|

|

| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Varo Bank, N.A. |

Varo Bank: Online Banking is a mobile application designed for managing personal finances digitally. It allows users to access and control their bank accounts, make payments, and monitor transactions directly from their smartphone or tablet.

The primary appeal of Varo Bank: Online Banking lies in its convenience and modern approach to everyday banking. It offers users a quick and secure way to handle financial tasks on the go, potentially saving time and reducing the need for branch visits or lengthy calls to customer service.

App Features

- Account Overview Dashboard: Get a clear, summarized view of balances and recent activity across all linked accounts. This provides an immediate financial snapshot, helping users quickly assess their cash position without navigating complex menus.

- Seamless Transaction History and Filtering: View past transactions in detail and use intuitive filters to find specific types, dates, or merchants quickly. This feature saves time when reconciling accounts or searching for a particular purchase, improving overall usability.

- Mobile Deposits: Easily deposit checks by taking a clear picture using your phone’s camera. Instead of waiting days for funds to clear through a branch, you can often access the money much faster, providing greater liquidity and convenience for unexpected expenses.

- Bill Pay Management: Set up recurring bills or pay individual invoices directly from the app. This eliminates the need for separate checks or online biller portals, streamlining the payment process and reducing the risk of missed due dates.

- Alerts and Notifications: Customize alerts for transactions, low balances, account openings, or other specific events. These timely notifications help users stay informed about their finances proactively, preventing overdrafts and promptly identifying suspicious activity.

- Expense Tracking and Insights: Analyze spending patterns across different categories. This feature helps users understand where their money goes, identify potential savings, and make data-driven decisions to better manage their personal budgeting.

Pros & Cons

Pros:

- Simplified Account Management

- Enhanced Transaction Visibility

- Accelerated Mobile Deposits

- Streamlined Bill Payment System

Cons:

- Limited In-App Support Channels

- Dependence on Mobile/Online Access

- Potential for Basic Fee Structures

- Varied Processing Times for Transactions

Similar Apps

| App Name | Highlights |

|---|---|

| Chime by American Express |

Known for same-day deposits and integrated spending rewards, emphasizing instant notifications and budgeting tools for everyday spending management. |

| Discover Bank Mobile |

Focuses on a simple interface with robust mobile deposit capabilities, offering specific features like round-up investing and detailed account analytics. |

| MPower Bank |

Highlights its free checking account with high interest rates and advanced online banking tools like check printing and investment options. |

Frequently Asked Questions

Q: How quickly can I deposit a check using Varo Bank: Online Banking?

A: Varo Bank: Online Banking allows for mobile deposits. While processing times can vary slightly based on factors like weekend processing, deposits made Monday-Friday (excluding holidays) are typically available within 1-2 business days, offering a fast alternative to traditional methods.

Q: What types of accounts can I manage through the Varo Bank: Online Banking app?

A: The app generally supports checking and savings accounts associated with the Varo Bank. Always check the app for the most current list of supported account types and features, as they may vary depending on your specific relationship with the bank.

Q: Is my information secure when using the Varo Bank: Online Banking app?

A: Absolutely. Varo Bank employs robust security measures including encryption and fraud monitoring to protect your data. Transactions require secure authentication methods to ensure only you have access to your financial information.

Q: Can I change my account notifications within Varo Bank: Online Banking?

A: Yes, notification settings are adjustable within the app. You can customize alerts for balances, transactions, account activities, and more, tailoring the alerts to your personal preferences and financial needs.

Q: Does Varo Bank: Online Banking offer investment services?

A: While the primary focus of Varo Bank is traditional banking, their online platform often highlights features like interest-bearing accounts and sometimes integrated savings tools. For direct investment services offered by Varo itself, users should check the bank’s current offerings, as these may differ from third-party investment platforms.

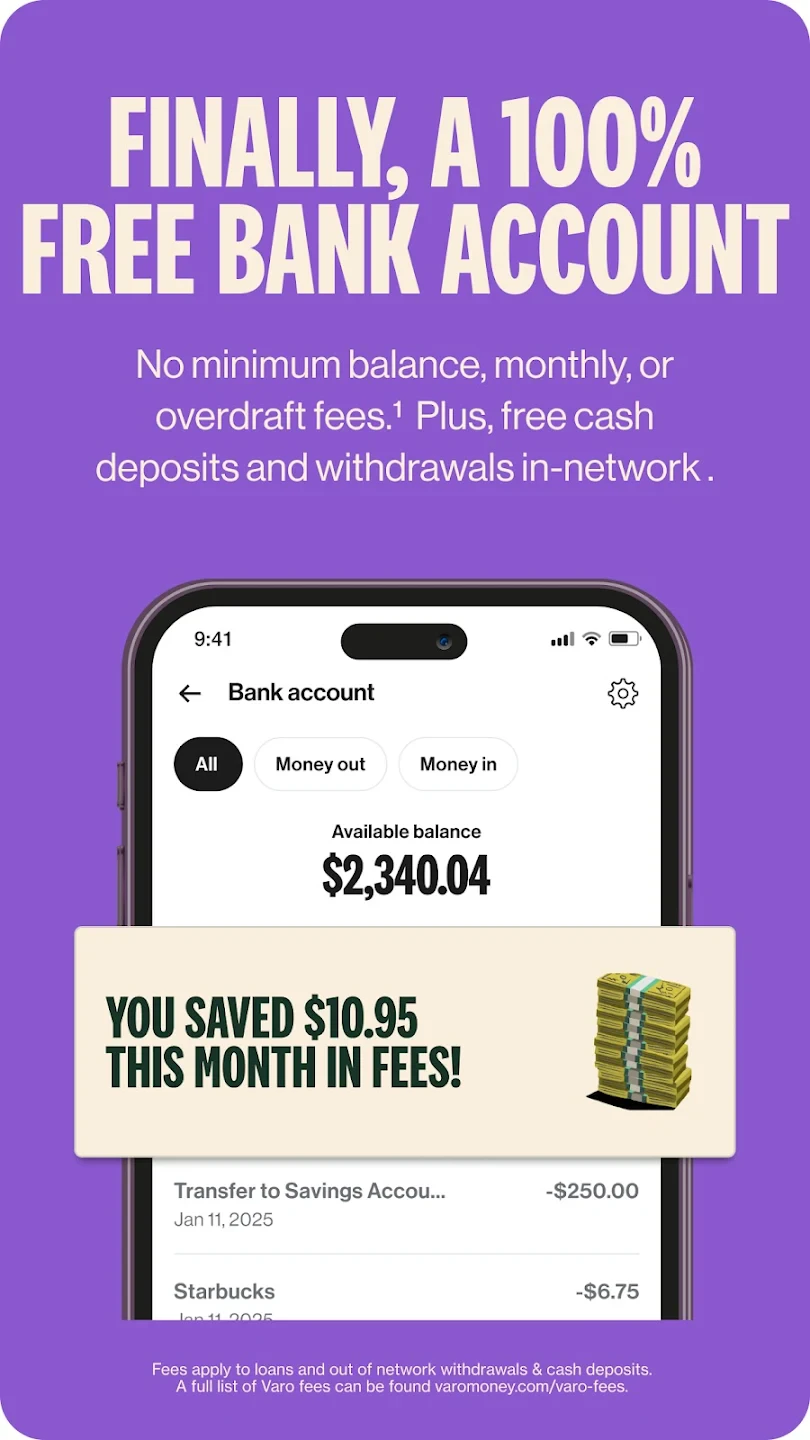

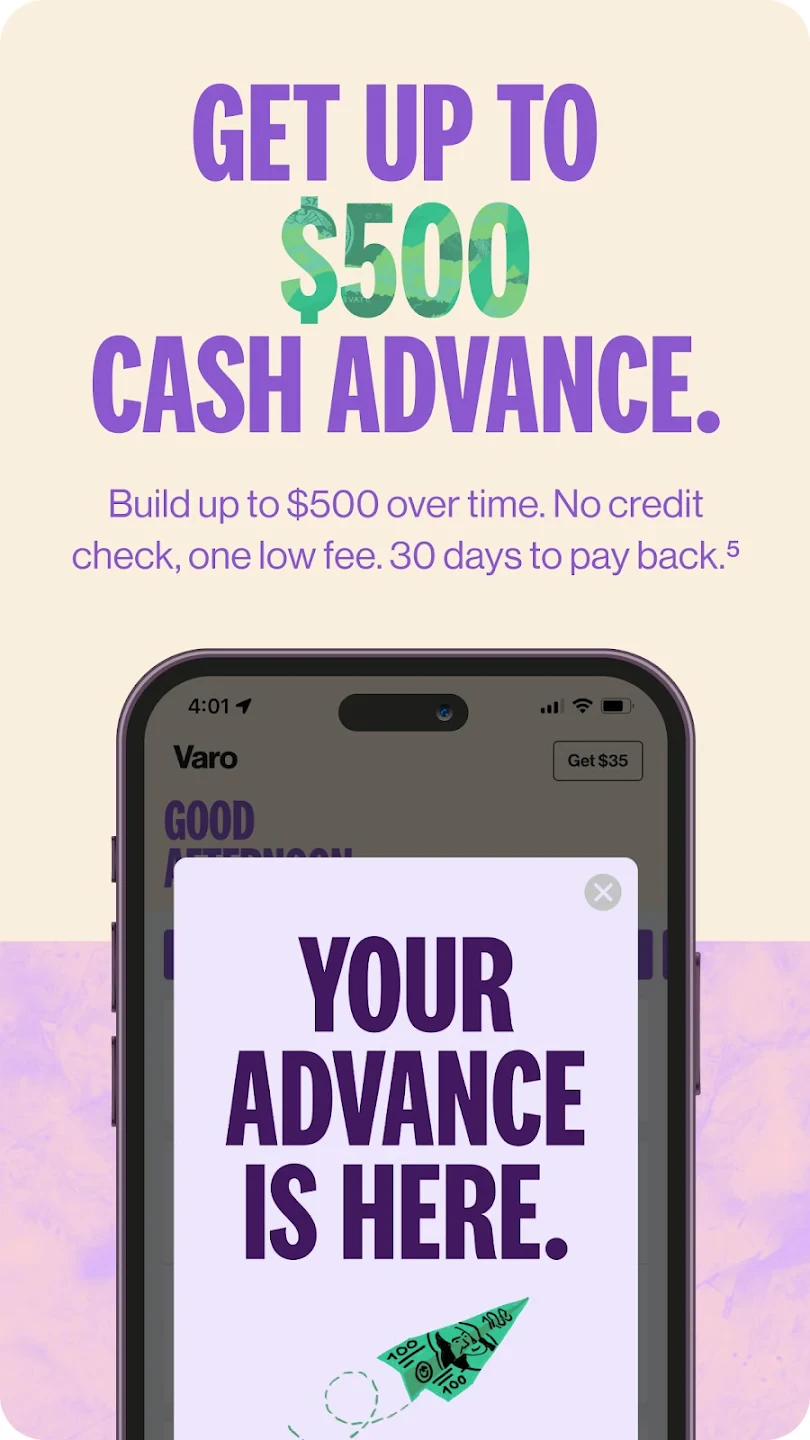

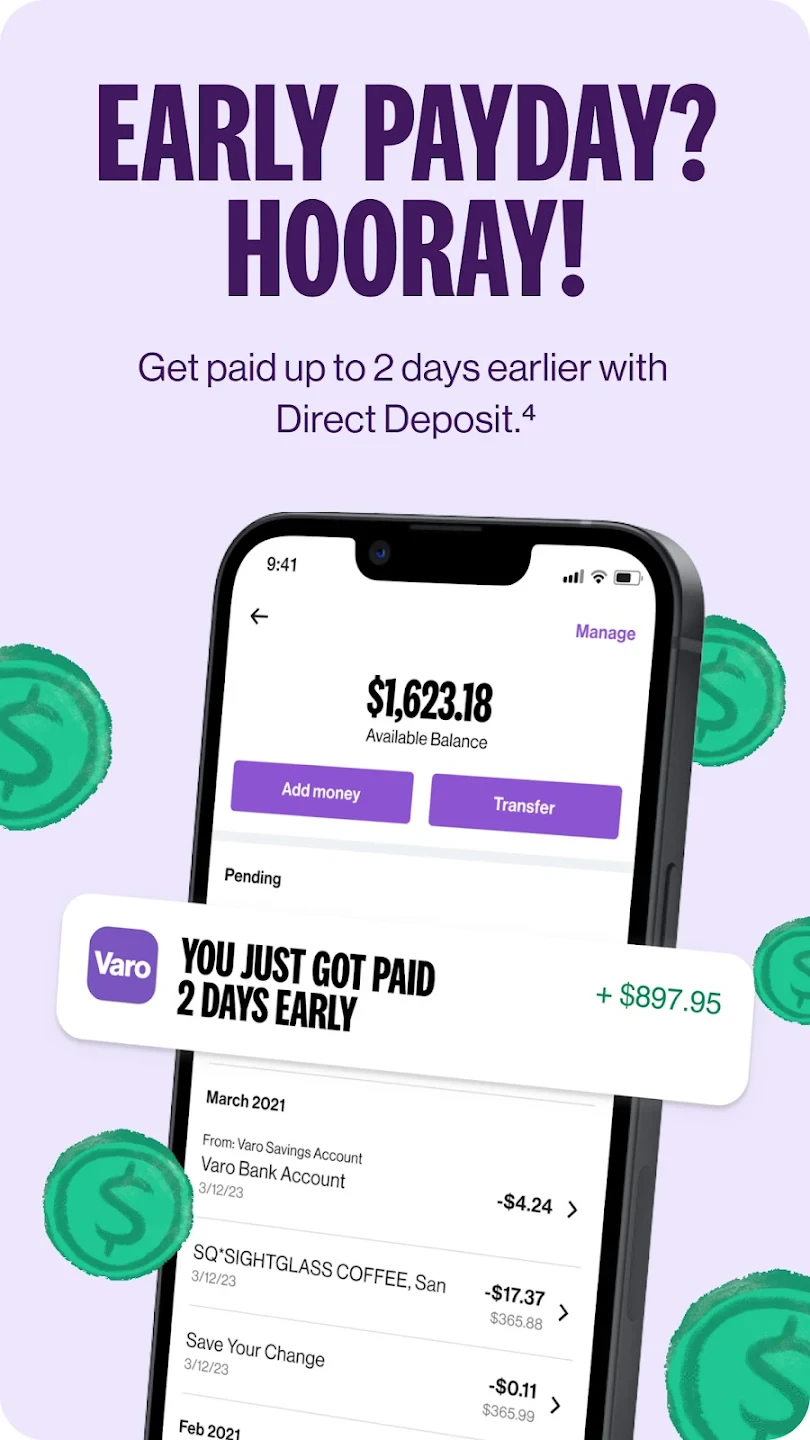

Screenshots

|

|

|

|