|

|

| Rating: 4.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: ONE Finance, Inc. |

OnePay – Mobile Banking is a comprehensive digital banking application designed for users seeking convenient and secure management of their finances from their mobile devices. It offers functionalities for checking balances, transferring funds, paying bills, and accessing various banking services anytime, anywhere, catering primarily to individuals and small businesses needing on-the-go banking control.

The key appeal of OnePay – Mobile Banking lies in its ability to streamline complex banking tasks into a user-friendly interface, providing significant time savings and accessibility. It empowers users with real-time information and the ability to conduct financial activities remotely, making daily banking more efficient and adaptable to modern lifestyles.

App Features

- Account Management: Seamlessly check your balances, transaction history, and account details in real-time, providing a clear overview of your finances. This feature offers the convenience of managing your accounts anytime, eliminating the need for physical branch visits and giving you immediate access to your financial status.

- Fund Transfer & Payments: Easily initiate transfers between your own accounts or send money securely to other individuals using recipient details. This includes sending payments for bills or splitting costs with friends, improving financial flow and facilitating quick, secure exchanges.

- Budgeting Tools: Set budgets for specific categories and track your spending against them, helping users manage their finances effectively. It offers a visual representation of spending habits, promoting better financial discipline and preventing overspending in particular areas.

- Bill Pay: Create a list of recurring bills and set them to be paid automatically on their due dates, simplifying the payment process significantly. You can customize payment amounts and schedules, ensuring timely payments without manual effort and preventing late fee surprises.

- Mobile Deposit: Capture images of checks directly through the app’s camera or upload them manually to initiate deposits, expediting the process considerably. This saves trips to the branch and allows funds to become available faster, offering unparalleled convenience for managing deposits remotely.

- Customer Support Access: Connect directly with customer service agents or find answers through the app’s built-in help section without needing to leave the application, making support readily accessible anytime. This integrated approach resolves minor issues quickly and provides peace of mind knowing help is just a tap away.

Pros & Cons

Pros:

- Enhanced Accessibility

- Time-Saving Transactions

- Convenient Bill Management

- Improved Security Features

Cons:

- Limited Investment Options

- Occasional App Glitches or Updates

- Dependency on Mobile Data/Connectivity

- Learning Curve for New Users

Similar Apps

| App Name | Highlights |

|---|---|

| Simple App |

Focused on ease of use with core banking features. Ideal for basic checking and savings account management. |

| Chase Mobile |

Offers comprehensive features from Chase Bank, including investment options and credit card management alongside core banking. |

| Bank of America Mobile |

Known for its extensive feature set including investment management and robust mobile deposit capabilities. |

Frequently Asked Questions

Q: What are the security features of the OnePay – Mobile Banking app?

A: The app employs robust security measures including biometric authentication (like Touch ID or Face ID) or PIN protection, end-to-end encryption for data transmission, and suspicious activity monitoring to ensure your financial transactions are always secure.

Q: Can I deposit a check using OnePay – Mobile Banking? If so, how does it work?

A: Yes, Mobile Deposit is a key feature. You can take a picture of both sides of a check directly within the app using your phone’s camera. The bank then processes the funds electronically, typically faster than traditional methods.

Q: Are there any fees associated with using OnePay – Mobile Banking features?

A: While core features like checking balances and viewing transactions are typically complimentary, fees may apply for certain actions like out-of-network ATM withdrawals or specific types of transfers. Always check the fee schedule within the app or online banking portal.

Q: Is the OnePay – Mobile Banking app available on all smartphone models?

A: The app is primarily optimized for iOS devices running the latest operating systems and is also offered on major Android platforms. While compatible with various models, performance and feature availability are best on recent device hardware and software versions.

Q: How can I contact customer support if I encounter an issue with the app?

A: Customer support can usually be accessed directly via an ‘Help’ or ‘Support’ link within the OnePay – Mobile Banking app itself, offering quick assistance. Alternatively, contact numbers and support channels are typically provided in the application’s ‘About’ section or online website footer.

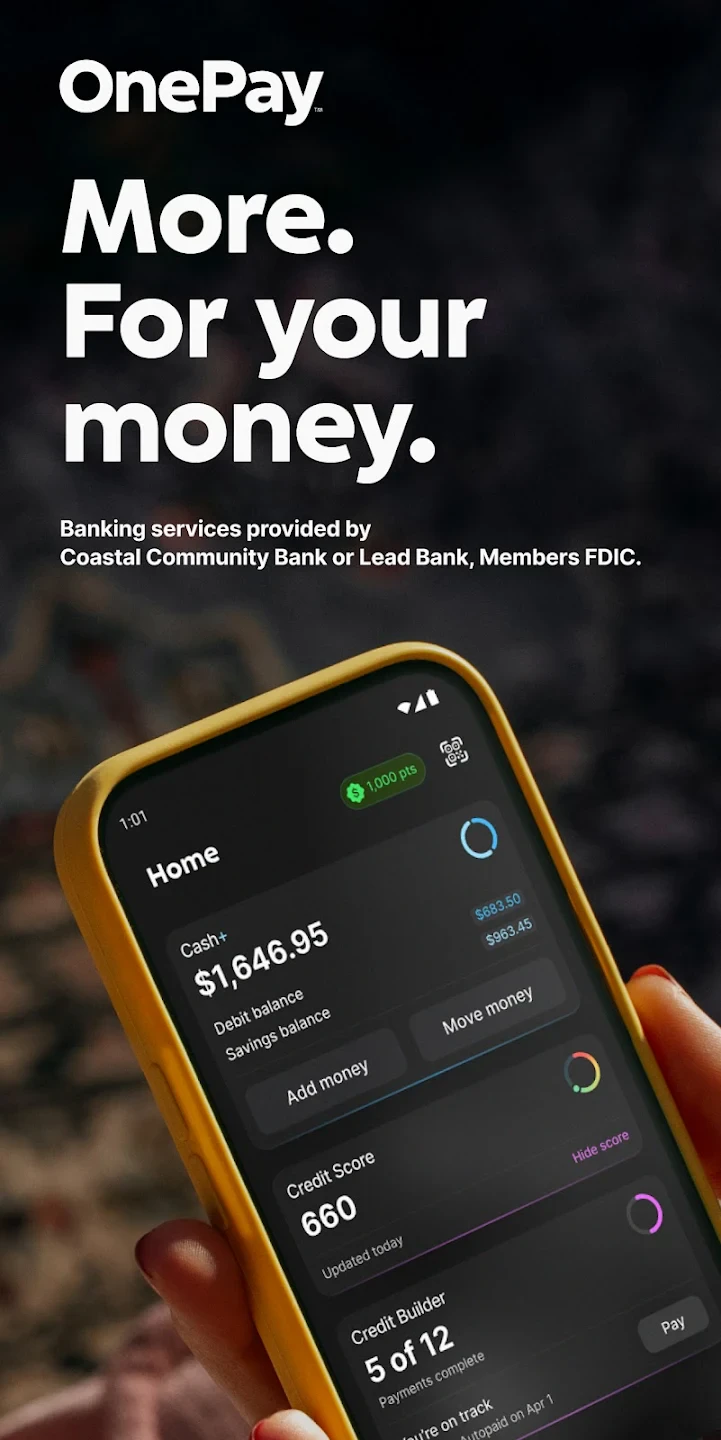

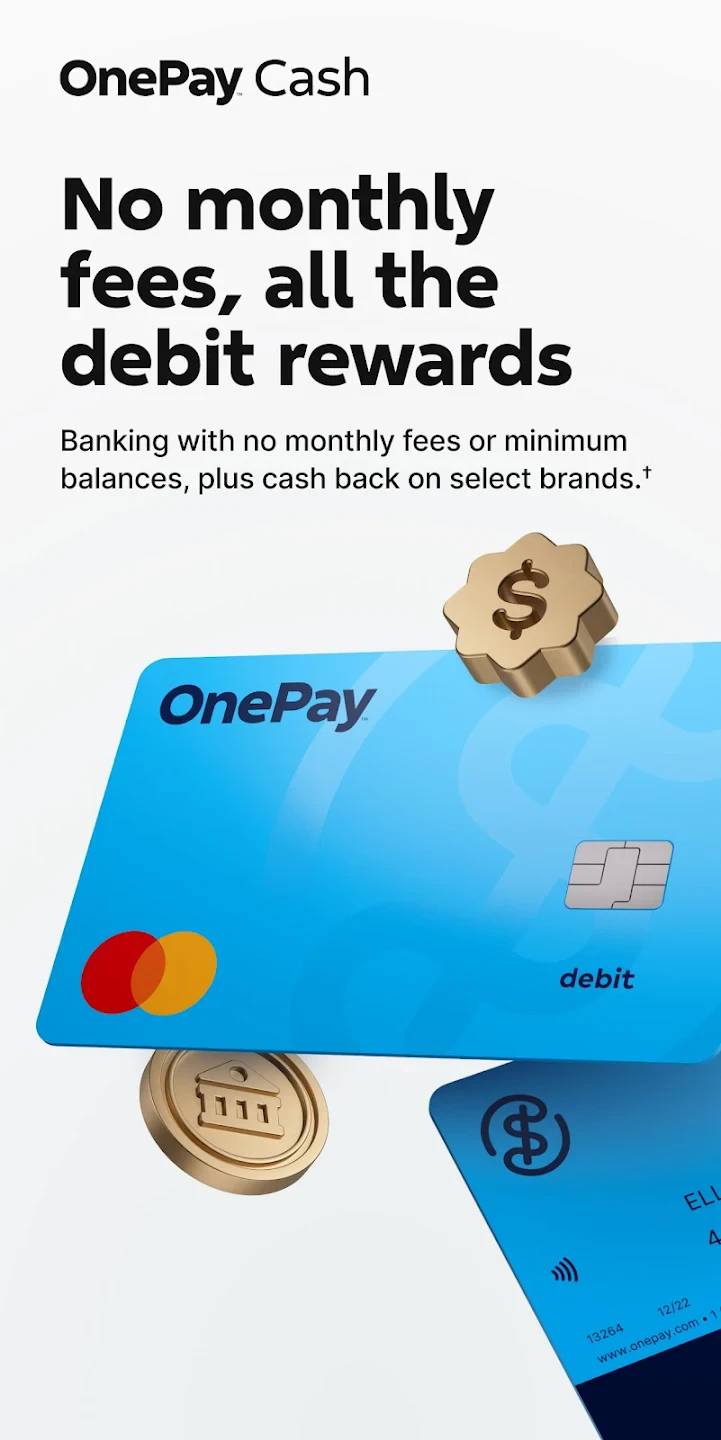

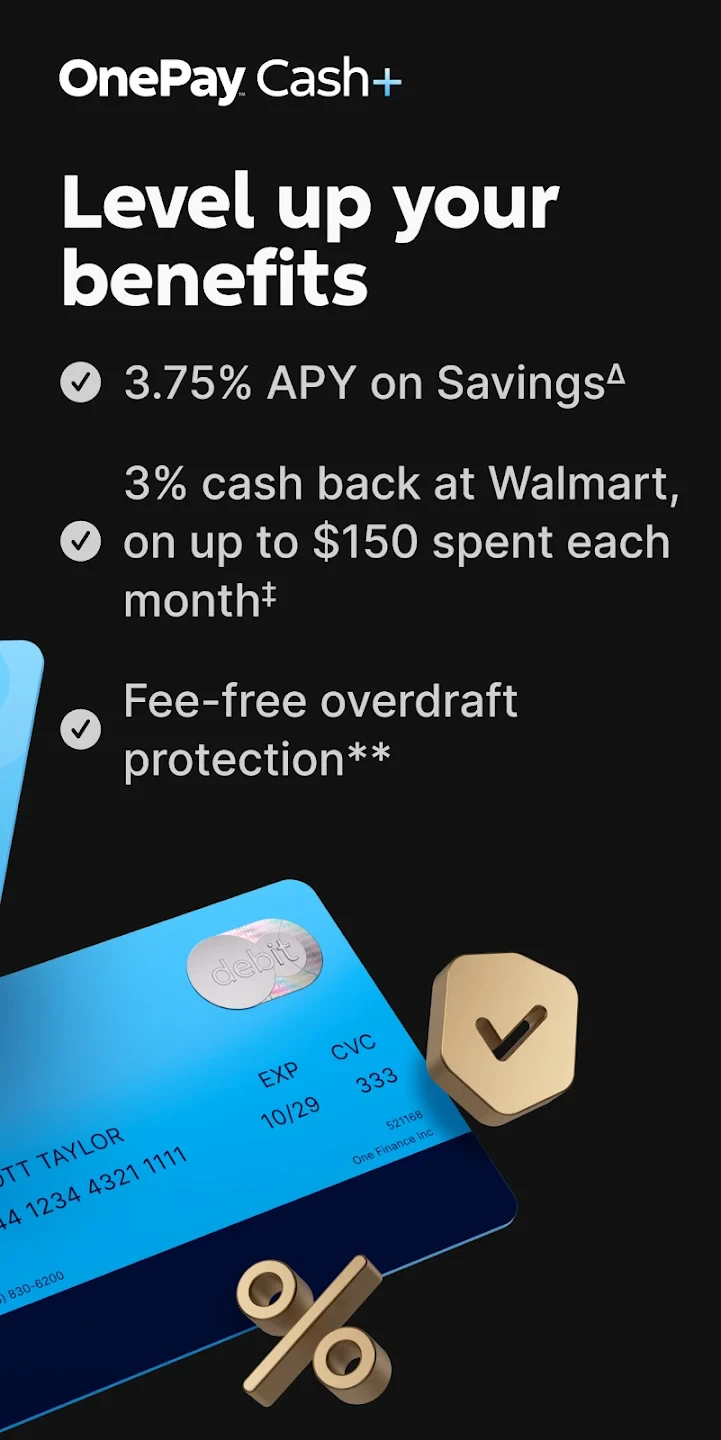

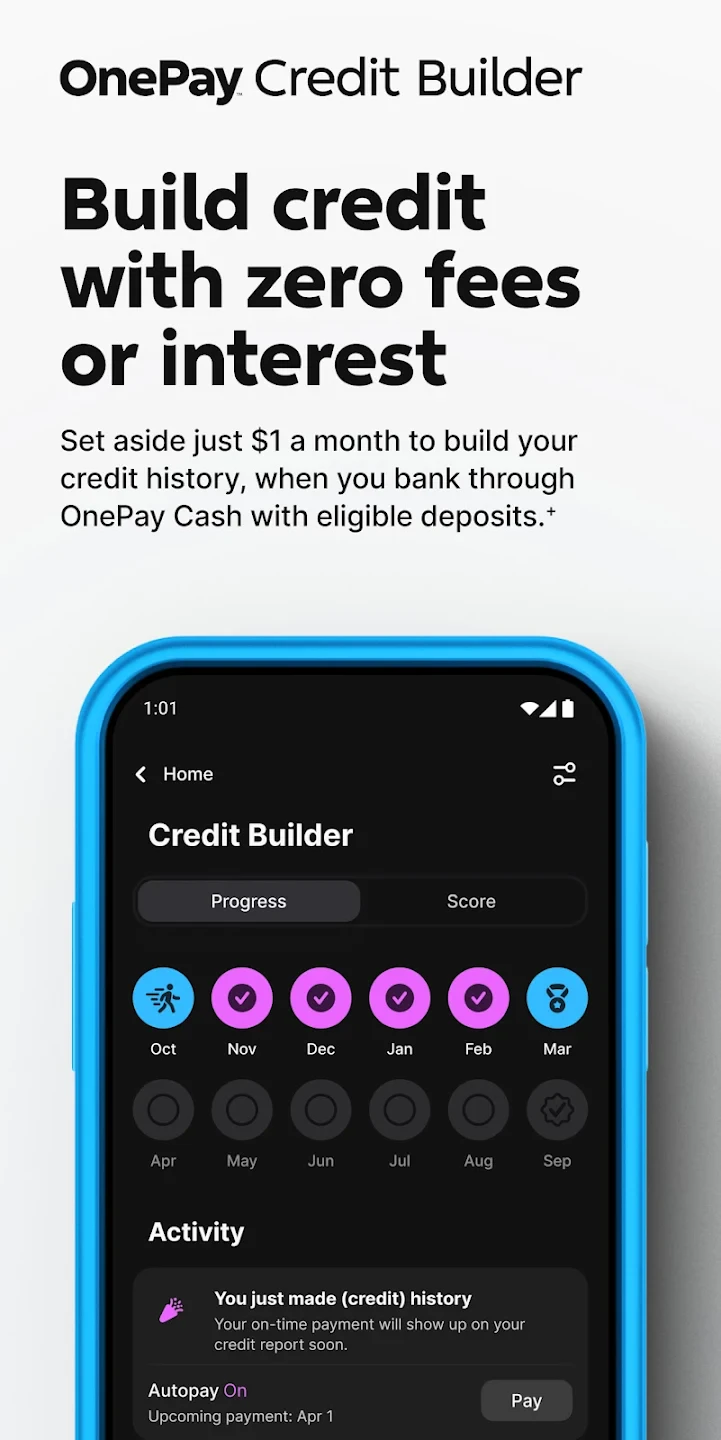

Screenshots

|

|

|

|