|

|

| Rating: 4.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Comerica Bank |

Direct Express® Mobile is a specialized app designed for managing your Direct Express reloadable card, primarily serving federal benefit recipients such as Social Security beneficiaries, military personnel, and SNAP program users. This mobile platform allows you to view your balance, deposit funds via various methods, and manage your account securely from your phone. It’s tailored for anyone who relies on electronic benefits but values the convenience of mobile banking tools.

The key appeal of Direct Express Mobile lies in its simplicity and accessibility, letting you handle essential financial tasks without visiting a branch. Its practical value is evident in everyday scenarios like checking your benefits balance while shopping or depositing a stimulus check directly through the app. This integrates financial management seamlessly into daily life, saving time and reducing reliance on less convenient methods.

App Features

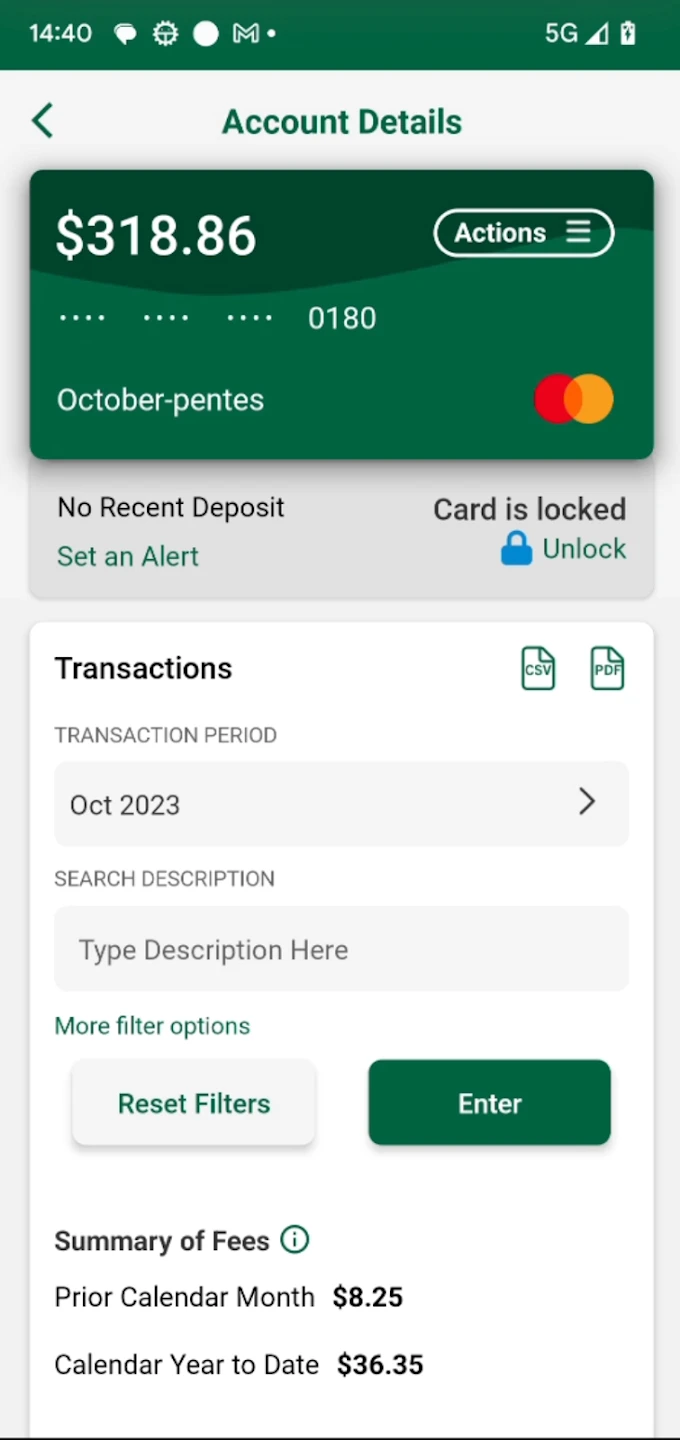

- Balance Inquiry: Instantly view your available balance whenever needed, eliminating confusion from outdated records. This feature is especially useful before making a purchase to ensure sufficient funds, enhancing your shopping confidence.

- Fund Deposits via Phone: Seamlessly load funds using your phone number or routing information without envelopes or physical trips. The speed of direct deposits saves days compared to traditional waiting periods for mailed checks.

- Statement Viewing and Transaction History: Access up to 30 days of transaction details organized by date and merchant name. This solves the dilemma of forgetting small purchases by providing a clear record to track benefits spending and government contributions.

- Mobile Referrals & Account Information: Easily share referral codes with family members or loved ones. The ability to access your Social Security Number (SSN) for verification purposes when requested adds security and convenience to your verification processes.

- Alerts & Notifications: Receive timely notifications for low balance warnings, deposit confirmations, or security alerts. This feature helps prevent overdraft fees and makes budgeting easier by keeping users aware of fund availability throughout the month.

- Budget Assistance Tools (Beta): Observe peers how this optional feature helps users set savings goals for larger purchases like holiday gifts or retirement planning, though specific functionality varies by platform updates.

Pros & Cons

Pros:

- Accessibility for All Users — Works seamlessly for individuals with limited banking access

- ZERO Account Fees — No monthly maintenance costs with direct deposit requirement

- Potentially Lower Transfer Times — Electronic deposits often faster than traditional options

- Fund Availability Notifications — Receives timely alerts for deposited money becoming available

Cons:

- Mobile Interface Complexity

- Limited Transaction Types

- Bank Account Dependency

- Eligibility Documentation Requirements

Similar Apps

| App Name | Highlights |

|---|---|

| EbtBenefits Mobile |

Streamlined experience for SNAP and TANF recipients. Includes benefit balance tracking and add-on features like grocery store loyalty programs. |

| Social Security Mobile |

Optimized for Social Security claimants with simplified statement viewing and claim history tracking capabilities. |

| USPS Income Payment Mobile |

Built around government payroll and tax refund deposits with real-time tracking for benefit disbursements. |

Frequently Asked Questions

Q: How often can I check my Direct Express® Mobile balance?

A: You can view your balance anytime, 24/7, though transaction posting may take 1–2 business days. This constant access helps budget effectively without the delay associated with some other systems.

Q: Are there any charges for using Direct Express® Mobile features?

A: The core features including balance checks and mobile deposits are completely free — many users discover they save money by avoiding ATM fees or money transfer services.

Q: Can I update my direct deposit info within Direct Express® Mobile?

A: Yes! In just a few clicks, update or change your bank account details to accommodate new account numbers or routing information directly from your phone.

Q: What happens if my Direct Express® Mobile transaction doesn’t go through?

A: Failed deposits create a pending resolution timeline, generally resolving within 48 hours. You’ll typically receive an email notification explaining the reason and steps to resolve such issues.

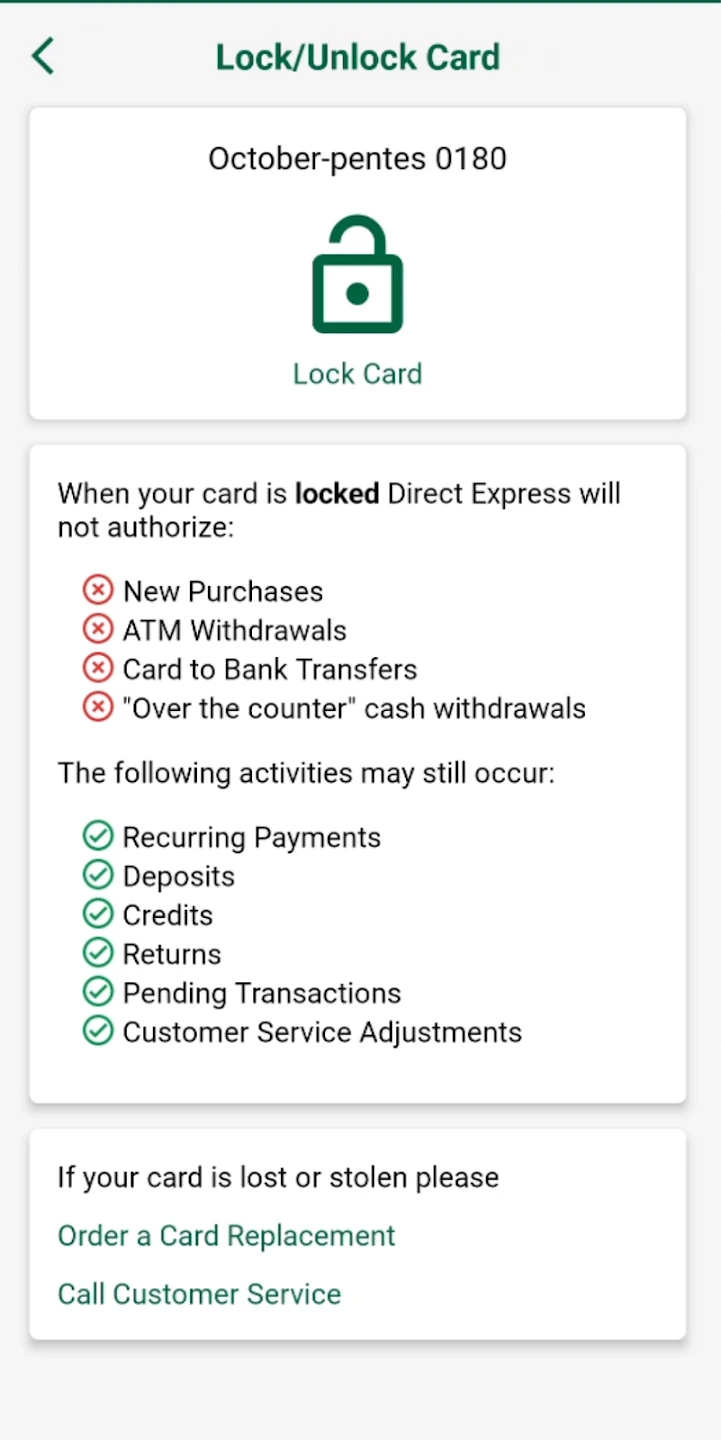

Q: Is Direct Express® Mobile secure against hacking attempts?

A: Absolutely essential — the app employs strong security protocols including data encryption and multi-factor authentication. Additionally, suspicious login attempts trigger immediate verification checks, fortifying your account protection against unauthorized access.

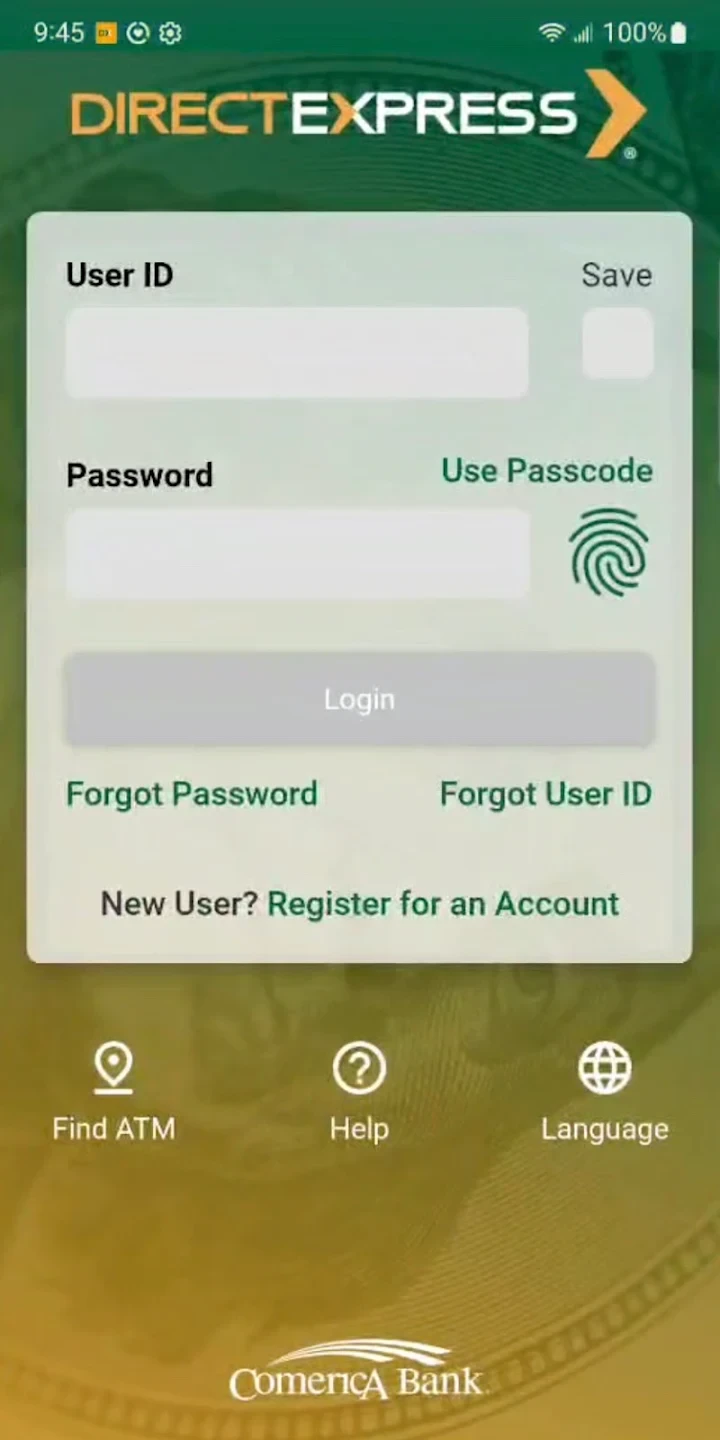

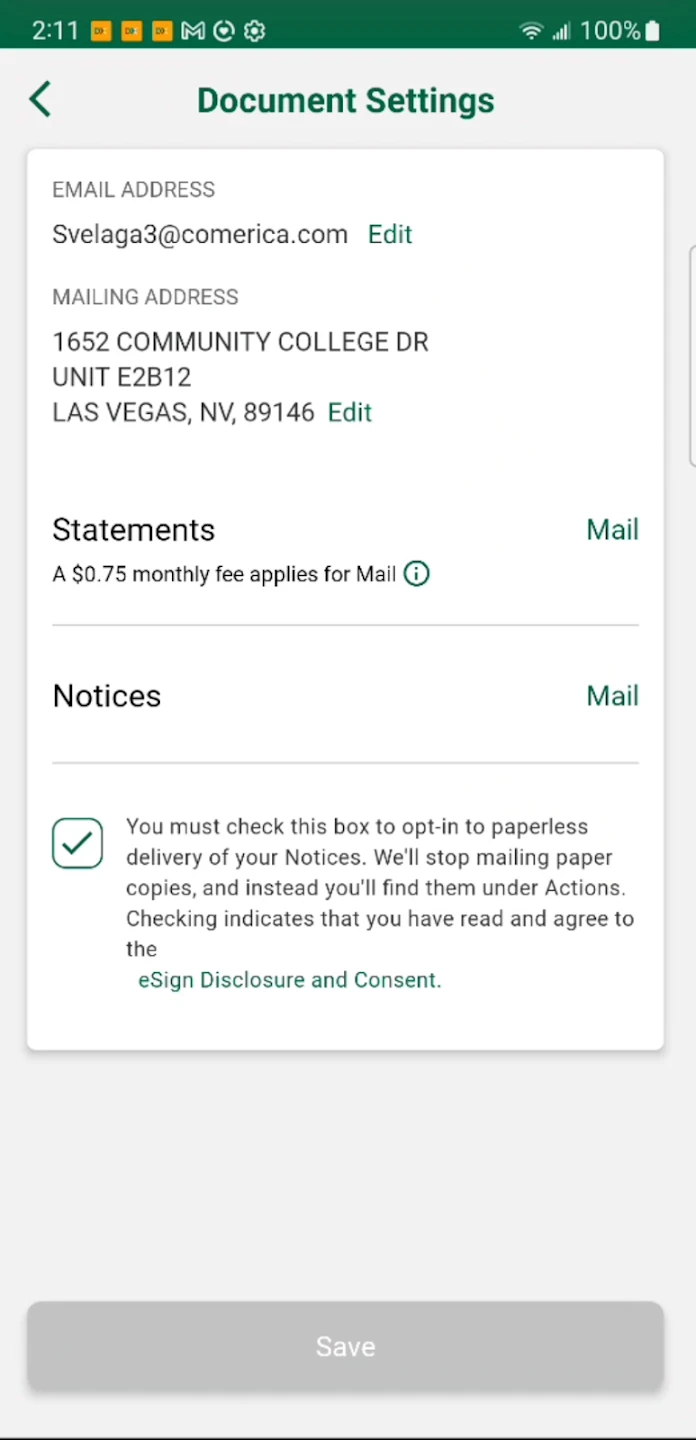

Screenshots

|

|

|

|