|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Klover Holdings |

Klover – Instant Cash Advance is a mobile application designed to deliver quick access to funds for users facing immediate financial needs. It connects eligible users with funding partners, offering a streamlined application and approval process directly through the app interface. Primarily targeting individuals seeking rapid personal loans for unforeseen expenses or debt consolidation.

Its key value lies in the significantly expedited funding timeline, often delivering cash within a few hours, contrasting with traditional lenders. Users benefit from simplified application steps managed entirely within the app and potentially more flexible eligibility options. This makes Klover – Instant Cash Advance a convenient option for addressing urgent cash requirements.

App Features

- Eligibility Check: The app begins by analyzing your financial situation and creditworthiness based on provided information. This quick assessment helps determine your potential funding range and interest rate options before you formally apply, saving time and setting clear expectations.

- Multi-Partner Network Integration: Klover – Instant Cash Advance connects users with a diverse network of financial institutions. This integration means the app can often match you with the most suitable lender for your specific criteria and requested amount at that moment, enhancing the speed and relevance of the funding options.

- Secure Document Upload: Applying involves securely uploading necessary identification and income verification documents directly through the app’s intuitive interface. Instead of scheduling appointments with lenders, this feature allows for a streamlined, paperless application experience from the comfort of your home, significantly reducing administrative delays.

- Application Timeline Tracking: Users can monitor their loan request status in real-time within the app dashboard. Whether it’s under review, awaiting documents, or awaiting disbursement, this transparency eliminates uncertainty and provides a clear path to knowing when funds will be available, often impressively quickly.

- Personalized Offers & Rate Comparison: Depending on your profile and chosen amount, the app presents loan offers with varying interest rates and terms. For example, a user needing a smaller sum for a car repair might see offers with lower APRs compared to someone seeking a larger personal loan, allowing informed decisions based on individual financial goals.

- Push Notifications & Alerts: The app keeps users informed via push notifications about key milestones: approval confirmation, document requests, funding release, or account changes. This proactive communication ensures users are always aware of their loan’s progress and required actions, minimizing back-and-forth communication.

Pros & Cons

Pros:

- Exceptionally Fast Funding Process

- User-Friendly Mobile Interface

- Simplified Application Experience with Secure Document Handling

- Wide Range of Potential Funding Sources

Cons:

- Potential for Higher Interest Rates on Smaller or Riskier Loans

- Eligibility Depends on Credit Score and Income Verification

- Loan Amounts May Be Limited Compared to Traditional Banks

- Some Lender Fees or Hidden Terms May Apply

Similar Apps

| App Name | Highlights |

|---|---|

| LendGuru |

This platform offers a comparison engine across numerous lenders, known for bargain-hunting capabilities and detailed loan analytics. |

| QuickFund Mobile |

Designed with slick animations for document submission, emphasizing speed and a visually engaging user journey. |

| FinanceFlow |

Features advanced repayment calculators and integrates with banking data for seamless transfers. |

Frequently Asked Questions

Q: How quickly can I typically get the money after approval?

A: Approval is often very fast, sometimes within an hour, and funds can be available within a few hours following the final sign-off on the agreement. The Klover – Instant Cash Advance process is designed for rapid disbursement.

Q: Who can use the Klover – Instant Cash Advance app to apply?

A: Generally, the app is available to individuals aged 18 and over with a valid ID. However, each specific funding offer from partnered lenders will have its own eligibility criteria, primarily based on income, credit history, and the requested amount.

Q: Are there any upfront fees to use the app or apply for a loan?

A: No. The Klover – Instant Cash Advance app itself has no upfront fees for using its services. All loan-related charges (like interest rates and potentially origination fees) will only be disclosed clearly by the specific lending partner if your application is successful.

Q: Is there a specific minimum loan amount required by the app?

A: The app typically supports loan applications starting from very small amounts, often $100 or even less, depending on the specific lender’s policies and your individual circumstances. It’s best to check the details provided during your initial eligibility check.

Q: How secure is my financial information when using the Klover – Instant Cash Advance app?

A: The app utilizes bank-level security protocols and encryption to protect your personal and financial data. It’s important to download the app from official app stores and use strong passwords for your device.

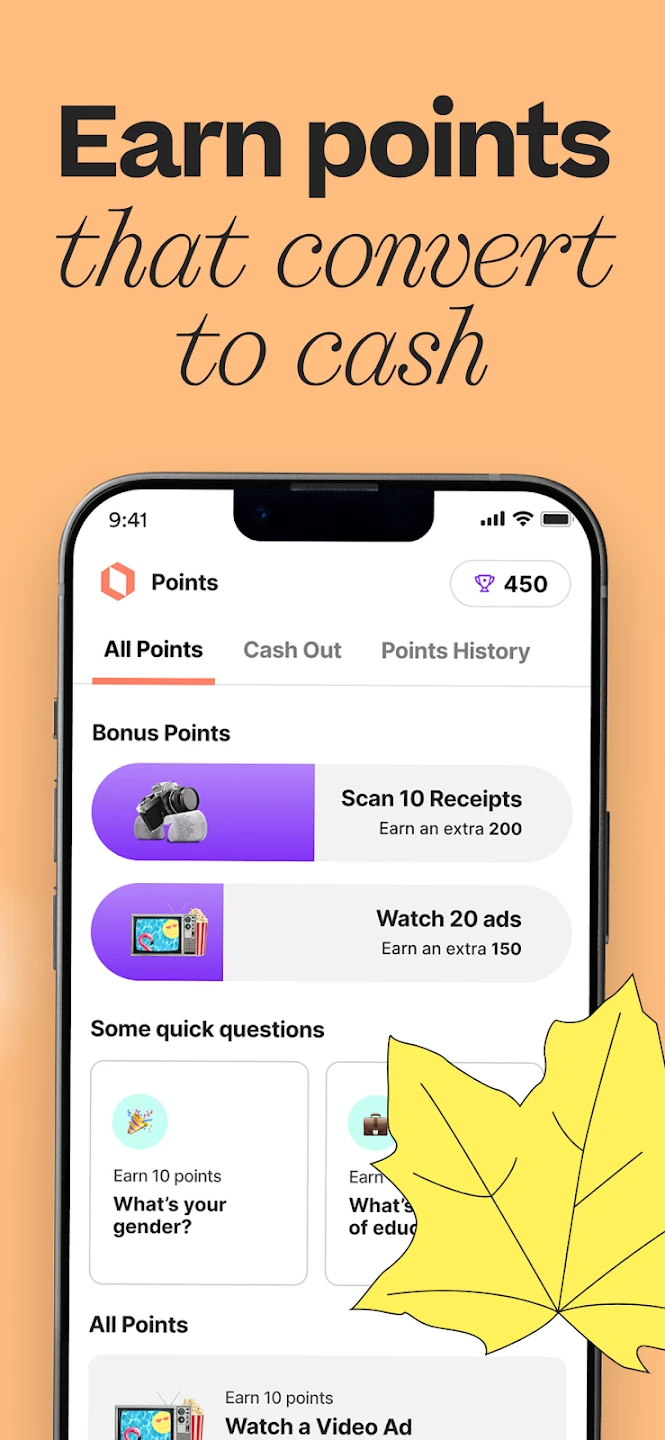

Screenshots

|

|

|

|