|

|

| Rating: 4.4 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Gemini Space Station, LLC |

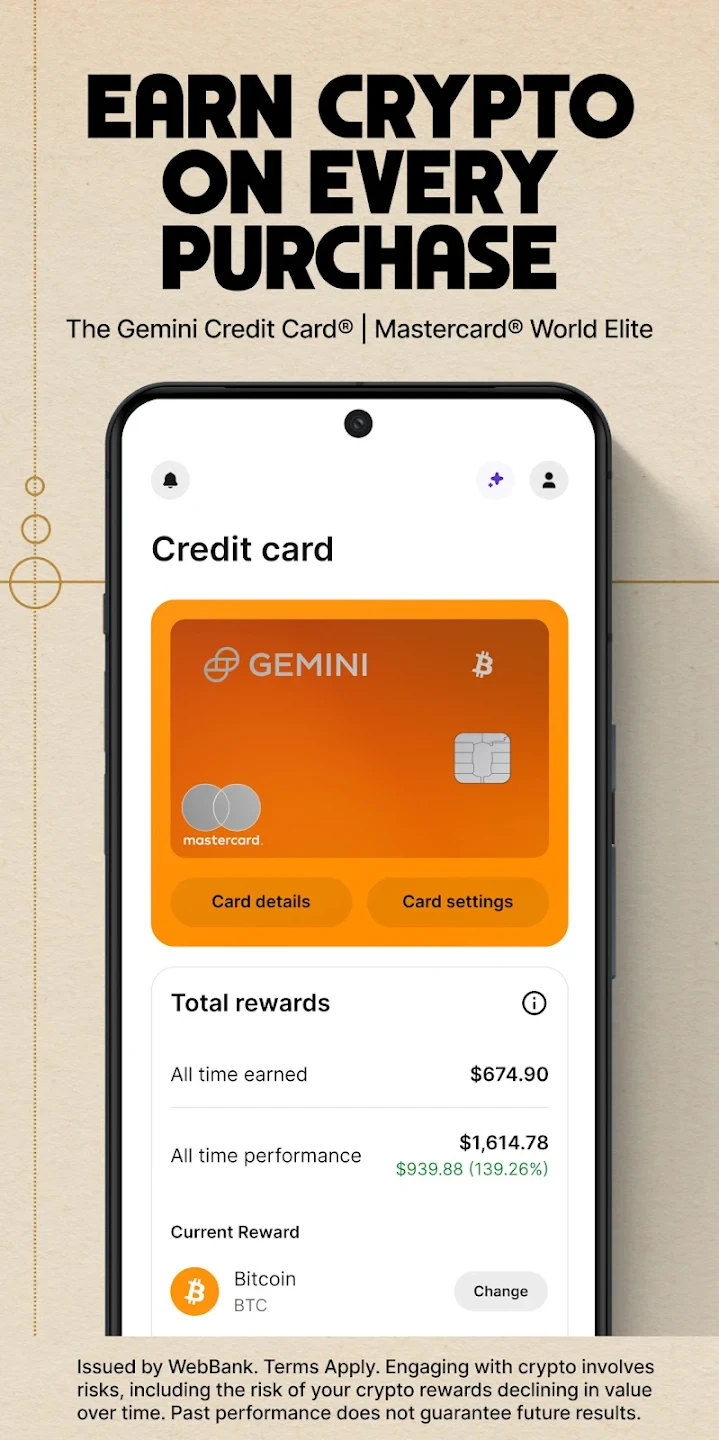

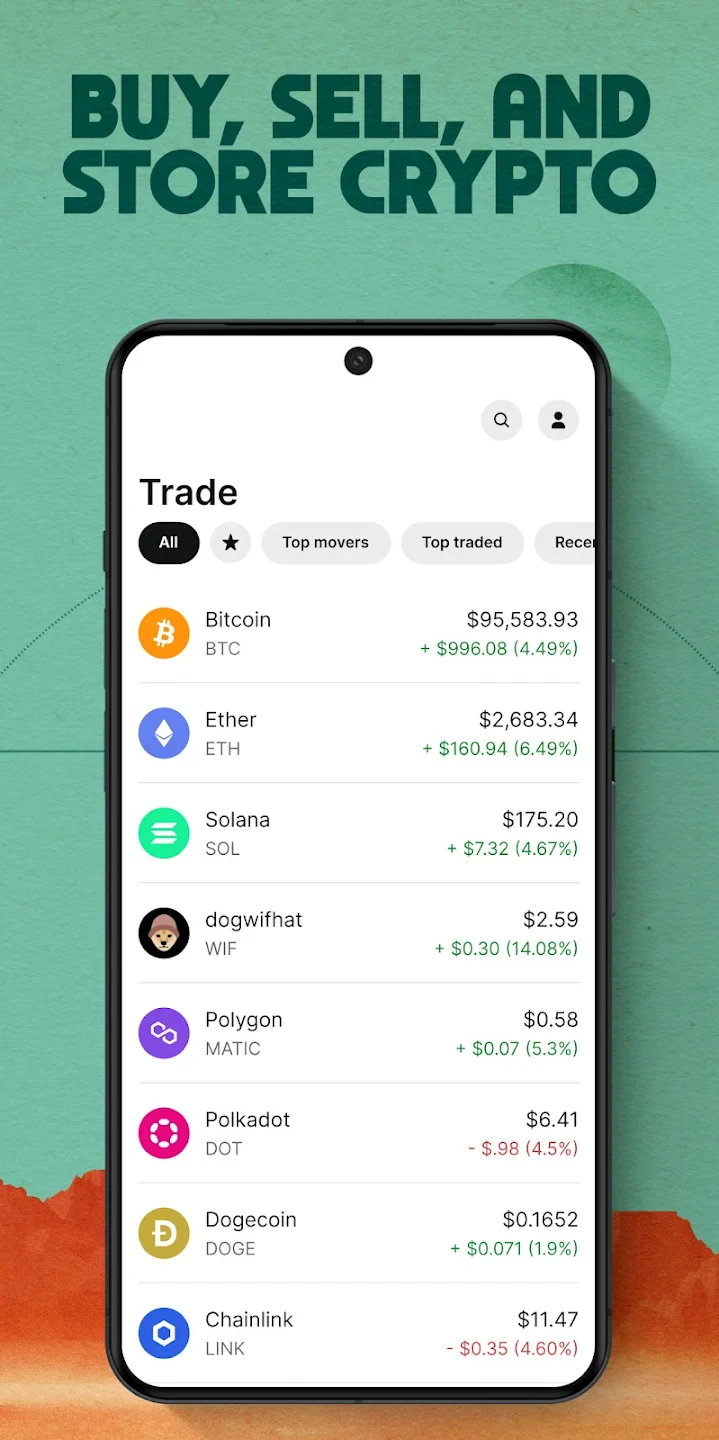

Gemini: Bitcoin Credit Card is a digital wallet and spending tool that enables users to spend their Bitcoin savings as if they were traditional fiat currencies. This app connects your Bitcoin holdings to a virtual credit card, allowing you to make everyday purchases online and in stores seamlessly. It’s designed for crypto enthusiasts who want to use Bitcoin as a regular payment method without the volatility concerns of direct Bitcoin transactions.

The key appeal of Gemini: Bitcoin Credit Card lies in its ability to simplify spending while offering exposure to Bitcoin prices through everyday expenses. Users can cover bills, groceries, subscriptions, and entertainment with their Bitcoin balance automatically converting as needed. This practical integration bridges the gap between the crypto world and everyday finances, making Bitcoin accessible for routine transactions.

App Features

- Seamless Bitcoin Conversion: Automatically converts your Bitcoin balance into fiat currency when making purchases. This feature eliminates the need for manual conversions, saving time and ensuring smooth transactions, especially useful during periods of Bitcoin price volatility.

- Credit Card-Style Spending: Provides a traditional credit card number that you can use at any Visa or Mastercard merchant worldwide. This integration simplifies everyday spending by abstracting the technicalities of Bitcoin payment processing, making it feel as secure and familiar as using standard plastic.

- Interest-Free Spending: Unlike conventional credit cards, the Gemini Bitcoin Credit Card does not accrue interest on purchases. This zero-interest approach makes using your Bitcoin for everyday expenses truly cost-effective, avoiding the accumulation of finance charges that can negate crypto savings.

- Real-Time Transaction Tracking: Offers detailed visibility into your spending across both crypto and fiat denominations. This transparency helps users precisely monitor their Bitcoin expenditure and cash equivalents, providing clear insights into budget allocation.

- Customizable Spending Caps: Allows users to set personalized daily, weekly, or monthly spending limits. This tool is invaluable for risk management, preventing overspending in volatile markets or protecting against large unexpected expenditures.

- Integrated Fiat Account: Supports both Bitcoin-based spending and traditional bank transactions. This dual functionality provides financial flexibility by enabling users to seamlessly switch between cryptocurrency payments and conventional banking when needed.

Pros & Cons

Pros:

- Simplified Bitcoin Spending

- Zero Interest on Purchases

- Global Payment Acceptance

- Spending Limit Controls

Cons:

- Limited Merchant Adoption

- Conversion Fees Potential

- Bitcoin Volatility Exposure

- Transaction Processing Limits

Similar Apps

| App Name | Highlights |

|---|---|

| Blockchain.com Pay |

This platform offers Visa and Mastercard payment processing for Bitcoin and other cryptocurrencies, focusing on global accessibility and low conversion fees. Ideal as an alternative payment gateway. |

| Square Crypto Card |

Designed for simplicity and mobile-first usability. Includes guided steps and real-time previews of Bitcoin conversion costs. |

| Coinbase Commerce |

Offers AI-powered automation, advanced export options, and collaboration tools ideal for teams needing robust merchant solutions. |

| BlockFi Card |

Known for its competitive rewards program and interest-earning potential, similar to credit cards but integrated with crypto holdings. |

Frequently Asked Questions

Q: How does the Gemini: Bitcoin Credit Card actually work for everyday purchases? Does it convert my Bitcoin to dollars behind the scenes?

A: Yes, when you use your Gemini card, the app handles the necessary Bitcoin-to-fiat conversion automatically. It pulls from your account balance and processes the transaction using the current exchange rate, making it seamless for Visa/MC merchants.

Q: Can I use this card at any store that accepts regular credit cards?

A: Absolutely. The Gemini: Bitcoin Credit Card functions identically to a standard card but powers itself with your Bitcoin. Simply enter your card details as you would with regular credit cards anywhere Visa or Mastercard is accepted.

Q: Are there any transaction limits or monthly caps I should be aware of with Gemini: Bitcoin Credit Card?

A: Yes, the Gemini Bitcoin Credit Card has daily and monthly spending limits. These can typically be adjusted within your account settings, though higher limits usually require additional identity verification.

Q: If Bitcoin’s price changes significantly between transaction initiation and processing, will that affect my purchase?

A: The Gemini: Bitcoin Credit Card uses the transaction amount in fiat currency (typically USD) at the time of authorization to lock in the conversion rate. This prevents losses or unexpected fees from price volatility during payment processing.

Q: What fees are associated with using the Gemini: Bitcoin Credit Card?

A: You’ll encounter typical credit card fees (including potential foreign transaction fees on international purchases) plus Gemini’s standard Bitcoin conversion spread. Review your account details for specific fee structures.

Screenshots

|

|

|

|