|

|

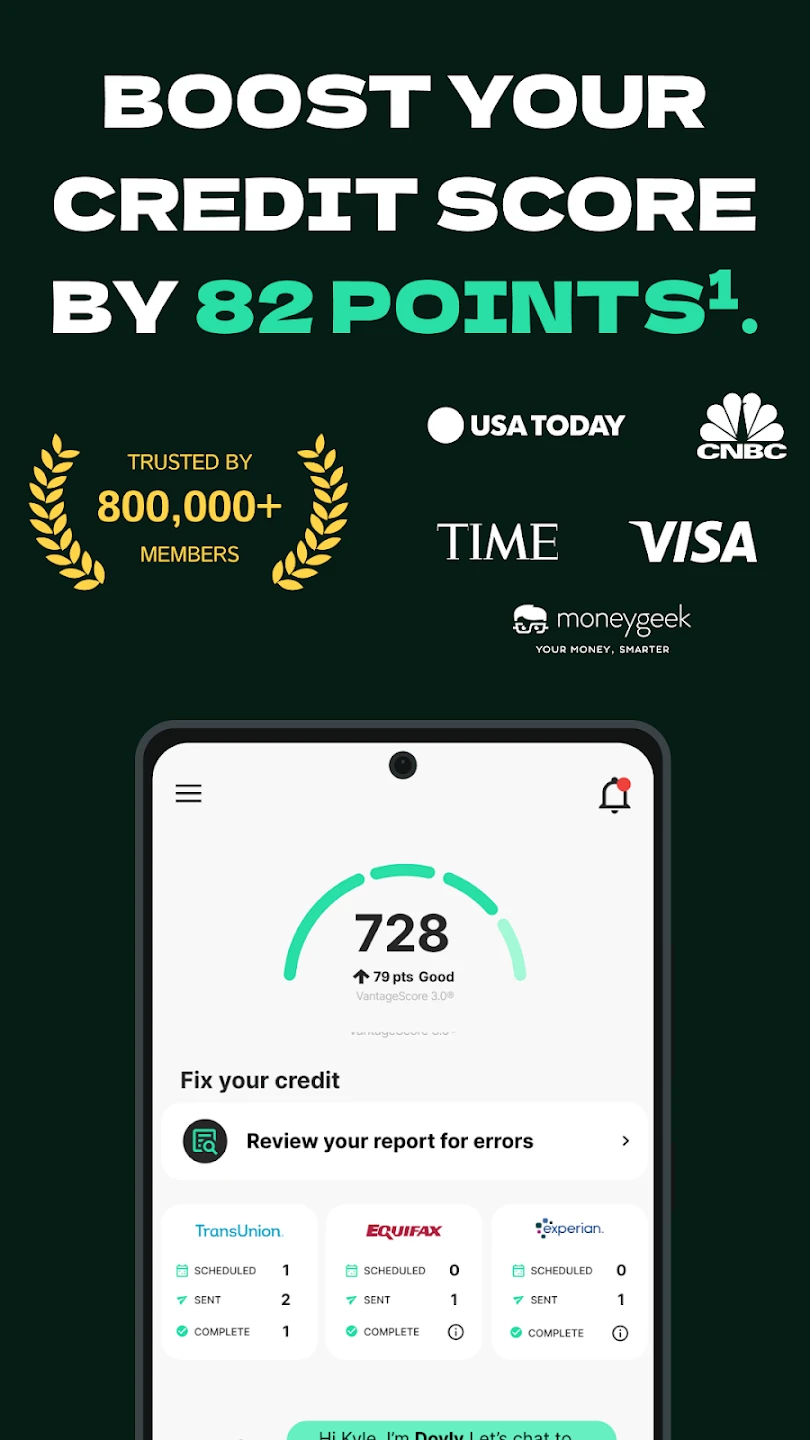

| Rating: 4.7 | Downloads: 500,000+ |

| Category: Finance | Offer by: Dovly.com |

Dovly: Grow your Credit Score is a mobile app designed specifically for Americans who want to improve their credit health. It helps users understand their credit reports, track their score progress, and take actionable steps toward better financial health. Whether you’re building credit for the first time, recovering from financial setbacks, or aiming for an excellent credit score, this app makes complex credit processes simple and accessible through easy-to-understand tools.

The key value lies in Dovly’s ability to demystify credit management, providing personalized insights and practical guidance that empowers users to make informed financial decisions. Its user-friendly interface and educational resources turn what can feel like a confusing process into a straightforward journey toward better credit, helping people save money on interest payments while achieving their personal financial goals.

App Features

- Credit Score Monitoring: Get real-time updates on your FICO and VantageScore, with easy access to free Experian reports directly within the app, allowing you to track improvements as you implement strategies from the personalized action plan. This feature eliminates the need to visit multiple websites or apps to compare scores, providing a centralized dashboard to stay informed about your progress toward financial goals.

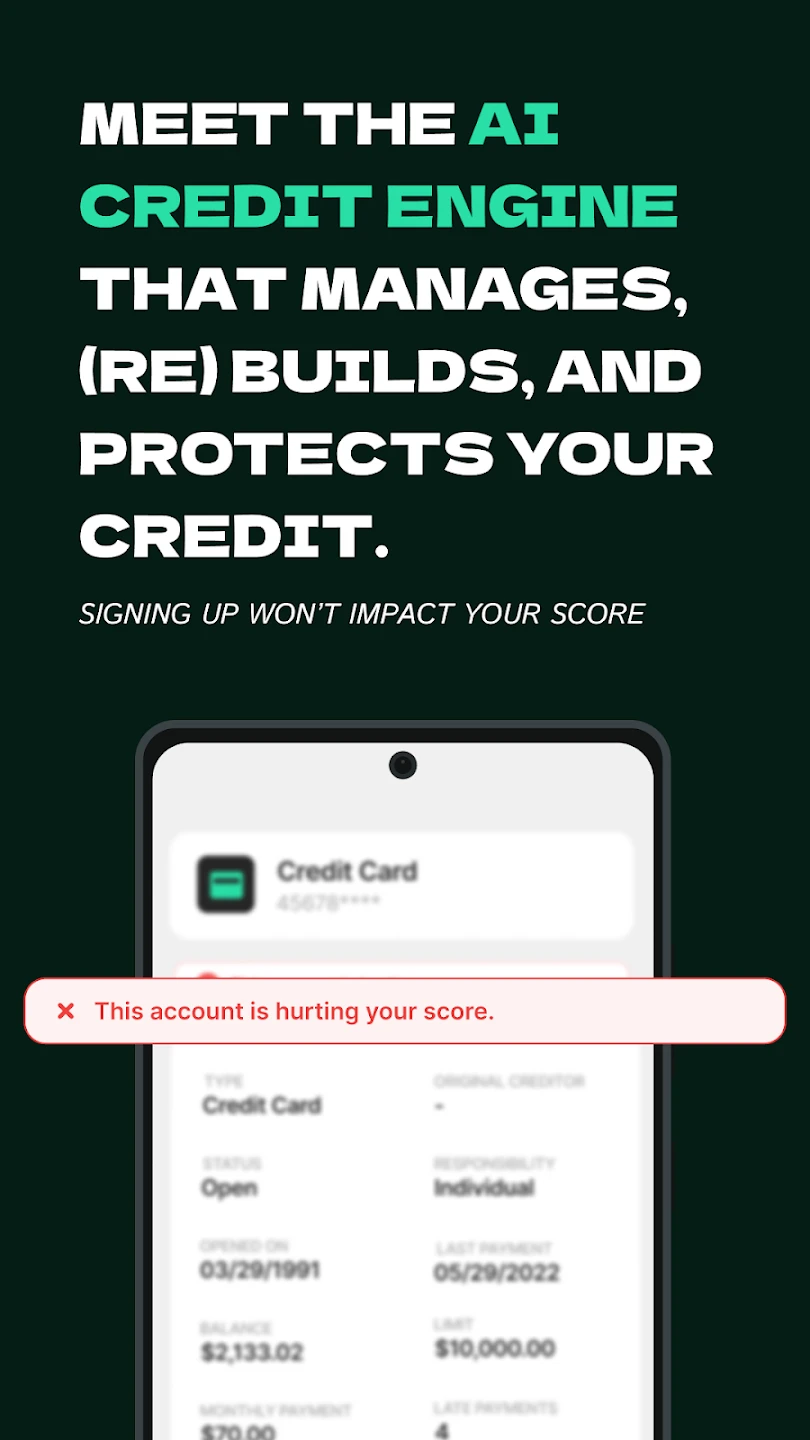

- Personalized Action Plan: The app creates a custom road map based on your credit profile, offering step-by-step guidance for disputing inaccuracies, managing credit utilization, and building positive payment history with clear examples like “pay this medical debt within 60 days to boost your score by up to 60 points.” Using proprietary algorithms, Dovly identifies the most impactful actions tailored to your specific credit situation, saving you time and preventing overwhelming choices.

- Interactive Learning Center: Explore bite-sized lessons covering credit basics like the difference between secured and unsecured cards, how interest rates affect loans, or the impact of “thin files” on young adults. Each module includes real-world scenarios and quizzes to test knowledge retention, transforming abstract concepts into practical skills you can immediately apply to improve your financial standing.

- Alert System: Set custom notifications for credit milestones, suspicious account creation, or when your credit utilization exceeds 30% — for example, “Your credit score dropped 12 points due to a new hard inquiry on Tuesday.” This feature allows proactive management rather than waiting for negative impacts to appear, giving you immediate visibility into factors affecting your score and enabling quick corrections.

- Score Simulator: Experiment with “what-if” scenarios by adjusting variables like payment history, credit utilization, or adding a new $5,000 installment loan, then see how these changes would affect your potential credit score in just 3-6 months. This tool helps prioritize actions based on impact potential, allowing you to make strategic financial decisions that maximize your credit growth while considering your budgetary constraints.

- Financial Health Score: Unlike the standard credit score, this unique metric combines payment history, balances owed, credit mix, and even alternative data like rental payment history or utility bills to give a more comprehensive view of your overall financial reliability. Financial institutions increasingly use this score for lending decisions, particularly for applicants who might be overlooked by traditional credit scoring methods.

Pros & Cons

Pros:

- Comprehensive Credit Education

- Direct Experian Data Access

- Personalized Improvement Roadmap

- Simplified Score Monitoring

Cons:

- Some Premium Features Cost Money

- Occasional Minor UI Glitches

- Limited Comparison Tool

Similar Apps

| App Name | Highlights |

|---|---|

| Credit Karma |

Free access to multiple credit scores and reports. Includes budgeting tools and community forums, but lacks the personalized action plans found in Dovly. |

| Mint by Intuit |

Strong budgeting and financial tracking alongside basic credit monitoring. Works best for users who want comprehensive financial management in one place. |

| MyFICO |

Direct access to official FICO scores from all three bureaus. More technical interface focused on data analysis rather than step-by-step improvement planning. |

Frequently Asked Questions

Q: How often do I get updated credit scores in Dovly?

A: Dovly provides daily monitoring for your Experian credit score and weekly notifications for significant changes. You can also choose to refresh your score manually anytime through the app.

Q: Does Dovly affect my credit score when I use it?

A: Absolutely not! The app only performs soft inquiries — these don’t impact your credit score — so you can confidently monitor your credit without worrying about temporary dings.

Q: Can I track my progress toward mortgage or loan pre-approval?

A: Yes! Use the Score Simulator feature to model scenarios that lenders typically require (usually 650+ FICO). Dovly helps you reach that target with a personalized action plan that considers your current financial situation.

Q: Is my credit data really secure in the app?

A: Dovly employs bank-grade encryption, multi-factor authentication, and never shares your personal information. Your data access portal uses the same security protocols as financial institutions, giving you complete control over which bureaus are connected.

Q: Are there any extra costs for advanced features?

A: The core monitoring features are free. However, premium options like unlimited Experian reports, advanced dispute tools, and priority customer support are available through an optional subscription that starts at $9.99/month.

Screenshots

|

|

|

|