|

|

| Rating: 4.5 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Social Finance, LLC |

The SoFi – Banking & Investing app is a comprehensive financial management tool designed to simplify users’ financial lives. It provides a single platform to handle everyday banking tasks like checking balances, paying bills, and managing transactions alongside investment tracking and portfolio management. This app is primarily aimed at individuals seeking an integrated approach to both personal banking accounts and investment goals.

The key value proposition of using SoFi – Banking & Investing lies in its convenience and the insights it offers. Instead of toggling between separate apps or financial institutions, users have a consolidated view of their finances. This streamlined approach makes budgeting, tracking spending, and observing the performance of their investment portfolios significantly easier and more practical for achieving financial objectives.

App Features

- Banking Dashboard: Offers a comprehensive overview of checking, savings, and money market accounts with real-time balances. This feature provides instant visibility into account health, benefiting users by allowing them to quickly assess liquidity and make informed decisions without needing to log into separate sections or recall balance details, saving valuable time each month.

- Investment Portfolio Tracking: Includes detailed charts, performance metrics (like ROI), and summaries of holdings across different asset classes, such as stocks and ETFs. The platform provides tools to analyze trends, set goals, and visualize growth, improving usability for investors by simplifying complex market data into understandable formats that support better decision-making and strategic planning.

- Saving Goals & Smart Goals: Users can set specific savings targets for major purchases or life events, and SoFi utilizes account information to create potential automated savings plans. This tool solves the problem of impulsive spending by visually tracking progress towards aspirations, making saving more structured; for example, setting a ‘dream vacation’ goal can automatically allocate funds based on income and expenses, enhancing discipline and long-term fulfillment.

- Bill Pay Integration: Allows users to schedule payments, set up direct deposits, and manage recurring bills directly from the mobile interface. Its user-friendly calendar view helps prevent late payments and simplifies financial planning, particularly valuable for busy professionals who can manage household finances efficiently without needing separate check-writing or payment processing applications.

- Expense Tracking & Analytics: Breaks down spending by category using data from linked accounts, offering visualizations like charts and graphs. This feature enhances user experience by revealing spending patterns, helping identify areas for cost reduction and budget adjustments, providing personalized insights tailored to individual financial behaviors.

- Account Management Center: Provides a consolidated place to view and link all financial accounts (checking, savings, investments, credit cards), manage user settings, and oversee security options like two-factor authentication. The centralized hub simplifies managing diverse financial entities under one platform, offering a key benefit for users with multiple accounts across different providers.

Pros & Cons

Pros:

- Consolidated View of Banking & Investing

- User-Friendly Mobile Experience

- Low-Minimum Account Options

- Generous Free Access to Investment Features

Cons:

- Potentially Higher Account Balances Needed for Premium Investing

- Credit Building Benefits May Be Limited Compared to Some Competitors

- Customer Support Availability Can Vary Outside Business Hours

- Fee Structures Require Careful Review (e.g., Wire Transfers)

Similar Apps

| App Name | Highlights |

|---|---|

| Acorns |

This popular app focuses on easy investing through micro-investments and fractional shares, often marketed towards beginners. Known for its intuitive UI and seed planting mechanics tied to spending. |

| Robinhood |

Known for commission-free trading, Robinhood emphasizes a simple interface for buying and selling stocks, ETFs, and cryptocurrencies, making investing accessible. |

| Chime |

Similar to SoFi, Chime offers checking and savings accounts with strong banking features like early direct deposits. It’s known for its fee-free ATM network and user-friendly digital experience. |

Frequently Asked Questions

Q: How secure is my banking and investment data using SoFi – Banking & Investing?

A: SoFi employs robust security measures including encryption, advanced fraud monitoring algorithms, and multi-factor authentication. They adhere strictly to regulations for handling customer funds, providing FDIC insurance for deposit accounts up to certain limits, and safeguarding digital assets with secure storage protocols and continuous security updates.

Q: Can I link my SoFi – Banking & Investing account to external budgeting apps like Mint or YNAB?

A: Currently, SoFi – Banking & Investing does not offer a direct, native API or sync integration with popular third-party budgeting services. While users can manually input their SoFi balance information into external apps, a built-in budgeting tool exists within the app itself, which some users may find sufficient.

Q: What are the minimum balances required to open a SoFi – Banking & Investing account?

A: SoFi typically requires low minimum balances (often $0 or very low amounts) for most account types, making it accessible. However, specific requirements for higher interest-earning accounts like money market or premium investment features might be slightly higher, so checking the current terms directly on their platform is recommended before opening an account.

Q: How often does SoFi update its investment portfolio performance graphs and data?

A: Investment data, including portfolio values and market performance graphs, is generally updated on a near real-time basis, reflecting current market conditions. The app fetches updated information frequently throughout the day, allowing users to monitor their portfolio performance and account activities almost instantly, although final settlement times for certain transactions apply.

Q: Does SoFi provide tools specifically designed for goal-based investing or retirement planning?

A: Yes, the SoFi Investment platform includes features like Smart Savings goals and portfolio allocation tools that can help users set objectives tied to their checking account spending. While dedicated, automated retirement planning tools are more limited compared to specialized platforms, the app does offer basic portfolio management capabilities that allow users to create and track investment goals over time.

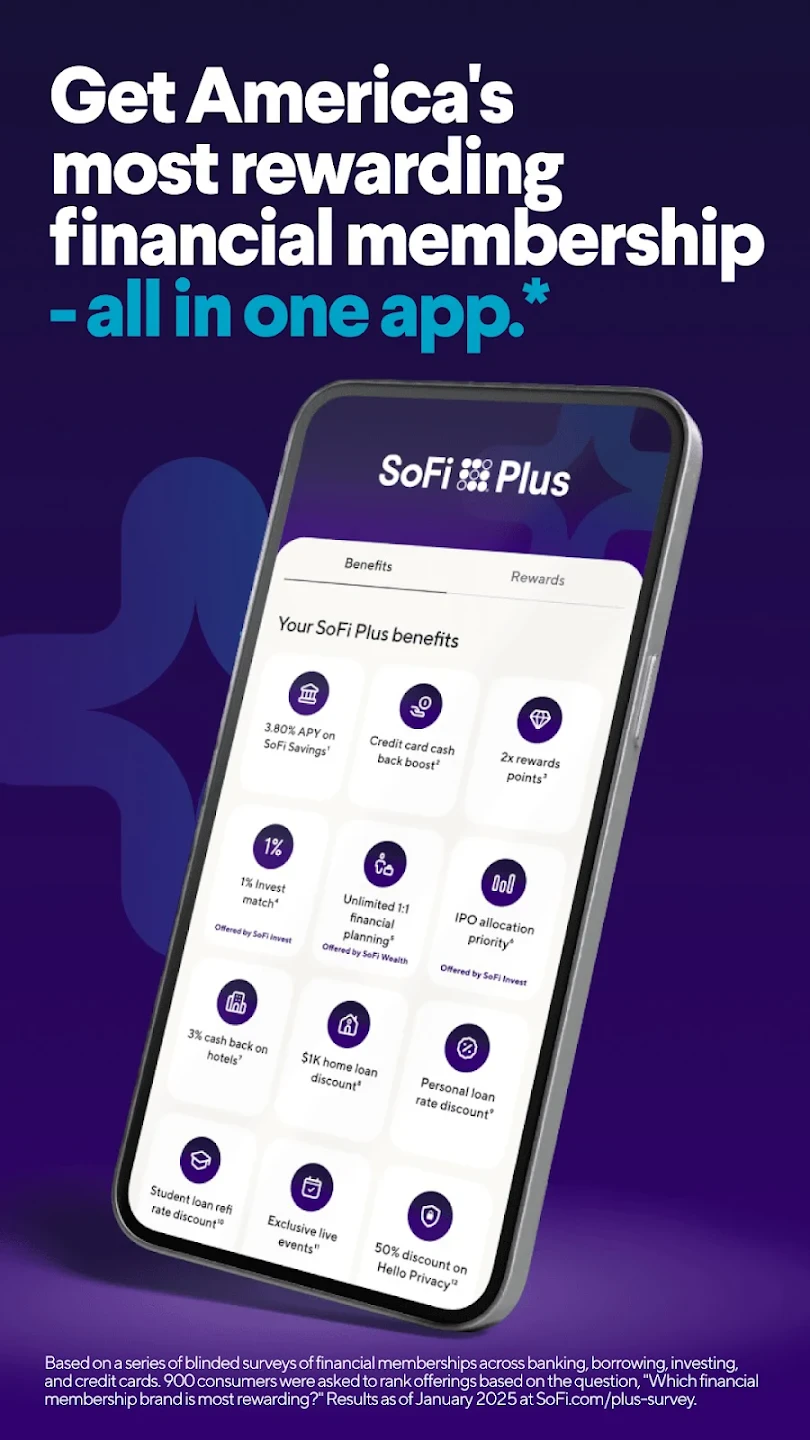

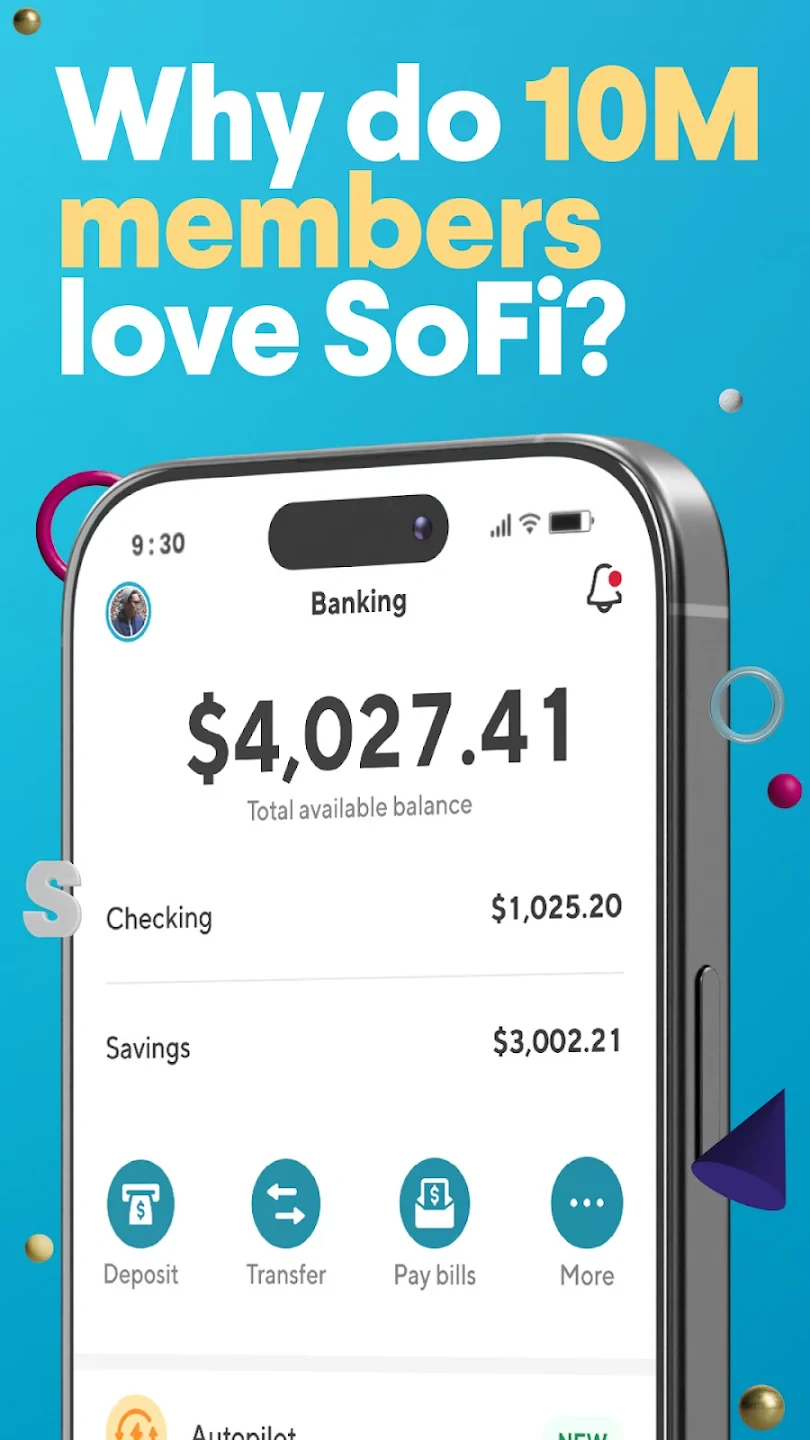

Screenshots

|

|

|

|