|

|

| Rating: 4.5 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: Revolut Ltd |

Revolut: Spend, Save, Trade is a versatile mobile banking app designed to manage finances across borders and for various needs. It provides users with tools for everyday transactions, saving money towards specific goals, and trading various financial instruments like currencies, stocks, and cryptocurrencies, making it suitable for frequent travellers, savers, and investors alike.

The appeal of Revolut: Spend, Save, Trade lies in its comprehensive feature set bundled into one app, offering convenience and potential savings. Users benefit from low-cost international payments, diverse saving options, and access to financial markets, simplifying complex financial operations for individuals managing personal money efficiently.

App Features

- Multi-Currency Accounts: Manage different currencies easily without keeping multiple cards. This feature saves time and reduces fees for international transactions, beneficial for frequent travellers or those dealing with foreign suppliers, allowing seamless payments in foreign currencies at potentially better rates than traditional banks or exchange services.

- Budgeting & Saving Tools: The app includes features to set budgets per category and goals for saving specific amounts. This functionality helps users track spending habits, visualize their financial progress, and stay disciplined, promoting better financial health through automated goal tracking and visual reports that highlight areas needing adjustment.

- Currency Exchange & Trading: Easily convert between hundreds of currencies and trade popular cryptocurrencies like Bitcoin and Ethereum directly from the app. This powerful integration empowers users to access global markets instantly, providing real-time exchange rates and simplifying the process of managing assets across different financial landscapes, often at competitive rates.

- Instant Notifications & Alerts: Users receive timely updates on account activity, low balances, price alerts for tracked assets, and upcoming subscription renewals. This timely information enhances awareness and control, helping users react quickly to potential issues like insufficient funds, track volatile investments, or manage subscriptions efficiently, fostering a proactive approach to personal finance.

- Expense Tracking & Insights: Revolut: Spend, Save, Trade categorizes spending automatically and offers insights into spending patterns and saving progress. This helps identify areas of overspending and track goal achievements, making financial management more intuitive and user-informed, providing a clearer picture of one’s financial behaviour and enabling better decision-making.

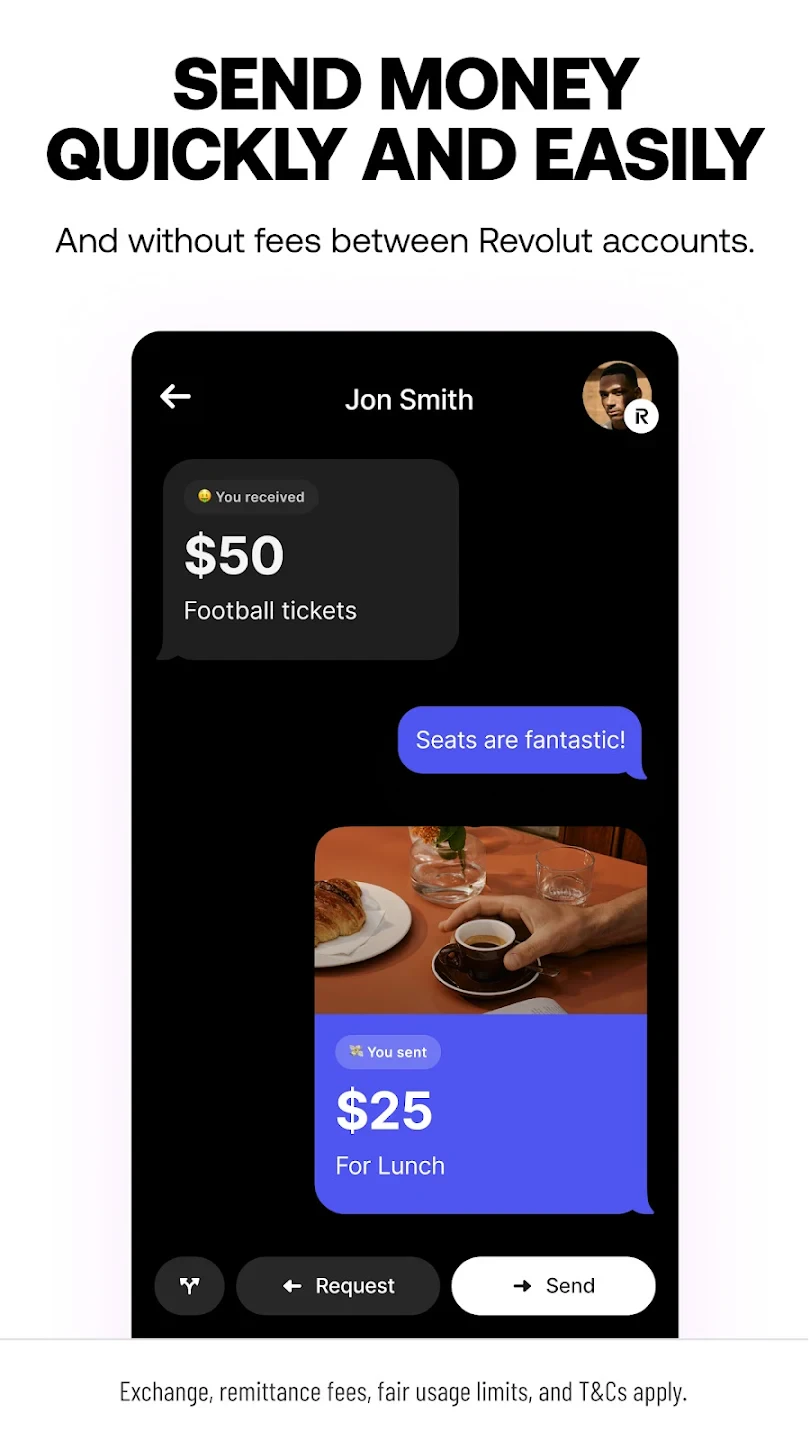

- Global Banking & Instant Deposits: Offers features like SWIFT-free money transfers between accounts, instant deposits from external accounts, and easy top-ups. This robust infrastructure significantly speeds up financial operations compared to traditional banking, crucial for users needing quick access to funds, facilitating faster transactions and improving overall banking efficiency.

Pros & Cons

Pros:

- Wide Range of Features in One App

- Competitive Exchange Rates & Low Fees

- Multi-Currency Support for Travellers

- User-Friendly Mobile Interface

Cons:

- Potential Inactivity Fees

- Occasional Transaction Delays or Errors

- Interface Can Feel Overwhelming with Options

- Currency/Trade Limits May Apply

Similar Apps

| App Name | Highlights |

|---|---|

| Monzo |

Popular for budgeting tools, spending insights, and a strong focus on user notifications and community features. |

| N26 |

Known for its sleek design, low-cost account options, and robust budgeting features tailored for younger or budget-conscious users. |

| TransferWise |

Initially focused purely on efficient international money transfer, often cited for better exchange rates and transparency compared to traditional banks. |

Frequently Asked Questions

Q: How are the foreign currency exchange rates on Revolut: Spend, Save, Trade determined? Will they be better than using my bank or a traditional money changer?

A: Revolut: Spend, Save, Trade sources rates from multiple providers, aiming for a competitive edge. While rates can vary, the app often offers more favourable deals and significantly lower fees for international payments compared to traditional banks and high-street money exchangers, making it a good option for saving on currency conversion costs.

Q: Can I use Revolut: Spend, Save, Trade to buy and sell cryptocurrencies like Bitcoin or Ethereum easily? Are there any restrictions or fees involved?

A: Yes, Revolut: Spend, Save, Trade supports trading several popular cryptocurrencies. Users typically link a supported bank account or card to buy and sell. Be mindful of any applicable spread or fee structures for these trades and potential limitations on the amount you can trade or the specific coins available.

Q: What should I do if I lose my phone or it gets stolen? How quickly can I secure my Revolut: Spend, Save, Trade account?

A: Security is key; Revolut: Spend, Save, Trade offers features like remote account deactivation and card blocking through the app if accessible elsewhere. If you’re locked out, you can usually log in to your account via web browser or contact support immediately to suspend your account, aiming for quick recovery and preventing unauthorised access.

Q: Are there any hidden fees or charges I should be aware of when using Revolut: Spend, Save, Trade for everyday spending and transfers, especially in other countries?

A: Revolut: Spend, Save, Trade clearly lists fees for different actions, but it’s crucial to understand that fees might apply for services like cash withdrawals from non-network ATMs (often marked with the logo), currency conversion, or specific subscription features. Always check the transaction details or the app’s fee schedule before sending money abroad to avoid unexpected charges.

Q: How does the automated budgeting and saving goal feature work in Revolut: Spend, Save, Trade? Can I customize the categories or set up specific rules for savings?

A: The app typically uses AI or pattern recognition to suggest categories and goals based on your spending habits, like saving for holidays or specific amounts. You have control to review, edit, or create custom rules; for instance, you could automate transfers to a separate saving account once a goal amount is reached within a category, helping manage finances proactively without needing complex spreadsheet management.

Screenshots

|

|

|

|