|

|

| Rating: 4.4 | Downloads: 100,000+ |

| Category: Business | Offer by: WorkSolo |

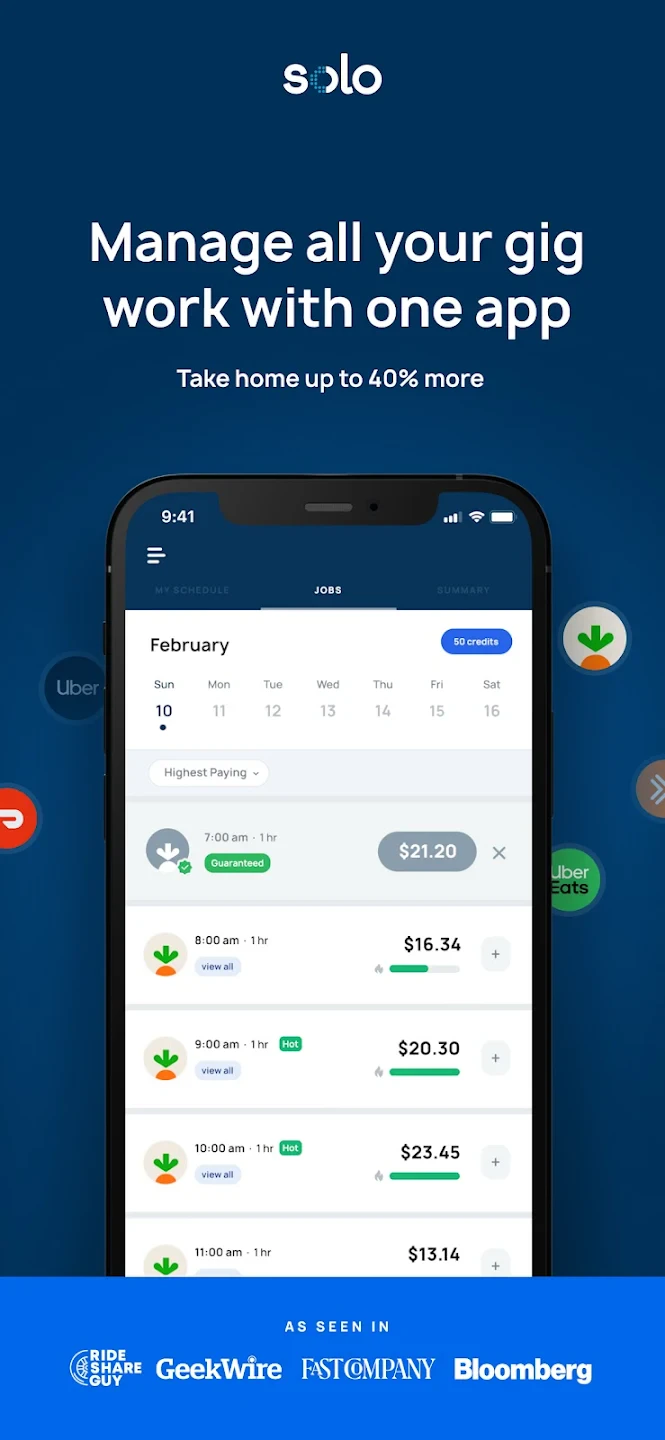

Solo: Your Gig Business App is designed specifically for independent contractors, freelancers, and gig economy workers. It streamlines income generation by helping them manage client relationships, track time, issue invoices, and get paid all through an intuitive mobile application or web browser, regardless of where they work.

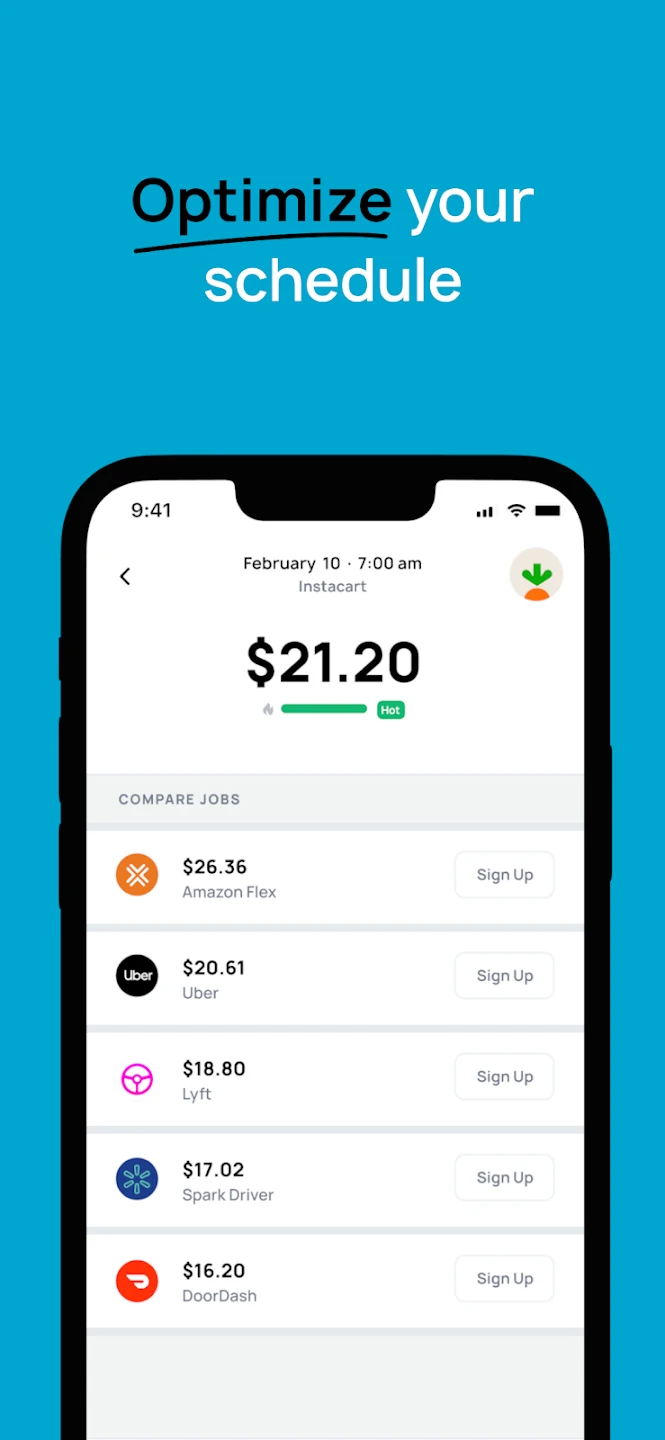

Its key value lies in consolidating gig management into one place. Instead of juggling multiple platforms, apps, or spreadsheets for payments, time tracking, and client comms, Solo offers a seamless experience, saving users considerable time, reducing errors, and making freelancing smoother for solo entrepreneurs and small teams.

App Features

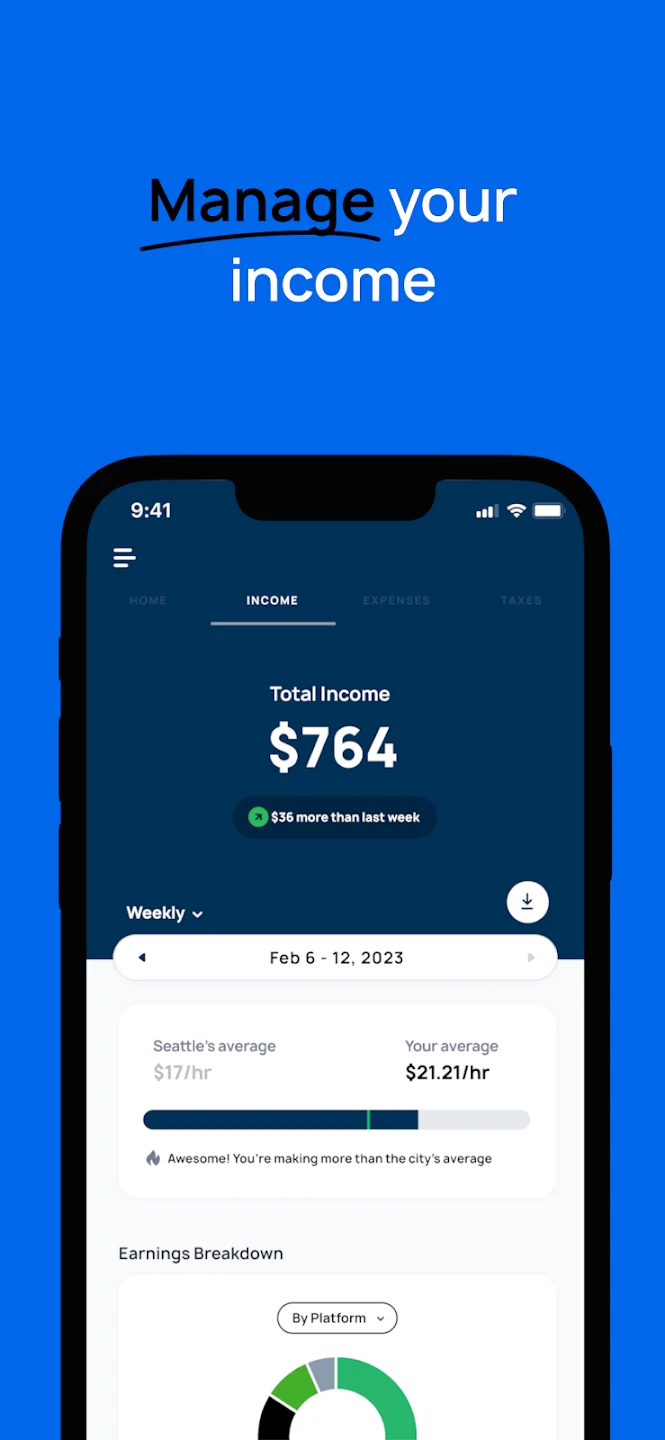

- Centralized Dashboard: This serves as the main hub displaying pending invoices, upcoming payments, recent clients, and overall financial status at a glance. Users immediately see their cash flow and tasks, promoting quick action and informed decision-making.

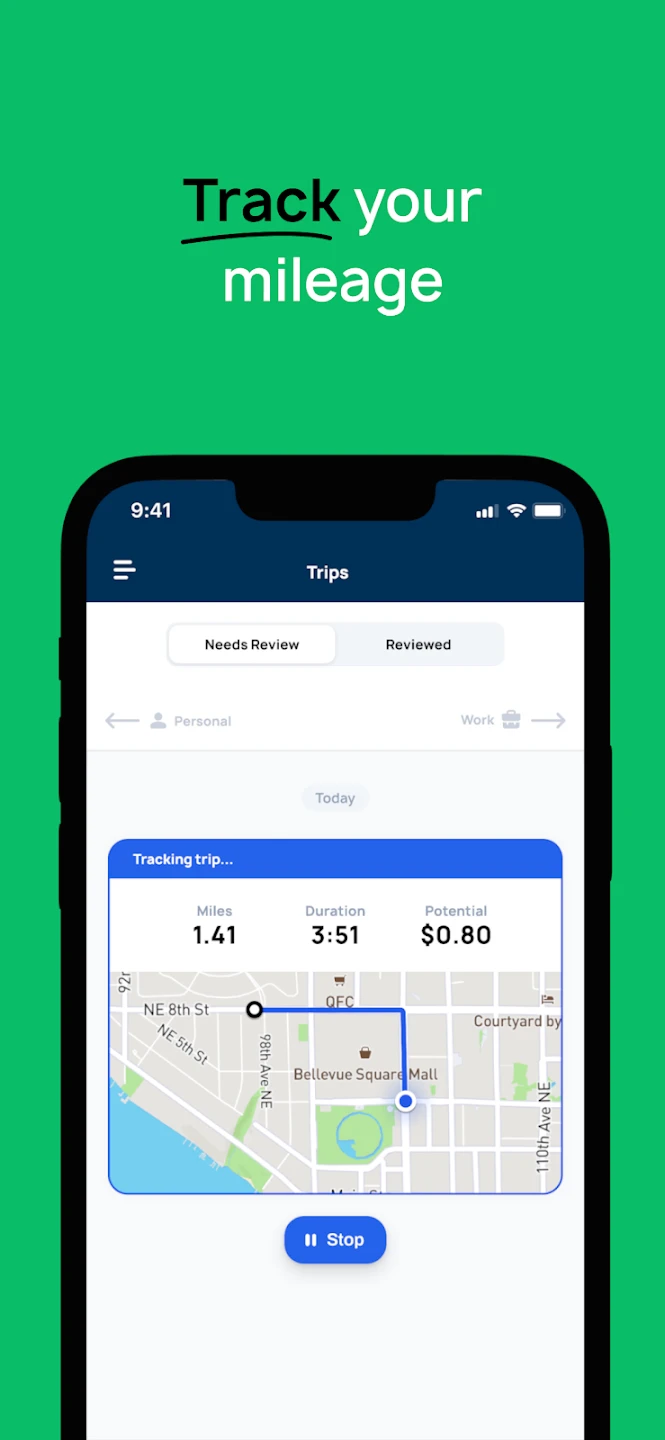

- Payslip & Expense Tracking: Easily input hours worked per job, log essential business expenses like mileage or software fees. These features simplify tax preparation later and provide detailed, categorized financial data crucial for freelancing profitability and record-keeping.

- Automated Invoice Generation: Create, customize, and instantly send professional invoices to clients with just a few clicks; payment reminders can often be set automatically too. This feature saves significant manual effort, ensures timely payments, and presents a polished business image.

- Multi-Client & Project Management: Organize clients separately from projects, allowing tracking of time spent on specific tasks for different gigs, ensuring accurate billing according to agreed rates. This capability is essential for freelancers juggling multiple contracts, preventing confusion, and maximizing income potential.

- Secure Payments & Payouts: Offers integration with popular online payment gateways for direct client payments via credit/debit cards or digital wallets. Receiving money faster is a major convenience, eliminating the wait for bank transfers and simplifying cash flow management.

- Expense Reimbursement Requests: Easily submit expense claims linked directly to specific projects or clients, attaching proof and submitting them for review or reimbursement according to predefined rules. This feature simplifies the administrative burden of tracking and submitting business expenses for reimbursement.

Pros & Cons

Pros:

- Time Efficiency for Billing & Tracking

- Professionalism through Invoicing Automation

- Better Financial Overview & Control

- Accessibility from Anywhere (Mobile/Web)

Cons:

- Potential Learning Curve Initial Setup

- Dependence on Internet Connectivity

- Subscription Cost vs. Paper/Basic Software

- Need for Manual Data Entry Accuracy

Similar Apps

| App Name | Highlights |

|---|---|

| Upwork Pro (Account Manager) |

Connects freelancers to clients on a large platform but offers specific account tools for managing portfolio, reviews, and direct client communication within the marketplace. Focuses heavily on job finding alongside project management. |

| Fuel (formerly TSheets) |

Known for robust time tracking features, often used by tradespeople and field service workers. Includes job cost tracking and payroll features, sometimes bundled with payroll services, offering deep integration with hardware like time clocks. |

| Payflow Pro |

Specializes in online payment processing with features tailored for businesses and freelancers, including invoicing and automated payments. Less comprehensive project/client management but strong in payment workflows and integrations for e-commerce. |

Frequently Asked Questions

Q: How does Solo help with getting paid faster?

A: Solo can automatically generate and send professional invoices to your clients. It also integrates with various payment gateways, allowing clients to pay directly via credit card or PayPal, often leading to faster transaction times compared to traditional methods.

Q: Can I use Solo if I work with different types of clients, like graphic design and writing?

A: Absolutely! Solo’s project and client organization features work well across different freelance gigs. You can set different rates, track time per project, and even customize invoice templates for various types of work, keeping everything organized regardless of what you’re hired for.

Q: Is Solo only for mobile use, or can it be used on a computer?

A: Solo offers both a user-friendly mobile app for on-the-go management and a dedicated web application. You can use whichever interface works best for you—whether you’re responding to a client email on your phone, tracking time during a work session, or reviewing financials on your laptop.

Q: Can I track expenses for my business using Solo?

A: Yes, that’s a key feature. You can log business-related expenses (e.g., software subscriptions, equipment, travel, supplies) directly within the app. You can categorize them, add receipts, and potentially submit them for reimbursement, helping you manage business costs effectively.

Q: How do taxes work with Solo? Does it help with tax time?

A: Solo helps by providing organized records of income, expenses, hours worked, and client information throughout the year. While it doesn’t prepare tax returns for you, the detailed reports and data it generates make gathering necessary information for your own tax filing significantly easier and less time-consuming.

Screenshots

|

|

|

|