|

|

| Rating: 3.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: TransUnion Interactive, Inc. |

TransUnion: Credit Monitoring provides a powerful platform for tracking your credit health. The application pulls your credit data, including your score and reports, allowing you to monitor changes and understand factors impacting your financial standing. This app is essential for anyone seeking greater control over their financial identity and creditworthiness.

Its primary value lies in empowering users proactively. By offering timely alerts and detailed insights, TransUnion: Credit Monitoring helps you spot potential errors or fraudulent activities early, enabling swift action to protect your finances and potentially improve your credit standing before issues can significantly impact your opportunities.

App Features

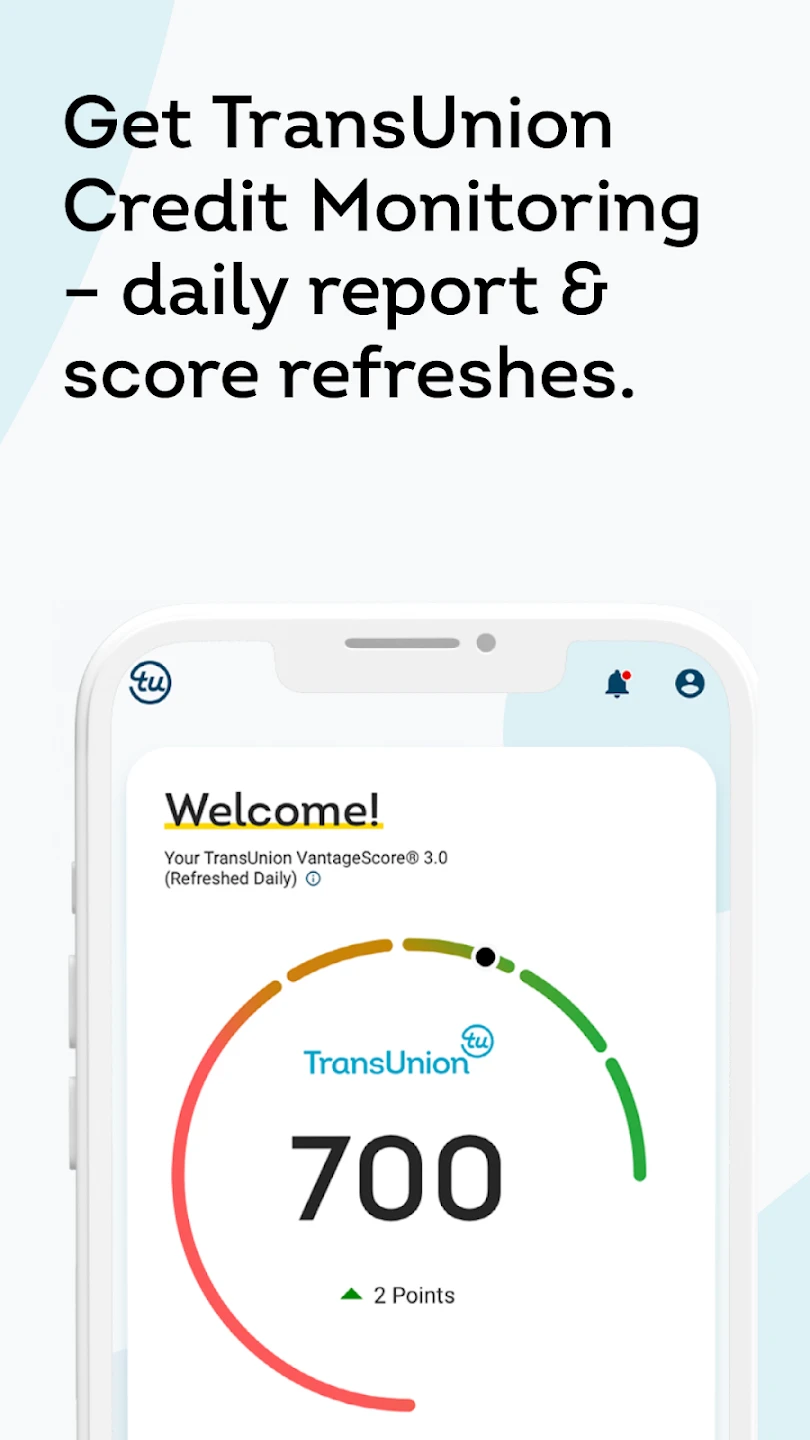

- Credit Score Monitoring: Get notified whenever your TransUnion credit score changes, allowing you to stay informed about the health of your financial identity. This feature is particularly beneficial if you are actively working on improving your credit, as it provides immediate feedback on the effectiveness of your efforts.

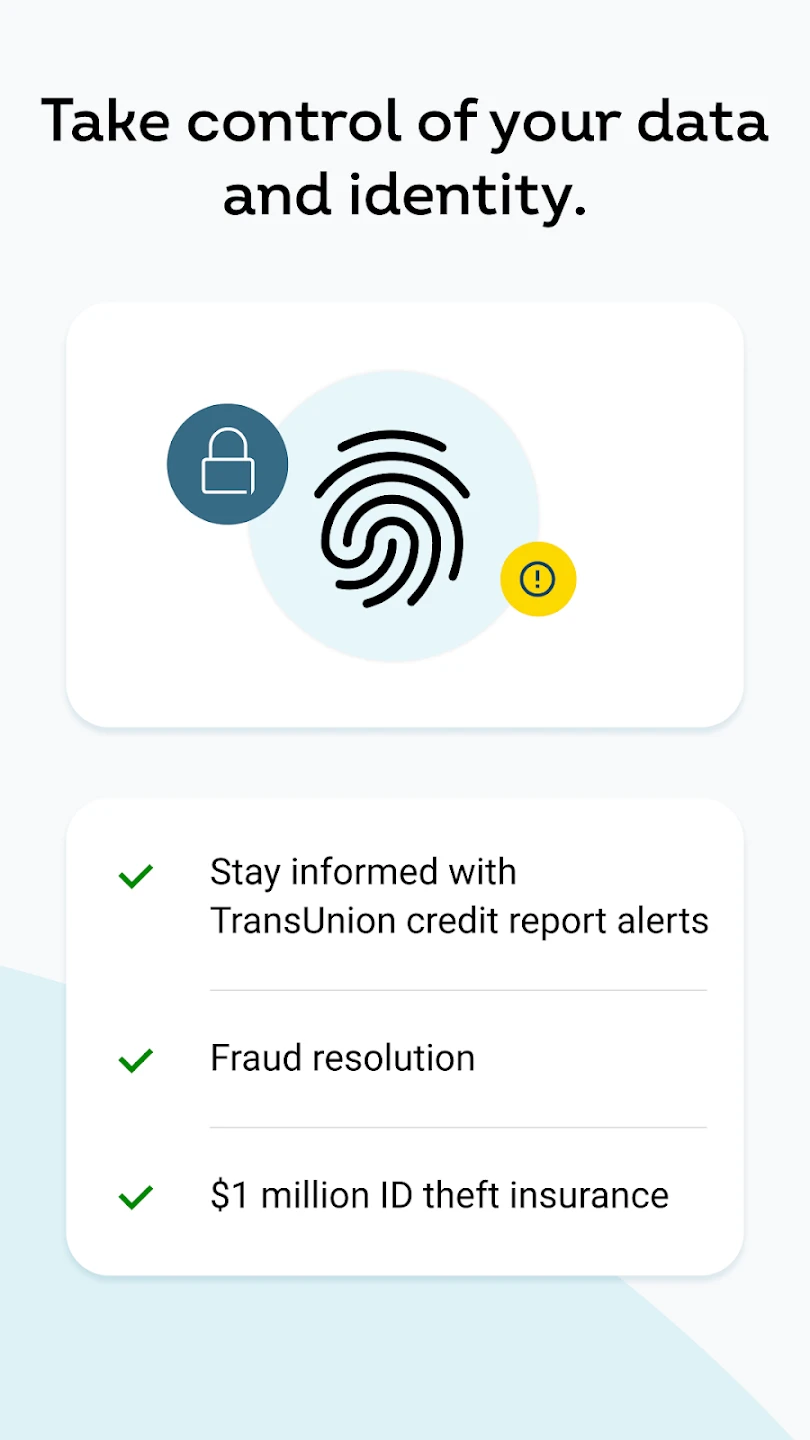

- Fraud Resolution Tools: Utilize advanced technology to identify suspicious accounts or inquiries reported on your credit report. This functionality streamlines the process of disputing fraudulent activity by providing a direct interface to guide you through the resolution steps.

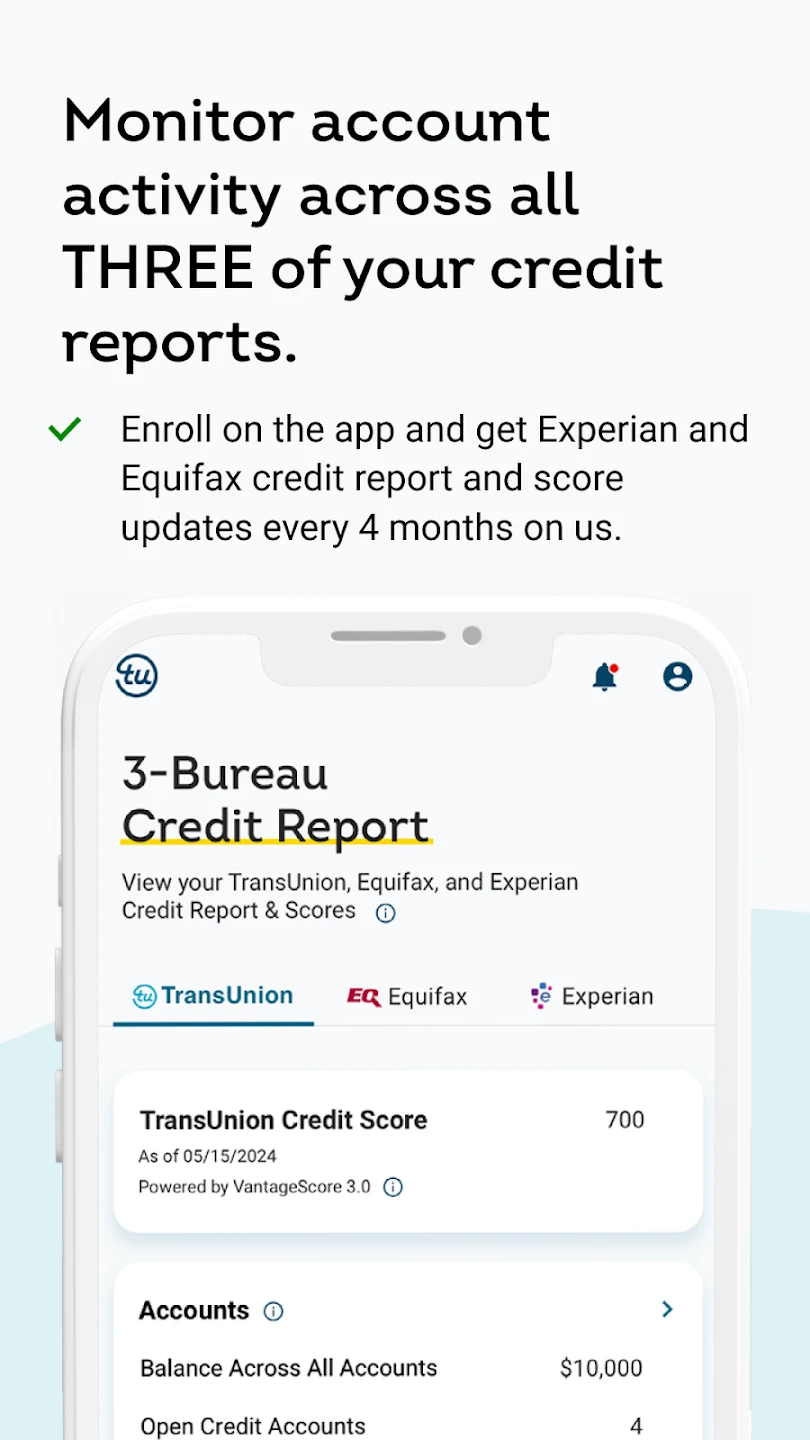

- Instant Credit Report Access: Access a detailed breakdown of your credit history, including payment history, credit utilization, and recent credit inquiries. This transparency allows you to understand the factors influencing your credit score and pinpoint specific areas needing improvement.

- Early Warning System: Set up alerts for significant changes or events detected on your credit profile, such as new hard inquiries or potential identity indicators, ensuring timely intervention before issues escalate.

- Identity Theft Protection: Benefit from features that continuously monitor for signs of misuse of your personal information and take steps to alert you or potentially mitigate fraudulent accounts in your name.

- Financial Education Resources: Access articles, guides, and explanations designed to help you understand credit reporting terminology, scoring models, and strategies for building and maintaining good credit habits.

Pros & Cons

Pros:

- Comprehensive Credit Tracking

- Early Fraud Detection Alerts

- Clear Insights into Credit Report Changes

- Empowering Tools for Financial Health Management

Cons:

- Subscription Tiers May Limit Free Access Scope

- Potential for Notification Fatigue with Frequent Alerts

- Dependence on TransUnion’s Reporting Accuracy

- Feature Set Might Vary by Device or Plan

Similar Apps

| App Name | Highlights |

|---|---|

| Experian CreditGuard |

This app provides identity theft protection and fraud monitoring. Known for its credit score variations and free monitoring options. |

| Equifax Complete |

Focuses on identity theft recovery alongside credit monitoring. Includes Dark Web scanning and credit report analysis tools. |

| Credit Karma |

Popular for free access to credit scores from multiple bureaus. Offers basic monitoring and simplified user interfaces but may lack advanced alert features. |

Frequently Asked Questions

Q: How often does TransUnion: Credit Monitoring update my information?

A: Updates to your credit score typically occur within a few hours to two days. Your full credit report is generally updated every 30 days, reflecting recent activity reported to the bureaus.

Q: Do I need a paid plan for basic credit monitoring?

A: TransUnion: Credit Monitoring may offer core monitoring features for free. However, for detailed reports, identity theft protection, fraud resolution services, and extended monitoring, subscription plans typically provide these enhanced functionalities.

Q: Can I monitor my credit across all three bureaus with this app?

A: TransUnion: Credit Monitoring primarily focuses on data from TransUnion’s specific bureau. While it aims to reflect your credit health accurately within TransUnion’s data, a complete view might require using services or tools that aggregate data from all three credit bureaus separately.

Q: What should I do if an alert says I have suspicious activity?

A: If you receive an alert regarding suspicious activity, carefully review it for the details provided. Check your recent financial statements for unfamiliar transactions and consider initiating a fraud alert. Contact TransUnion: Credit Monitoring’s support if you’re unsure about the alert’s validity or need assistance initiating a dispute or protection measures.

Q: Is my personal information secure when using TransUnion: Credit Monitoring?

A: TransUnion places a high priority on security and data privacy. The app employs robust security measures to protect your personal information and credit data. However, always practice good security habits like using strong, unique passwords and enabling two-factor authentication where offered, as online account security depends on both platform measures and user practices.

Screenshots

|

|

|

|