|

|

| Rating: 4.2 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: PayPal, Inc. |

The Venmo App is a popular mobile payment service that revolutionizes the way people send and receive money. Developed by PayPal, Venmo provides a convenient and secure platform for individuals to split bills, pay friends or family, and make purchases seamlessly from their smartphones. With its user-friendly interface and social media-like features, Venmo has gained widespread popularity, especially among younger generations, as a go-to app for peer-to-peer transactions and splitting expenses.

Venmo simplifies the process of sending and requesting money, eliminating the need for cash or checks. Users can link their bank accounts, debit cards, or credit cards to the app, making transactions quick and hassle-free. Additionally, Venmo’s social feed enables users to share payment activity, adding a social element to the app and making it a popular choice for splitting expenses among friends or roommates. With its convenience, ease of use, and social features, Venmo has become a prominent player in the digital payment landscape.

Features & Benefits

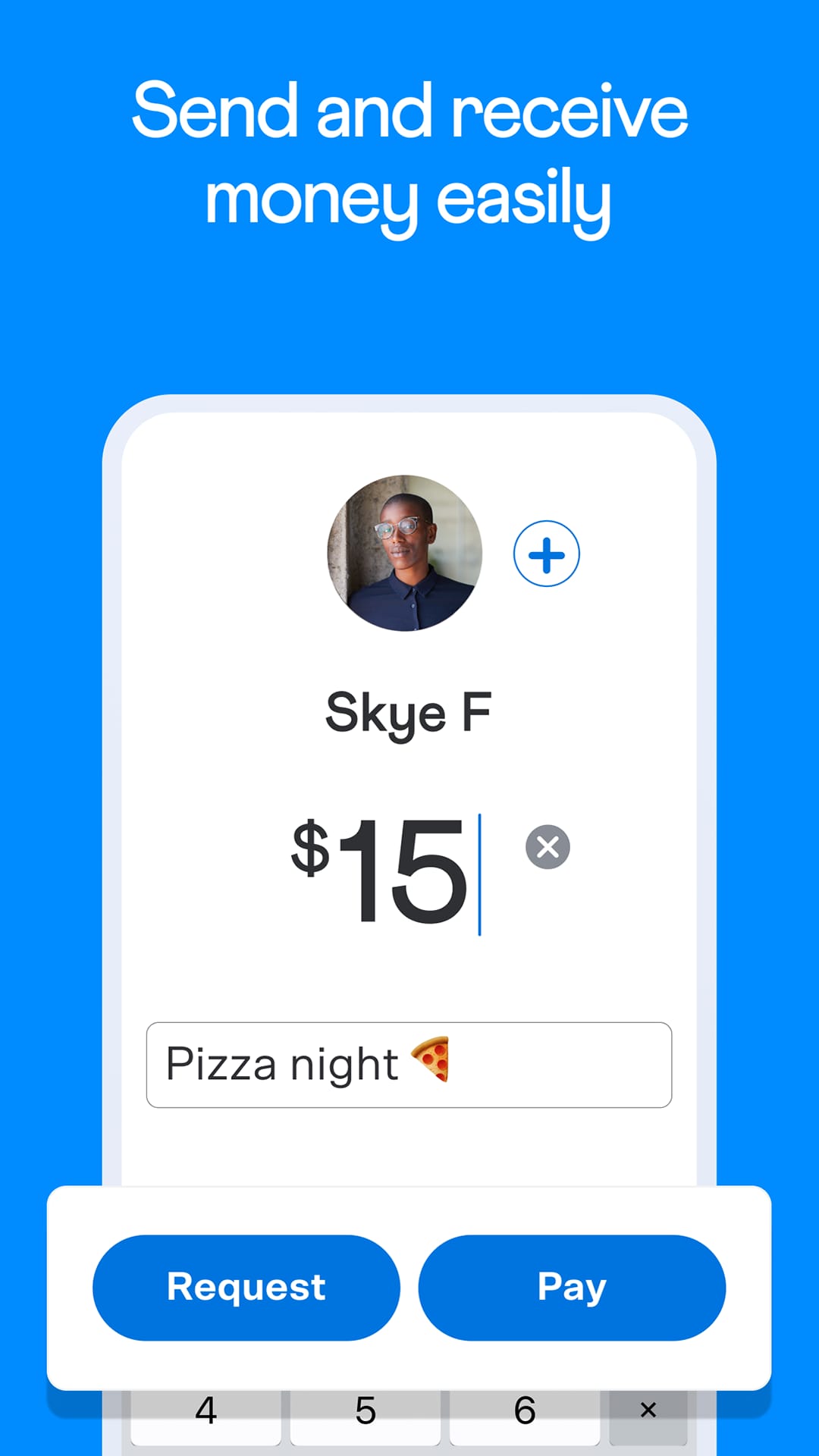

- Easy Peer-to-Peer Payments: Venmo allows users to send and receive money easily among friends, family, and acquaintances. It simplifies the process of splitting bills, paying back loans, or sharing expenses, eliminating the need for cash or checks.

- Social Payment Experience: The app incorporates a social aspect by enabling users to view and engage with their friends’ payment activities. It adds a fun and interactive element to transactions, making it feel more like a social network while maintaining privacy controls.

- Convenient Payment Options: Venmo offers multiple payment options, including bank transfers, debit card payments, and the ability to link credit cards. This flexibility allows users to choose the payment method that suits them best, making transactions seamless.

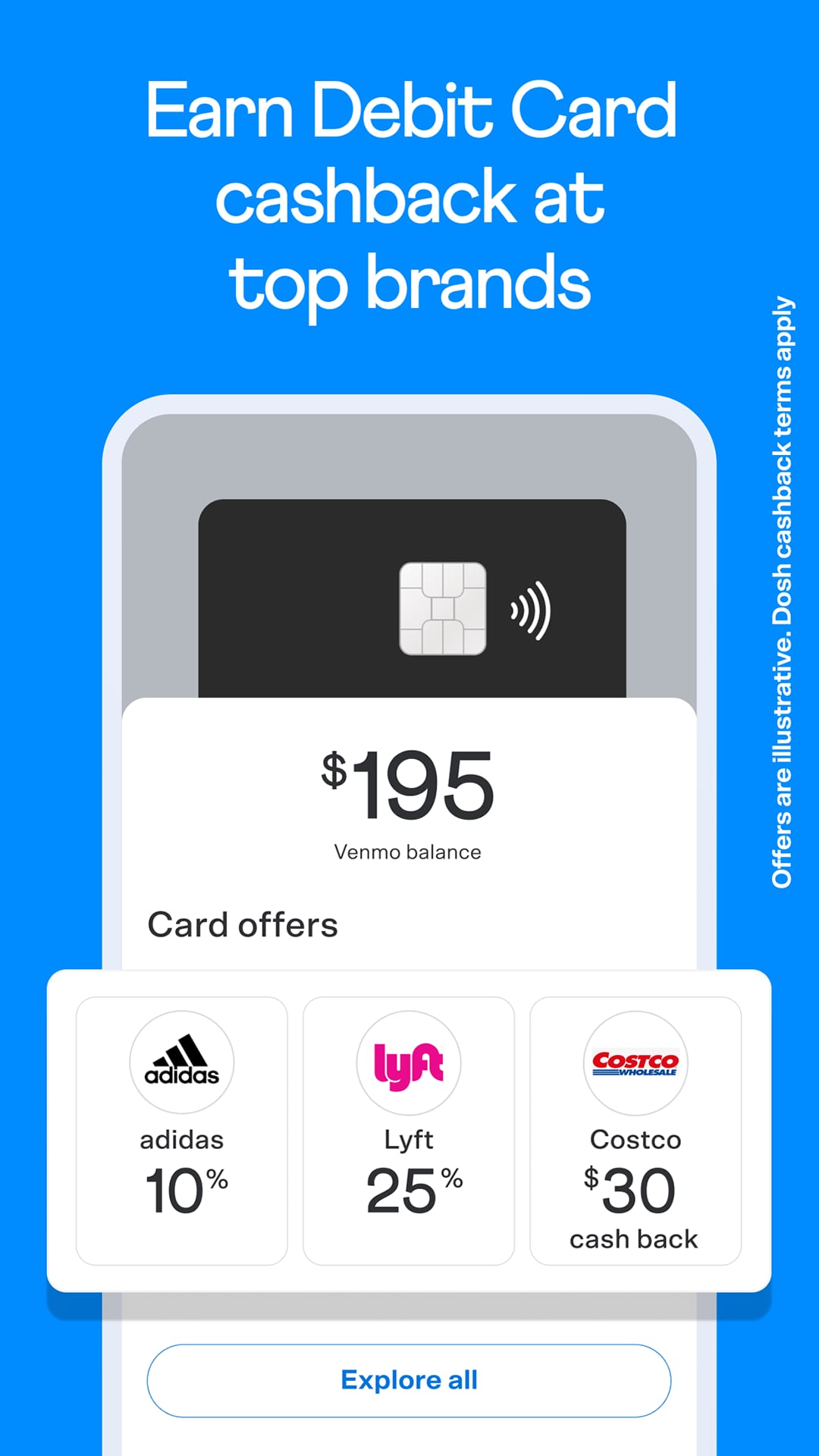

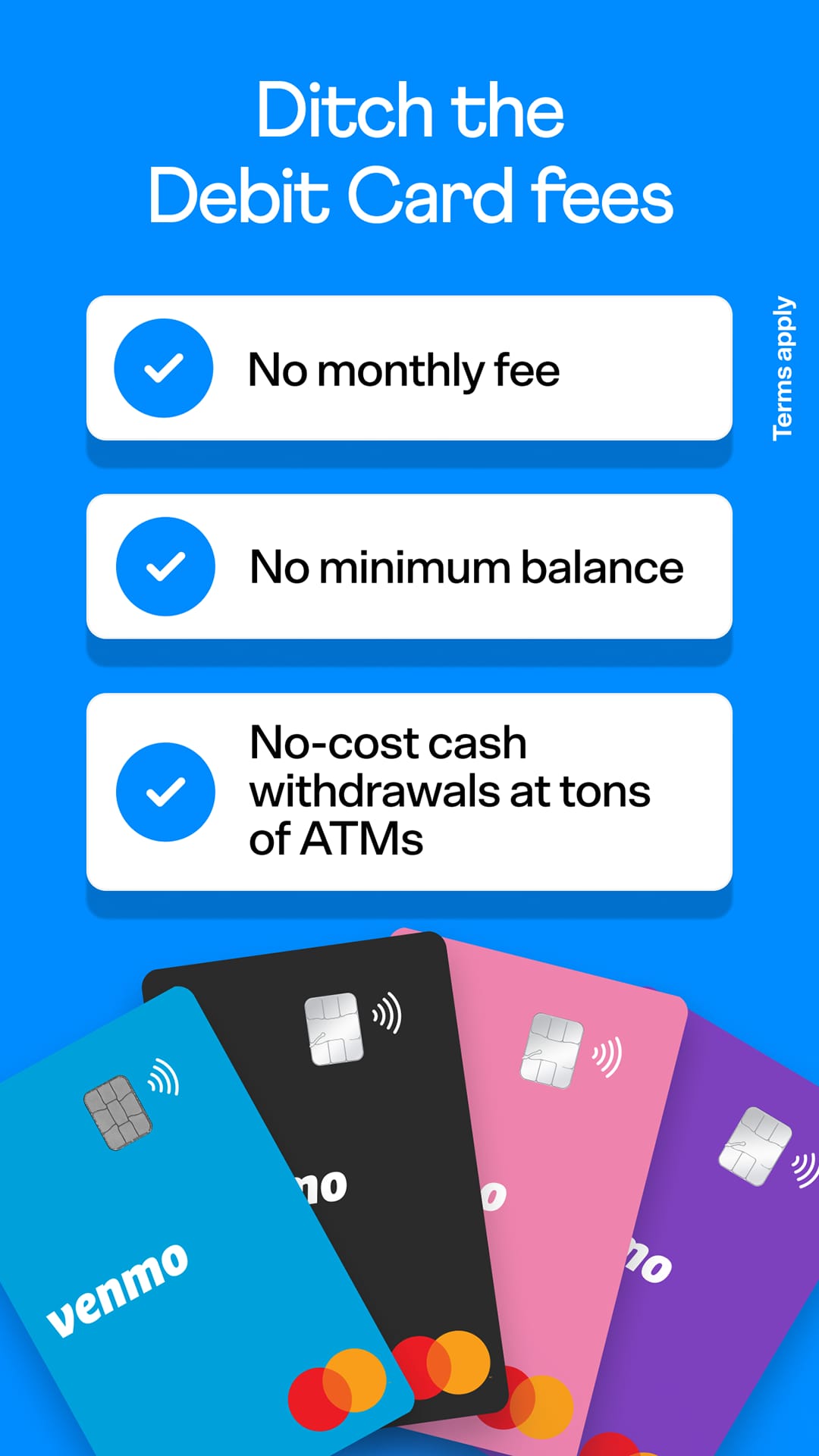

- Venmo Card: Users can request a physical Venmo debit card, which is connected to their Venmo account. This card can be used for purchases at any merchant that accepts Mastercard, providing a convenient way to access funds and make payments.

- Integration with Merchants: Venmo has integrated with various merchants, allowing users to make purchases directly through the app. This feature eliminates the need to enter payment information repeatedly, making online shopping more convenient.

Pros

- Convenient Peer-to-Peer Payments: Venmo makes it incredibly convenient to send and receive money from friends, family, or acquaintances, eliminating the need for cash or checks.

- Social and Interactive Payment Experience: The app’s social feed feature adds a unique and fun element to transactions, creating a more engaging and interactive payment experience.

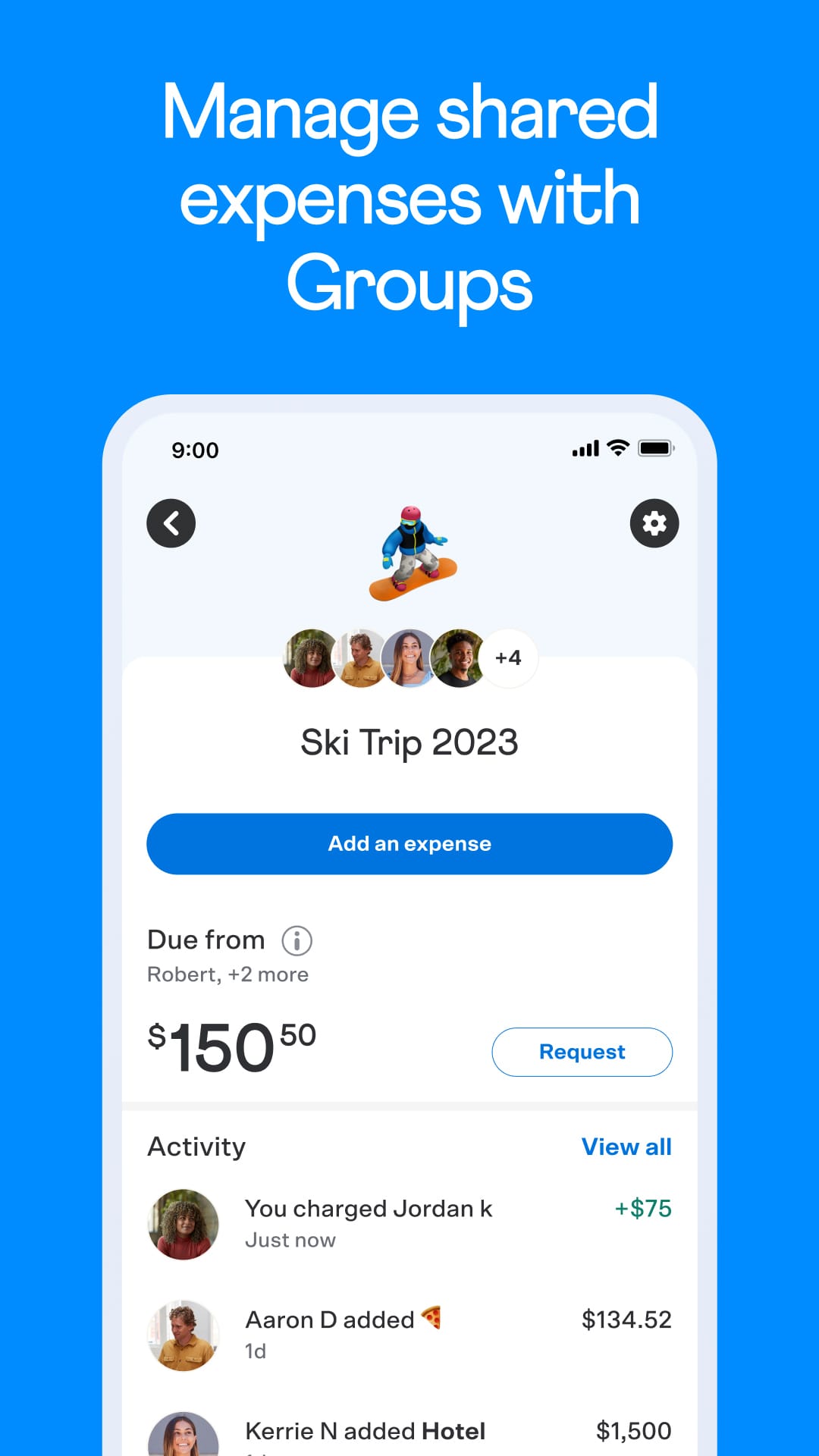

- Simplified Expense Splitting: Venmo simplifies the process of splitting bills among friends or roommates, making it easy to keep track of shared expenses and settle payments within the app.

- Seamless Integration with Bank Accounts: The app integrates smoothly with users’ bank accounts, debit cards, and credit cards, allowing for easy transfers and access to funds.

- Security and Buyer Protection: Venmo prioritizes the security of users’ financial information and provides buyer protection for eligible transactions, offering peace of mind when making payments.

Cons

- Limited International Availability: Venmo is primarily available for users within the United States, limiting its accessibility for international transactions or users outside the supported regions.

- Transaction Limits and Fees: Venmo imposes certain transaction limits and fees for specific types of transfers, such as instant transfers or transfers to non-linked bank accounts, which may be a consideration for heavy users.

- Privacy Concerns: Venmo’s social feed feature, while adding a social element, may raise privacy concerns for users who prefer to keep their payment activity private or restrict visibility to a limited audience.

- Dependence on Network Connectivity: The app requires a stable internet connection to perform transactions, which may pose challenges in areas with limited or unreliable network coverage.

- Limited Merchant Acceptance: While Venmo is widely accepted among individuals, merchant acceptance may vary, and not all businesses or online platforms may support Venmo as a payment option.

Apps Like Venmo

Zelle: Zelle is a digital payment network that enables users to send money directly to bank accounts in the United States. It is often integrated into banking apps, making it convenient for users to transfer funds.

Google Pay: Google Pay allows users to send money, make online purchases, and store loyalty cards. It also offers contactless payment options through NFC technology, making it easy to pay with a smartphone.

Apple Pay: Apple Pay is a mobile payment and digital wallet service by Apple. It allows users to make payments using their Apple devices at participating merchants, both online and in physical stores.

Screenshots

|

|

|

|

Conclusion

The Venmo app offers a range of features and benefits for convenient peer-to-peer payments. Users can easily send and receive money, split bills, and share expenses with friends, eliminating the need for cash or checks. The app’s social payment experience adds an interactive element, allowing users to view and engage with their friends’ payment activities. Venmo provides multiple payment options, including bank transfers, debit cards, and credit cards, ensuring flexibility for users. The inclusion of the Venmo card enables offline purchases at any Mastercard-accepting merchant, further enhancing convenience. Integration with merchants streamlines online purchases, reducing the need to repeatedly enter payment information. However, privacy concerns and transaction limits should be considered. Fees for certain transactionssuch as instant transfers or credit card payments and limited international availability are also factors to be aware of. Some users have reported difficulties with customer support, highlighting an area for improvement. User reviews emphasize the convenience and social aspect of Venmo, while also mentioning privacy concerns, international availability limitations, and the need for better customer support. Overall, Venmo proves to be a popular choice for easy peer-to-peer payments, offering a unique and engaging payment experience.