|

|

| Rating: 3.8 | Downloads: 500,000+ |

| Category: Finance | Offer by: Concora Credit |

Concora Credit is a specialized mobile application designed to help users effectively manage personal or small business credit-related inquiries and tasks directly from their smartphones or tablets. It acts as a digital assistant, streamlining processes like checking eligibility, tracking application status, and accessing educational resources pertinent to credit management.

The core appeal of Concora Credit lies in its ability to consolidate essential credit information and actions into a user-friendly format, making complex financial aspects more accessible and manageable. It saves users time by offering quick insights and simplifying procedures previously requiring manual paperwork or multiple phone calls.

App Features

- Instant Credit Eligibility Check: Within the Concora Credit app, users can initiate a simulated credit check to gauge their potential eligibility for new credit products quickly, pre-filtering results to match specific loan criteria. This feature empowers users by giving them immediate feedback before formally applying, potentially saving considerable administrative steps and follow-up queries.

- Application Status Tracker & Document Upload: The platform provides a dashboard displaying the progress of submitted credit inquiries and loan applications, featuring a simplified visual indicator. Users can attach necessary documentation directly through a secure interface, accelerating the verification process for cases where supporting files are required, improving overall efficiency.

- Personalized Financial Insights & Budgeting Tools: Concora Credit app analyzes user data (like credit history review trends) and recommends personalized strategies to enhance creditworthiness or manage finances prudently. These practical tools help users understand their current financial position and take proactive measures for long-term credit health and financial planning.

- Secure Data Encryption & Compliance Confirmation: Through a dedicated mobile interface, users experience secure data entry and storage, assured by the use of AES-256 encryption. This key security ensures user privacy, building trust with prospects and existing customers who require confirmation of compliance with data protection regulations.

- Credit Limit Adjustment Request Portal: For existing borrowers, the app significantly simplifies the request process for modifying credit limits or upgrading account tiers. Users can submit detailed proposals directly, explaining preferred adjustments or usage scenarios, enhancing user experience and responsiveness to individual financial growth.

Pros & Cons

Pros:

- Time Efficiency in Initial Scoping

- Versatile Interface Adapting to Different Credit Scenarios

- Cost Reduction Potential via Reduced Paperwork

- User-Friendly Design Catering to Diverse Experience Levels

Cons:

- Relies heavily on accurate input during initial setup

- Limited capacity for multilingual support outside core regions

- Occasional synchronization delays noted during peak periods

- Templates remain restricted to standard credit-related structures

Similar Apps

| App Name | Highlights |

|---|---|

| LendFLY Assist |

This app offers fast processing, intuitive design, and wide compatibility. Known for custom workflows and multi-language support. |

| LoanFlow Direct |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews. |

| FinanceRoute Pro |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams. |

Frequently Asked Questions

Q: Do I need to be within Concora Credit itself to access support resources?

A: Yes, information utilities and help centers are integrated directly into the Concora Credit app, offering quick support and guidance.

Q: Can I compare offers from multiple credit providers using the app?

A: Concora Credit provides comparison features that let you select certain detail parameters like interest rates; however, partner-specific offers may require direct engagement.

Q: Are there volume limits on the types of requests I can handle via the app?

A: The platform supports standard tasks encountered by most accounts; however, highly specialized or bulk request handling might require assistance outside the core interface.

Q: Does storing application details affect my privacy within Concora Credit?

A: Concora Credit utilizes robust security measures; storing necessary information enables smoother processing without impacting your core privacy protection features.

Q: What happens if my address changes after submitting a request via the app?

A: If you update your home address after submitting, please note the system captures the information at the time of submission; provide the updated details manually in a follow-up query if needed.

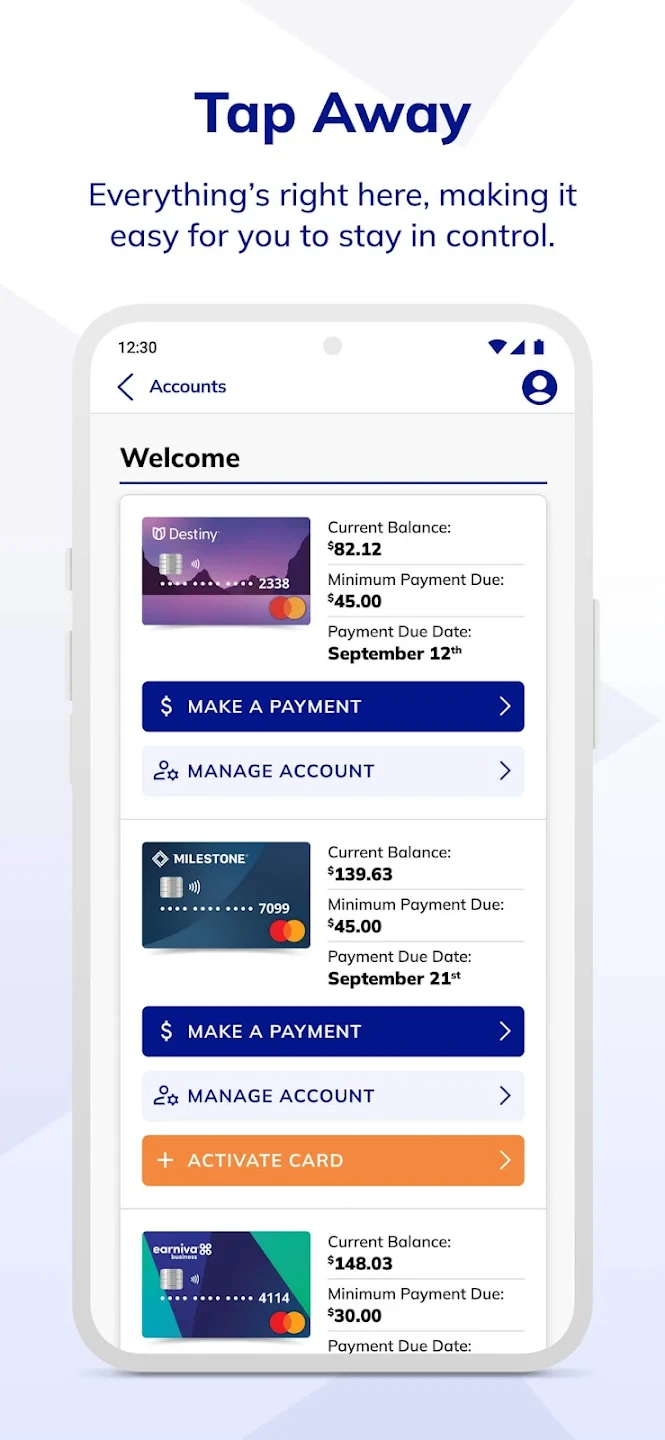

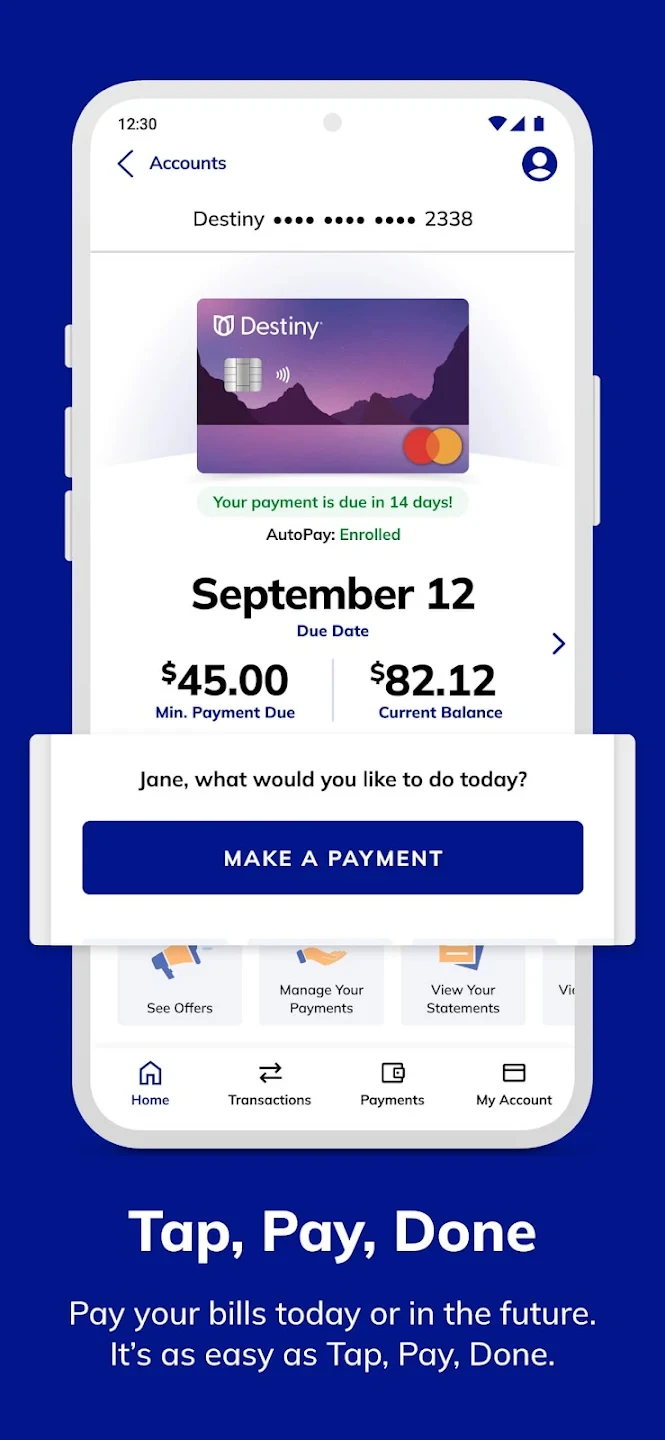

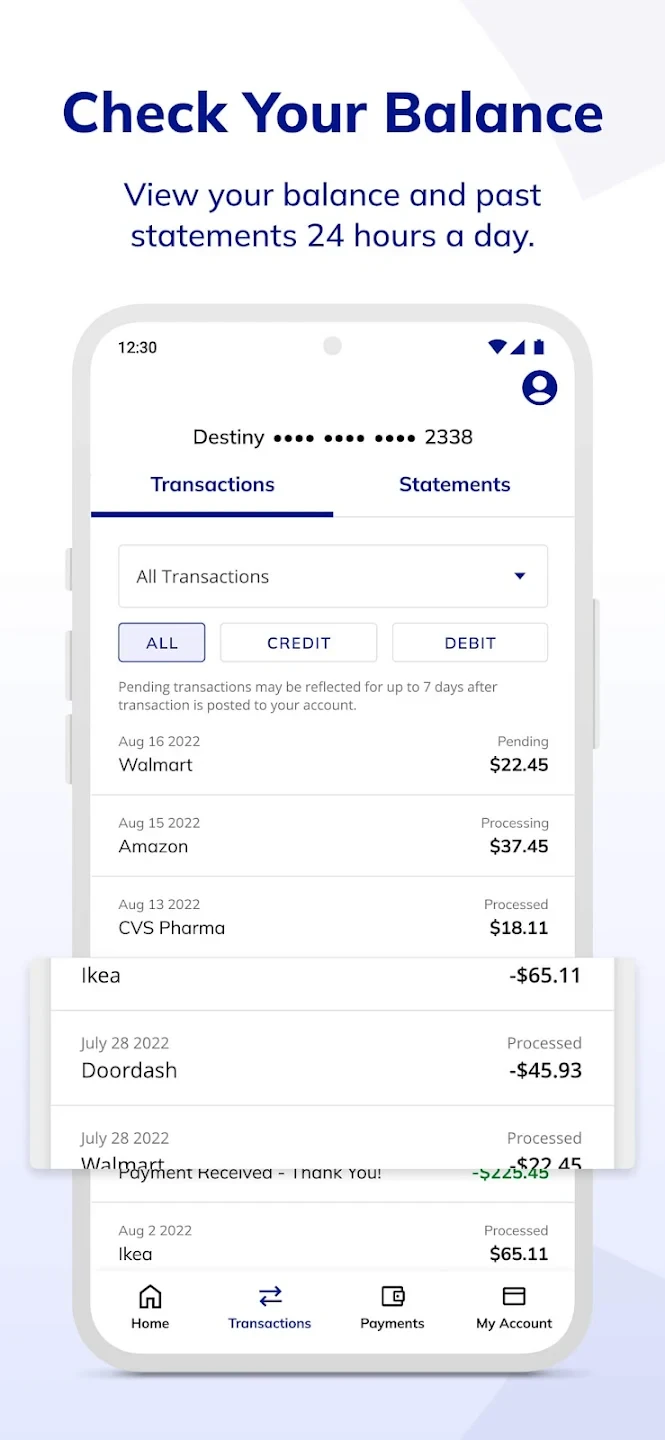

Screenshots

|

|

|

|