.

- Automatic Savings: Chime’s automatic savings feature helps users effortlessly save money. Every time a Chime debit card is used for a purchase, the app rounds up the transaction to the nearest dollar and transfers the spare change into a designated savings account. This “round-up” method makes saving a part of everyday spending and encourages healthy financial habits.

- Fee-Free ATM Access: Chime provides access to thousands of fee-free ATMs through its network of partners. Users can easily locate nearby ATMs within the app and withdraw cash without incurring any additional fees. This feature ensures that users have convenient access to their funds without worrying about costly ATM charges.

- Real-Time Notifications: Chime keeps users informed about their account activity in real-time. Notifications are sent for every transaction, including purchases, deposits, and withdrawals. These instant updates help users stay on top of their finances and detect any unauthorized or suspicious activities quickly.

Pros

- Chime’s fee-free structure saves users money by eliminating common banking fees.

- Early direct deposit provides users with faster access to their funds, offering greater financial flexibility.

- Automatic savings feature encourages regular saving habits without requiring additional effort.

- Fee-free ATM access through partner networks ensures convenient cash withdrawals.

- Real-time notifications keep users informed about their account activity, enhancing security and awareness.

Cons

- Chime’s lack of physical branches may be a disadvantage for individuals who prefer in-person banking services or need assistance with complex financial matters.

- Some users have reported occasional technical issues or glitches with the app, although Chime continually works to improve its performance.

- The absence of certain traditional banking features, such as physical check deposits, may be inconvenient for users who frequently receive or make payments via checks.

- Chime’s partnerships with specific ATMs limit the availability of fee-free withdrawals in certain areas, requiring users to plan their cash needs accordingly.

- The app’s reliance on technology and internet connectivity means that users may experience limitations or disruptions in service during network outages or maintenance periods.

Apps Like Chime

- Varo: Varo is another popular mobile banking app that provides a range of features similar to Chime. It offers fee-free banking, early direct deposit, automatic savings, and real-time transaction notifications. Varo also provides access to a network of fee-free ATMs and aims to simplify the banking experience for its users.

- Simple: Simple is known for its user-friendly interface and robust budgeting tools. Like Chime, Simple offers fee-free banking, early direct deposit, and real-time notifications. It emphasizes budgeting and spending insights, helping users stay on top of their finances and make informed financial decisions.

- Ally Bank: While Ally Bank is not a mobile-only app, it provides a comprehensive online banking experience with similar features to Chime. Ally offers fee-free banking, early direct deposit, savings tools, and a wide network of fee-free ATMs. It also provides additional services such as investment accounts, loans, and mortgages, catering to a broader range of financial needs.

Screenshots

|

|

|

|

Conclusion

Chime is a mobile banking app that offers a refreshing and user-centric approach to managing finances. With its fee-free structure, early direct deposit, automatic savings, fee-free ATM access, and real-time notifications, Chime empowers users to take control of their money and achieve their financial goals. While there are considerations such as the absence of physical branches and occasional technical issues, Chime’s innovative features and commitment to transparency make it a compelling choice for individuals seeking a modern banking experience.