|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Fifth Third Bank |

Fifth Third: 53 Mobile Banking is a dedicated mobile application designed for users of Fifth Third Financial Corporation. It allows customers to access their Fifth Third accounts, perform transactions, manage accounts, and utilize various banking services directly from their smartphones, catering specifically to members of this financial institution.

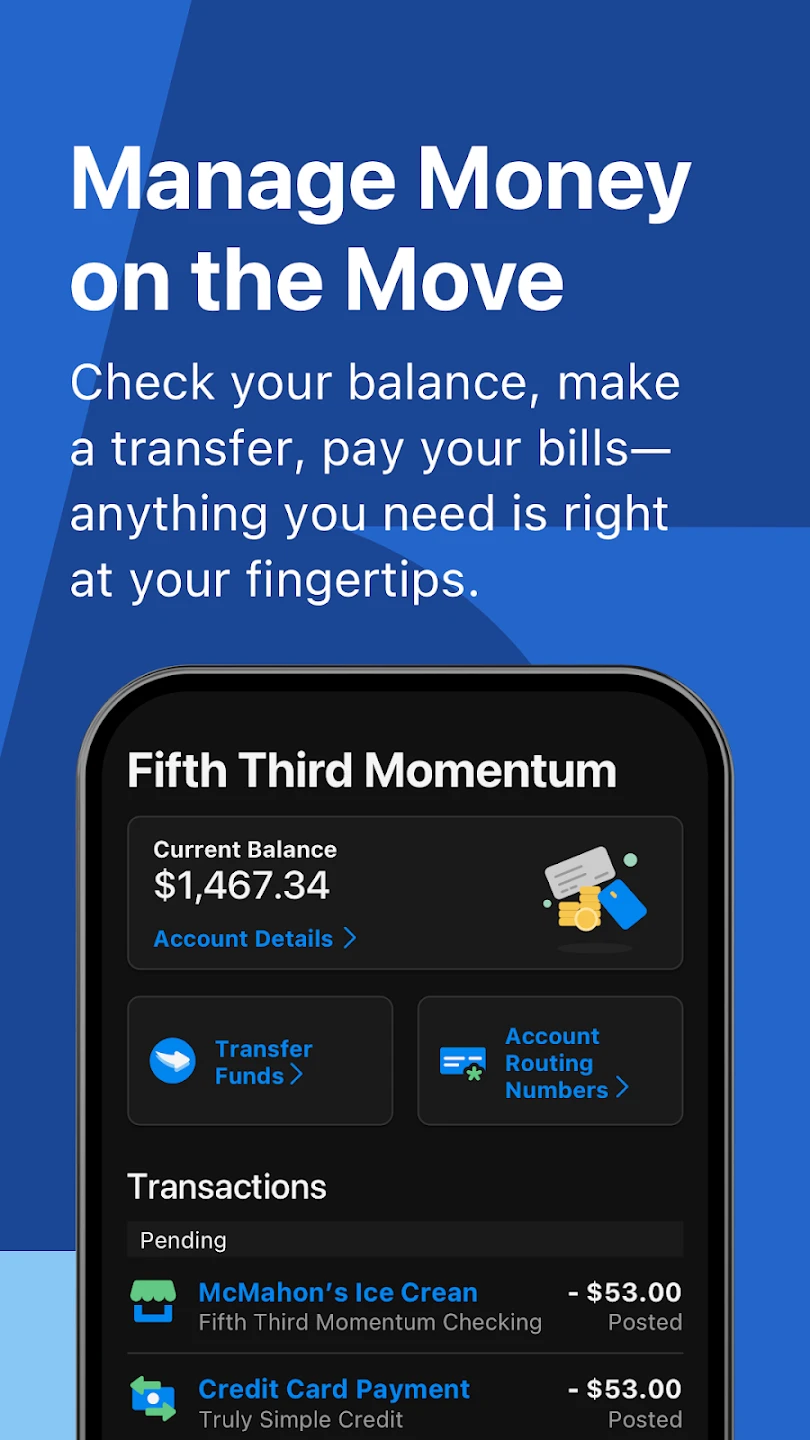

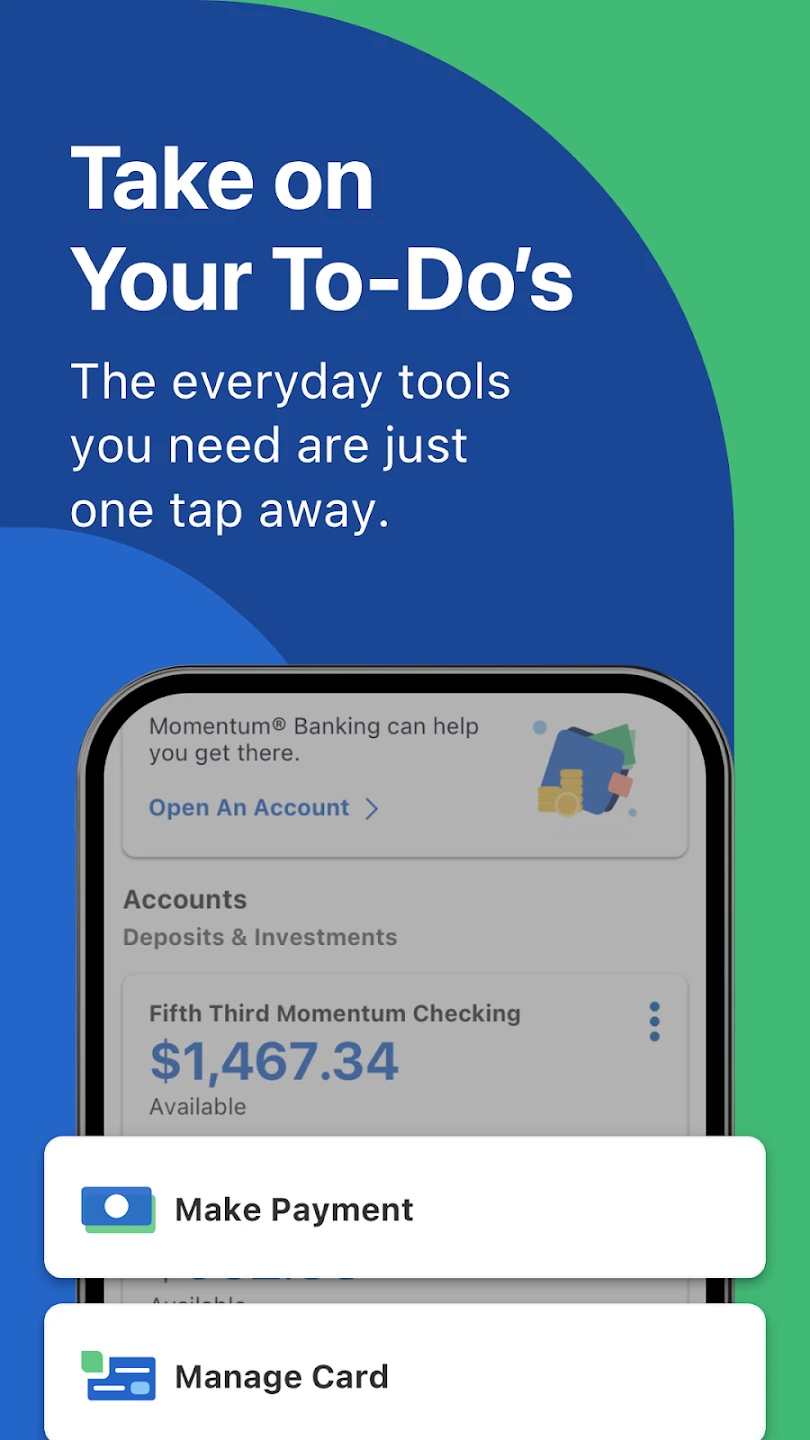

The key value of Fifth Third: 53 Mobile Banking lies in its convenience and accessibility, providing customers with a practical way to handle everyday banking tasks on-the-go. From checking balances and depositing checks to transferring funds between accounts and paying bills, this app streamlines essential banking activities, saving time for users.

App Features

- Account Overview & Balances: See a consolidated view of checking, savings, loan, and investment accounts balances in one place. This immediate access saves you scrolling through multiple websites or apps and provides a clear financial snapshot at a glance.

- Instant Account Transfers: Move money securely between your Fifth Third: 53 Mobile Banking accounts without needing to visit a branch or call customer service. The feature utilizes secure authentication and is typically very quick (within seconds), enhancing your ability to manage cash flow efficiently.

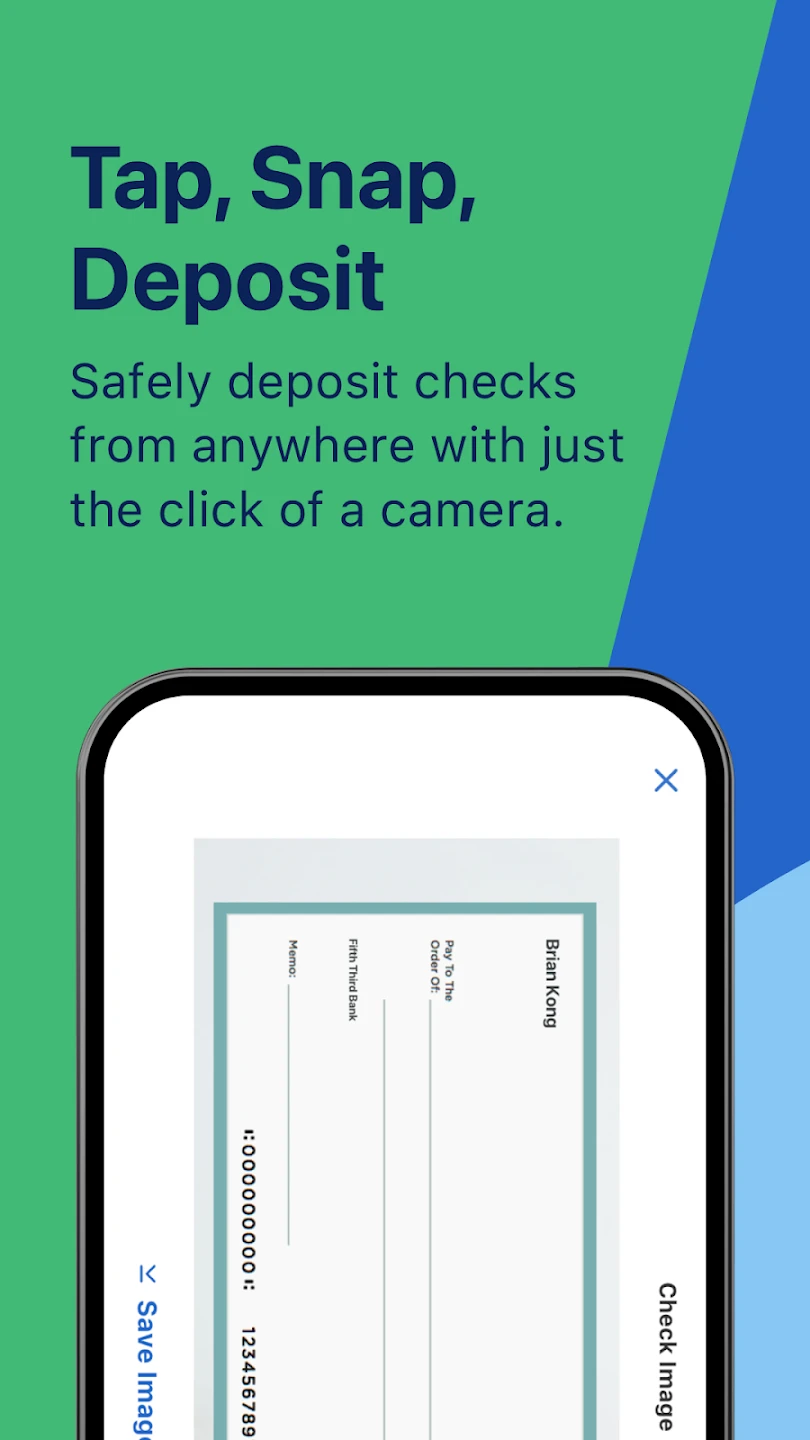

- Mobile Check Deposits via Image Capture: Deposit checks remotely by taking a picture of the front and back. This feature eliminates the trip to the branch for deposits and speeds up the clearance time, providing a more streamlined and convenient process for handling your deposits.

- Budgeting Tools: Utilize integrated budgeting features that allow setting spending limits and tracking expenses across different accounts. This helps users stay on top of their finances and manage money more effectively, making budget adherence more achievable and less stressful.

- Bill Pay Management: Set up and manage recurring bills and one-time payments directly within the app. You can schedule payments in advance, track due dates, and even view your payment history, offering significant convenience and organization for managing household or personal expenses.

- Online Banking Login Integration: Seamlessly log into your Fifth Third: 53 Mobile Banking account using the same credentials as your Online Banking portal. This unified approach ensures you experience consistent security protocols and a familiar interface across all platforms, reinforcing user trust and simplifying your banking routine.

Pros & Cons

Pros:

- Convenience

- Security Features

- Account Management Capabilities

- Customer Support Channels (Often Integrated or Accessible)

Cons:

- UI/UX Potential Minor Quirks (Occasional Layout Glitches)

- Credit Card Management Might Be Limited Compared to Other Apps

- Notification System Customization Options Could Be More Extensive

- Some Advanced Investment Tools Might Not Be Directly Available

Similar Apps

| App Name | Highlights |

|---|---|

| Titan Mobile Banking |

Offers robust mobile check deposit and investment management options. Known for low transaction fees and access to unique financial products. |

| First National Direct Mobile |

Focuses on streamlined loan management and peer-to-peer transfers. Includes biometric login security and a user-friendly navigation design. |

| CapitalOne 360 App |

Provides strong AI-driven insights for spending and savings, along with versatile credit card management. Features high flexibility in account types and investment options. |

Frequently Asked Questions

Q: Can I deposit a check using Fifth Third: 53 Mobile Banking if it’s a cashier’s check?

A: The Fifth Third: 53 Mobile Banking app’s check deposit feature is generally intended for personal checks. While it might technically allow depositing a cashier’s check by image (though not guaranteed by Fifth Third), it’s always best to verify with customer service directly for confirmation based on current Fifth Third policies.

Q: What are the security measures in place for my Fifth Third: 53 Mobile Banking app?

A: Fifth Third: 53 Mobile Banking uses multiple security layers. These include device passcodes, secure token authentication (like Touch ID or Face ID), end-to-end encryption for data transfer, and often transaction monitoring for suspicious activity, ensuring your banking information remains virtually impervious to unauthorized access.

Q: Are there any transfer limits between my Fifth Third: 53 accounts?

A: Transfer limits within Fifth Third: 53 Mobile Banking are typically determined by the type of accounts involved and the bank’s policies, but are usually quite high for standard user scenarios. You can usually find the specific daily/ monthly limits for transfers by navigating to Settings or Account Information within the app.

Q: Can I access my Fifth Third investment accounts directly through the mobile app?

A: Depending on your specific Fifth Third investment accounts, the primary mobile interface might offer basic view capabilities. For detailed trading, portfolio analysis, or executing transactions on investments, you might need to use Fifth Third’s separate Online Investing platform, which could have a distinct interface and feature set.

Q: How often are my Fifth Third: 53 account balances updated in the app?

A: Fifth Third: 53 Mobile Banking account balances are usually updated in real-time or within a few minutes for most activities like deposits and withdrawals. However, for transactions processed via Automated Clearing House (ACH), such as incoming transfers or direct deposits, full posting might take one or more business days, and reflect later in the app.

Screenshots

|

|

|

|